Are you a seasoned Insurance Sales Supervisor seeking a new career path? Discover our professionally built Insurance Sales Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

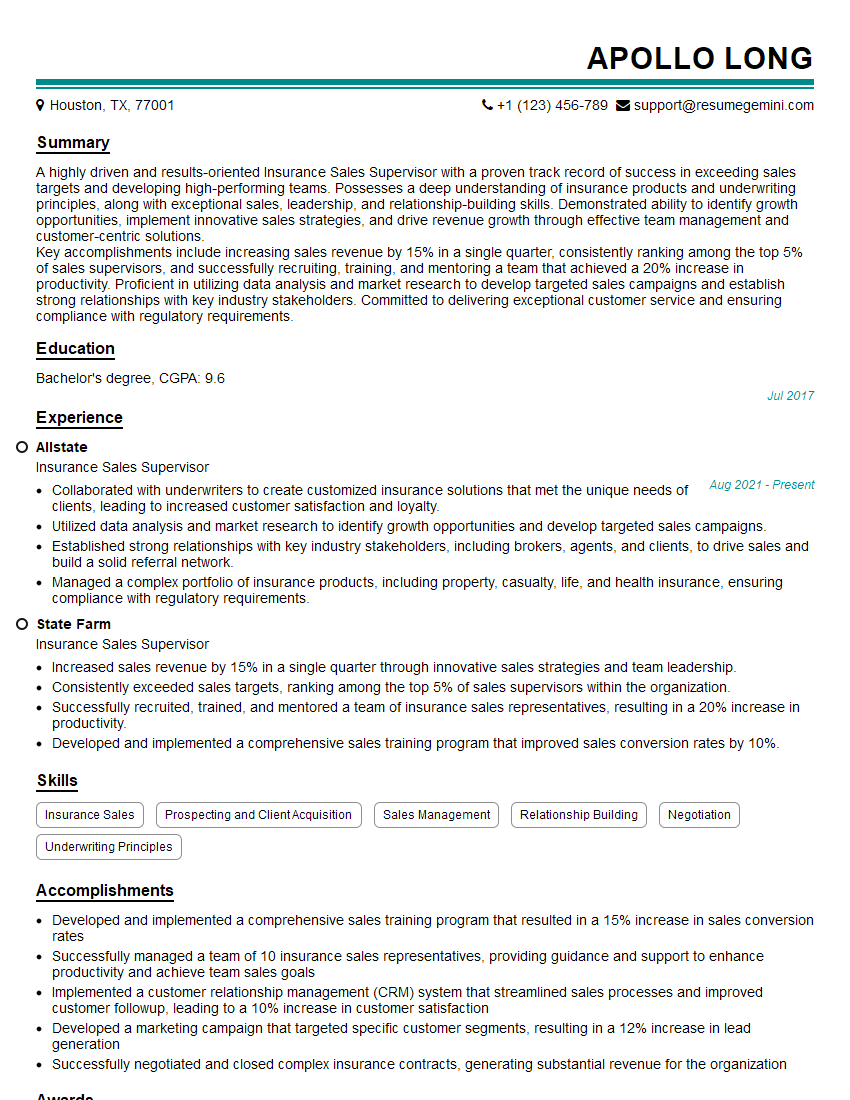

Apollo Long

Insurance Sales Supervisor

Summary

A highly driven and results-oriented Insurance Sales Supervisor with a proven track record of success in exceeding sales targets and developing high-performing teams. Possesses a deep understanding of insurance products and underwriting principles, along with exceptional sales, leadership, and relationship-building skills. Demonstrated ability to identify growth opportunities, implement innovative sales strategies, and drive revenue growth through effective team management and customer-centric solutions.

Key accomplishments include increasing sales revenue by 15% in a single quarter, consistently ranking among the top 5% of sales supervisors, and successfully recruiting, training, and mentoring a team that achieved a 20% increase in productivity. Proficient in utilizing data analysis and market research to develop targeted sales campaigns and establish strong relationships with key industry stakeholders. Committed to delivering exceptional customer service and ensuring compliance with regulatory requirements.

Education

Bachelor’s degree

July 2017

Skills

- Insurance Sales

- Prospecting and Client Acquisition

- Sales Management

- Relationship Building

- Negotiation

- Underwriting Principles

Work Experience

Insurance Sales Supervisor

- Collaborated with underwriters to create customized insurance solutions that met the unique needs of clients, leading to increased customer satisfaction and loyalty.

- Utilized data analysis and market research to identify growth opportunities and develop targeted sales campaigns.

- Established strong relationships with key industry stakeholders, including brokers, agents, and clients, to drive sales and build a solid referral network.

- Managed a complex portfolio of insurance products, including property, casualty, life, and health insurance, ensuring compliance with regulatory requirements.

Insurance Sales Supervisor

- Increased sales revenue by 15% in a single quarter through innovative sales strategies and team leadership.

- Consistently exceeded sales targets, ranking among the top 5% of sales supervisors within the organization.

- Successfully recruited, trained, and mentored a team of insurance sales representatives, resulting in a 20% increase in productivity.

- Developed and implemented a comprehensive sales training program that improved sales conversion rates by 10%.

Accomplishments

- Developed and implemented a comprehensive sales training program that resulted in a 15% increase in sales conversion rates

- Successfully managed a team of 10 insurance sales representatives, providing guidance and support to enhance productivity and achieve team sales goals

- Implemented a customer relationship management (CRM) system that streamlined sales processes and improved customer followup, leading to a 10% increase in customer satisfaction

- Developed a marketing campaign that targeted specific customer segments, resulting in a 12% increase in lead generation

- Successfully negotiated and closed complex insurance contracts, generating substantial revenue for the organization

Awards

- Presidents Club Award for achieving exceptional sales performance exceeding targets by 20%

- Regional Salesperson of the Year Award for consistently delivering outstanding sales results

- Top Producer Award for leading the sales team in revenue generation and customer acquisition

- Excellence in Sales Award for demonstrating exceptional customer service skills and ability to build strong relationships

Certificates

- Certified Insurance Counselor (CIC)

- Certified Insurance Sales Professional (CIS)

- Associate in Insurance Services (AIS)

- Registered Life Underwriter (RLU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Sales Supervisor

- Highlight your sales achievements and quantify your results whenever possible, using specific metrics and data points.

- Showcase your leadership skills by describing how you have successfully motivated, trained, and mentored your team to achieve exceptional performance.

- Emphasize your ability to build strong relationships with clients and industry stakeholders, demonstrating your networking prowess and customer-centric approach.

- Incorporate keywords relevant to the insurance industry, such as underwriting, risk assessment, and regulatory compliance, to enhance your resume’s visibility to potential employers.

Essential Experience Highlights for a Strong Insurance Sales Supervisor Resume

- Develop and execute sales strategies to achieve revenue targets and drive business growth.

- Lead, motivate, and mentor a team of insurance sales representatives, providing training and support to enhance their skills and performance.

- Identify and pursue new sales opportunities through prospecting, networking, and building relationships with key industry stakeholders.

- Negotiate and close insurance deals, ensuring compliance with underwriting guidelines and regulatory requirements.

- Manage a portfolio of insurance products, including property, casualty, life, and health insurance, providing expert advice and customized solutions to meet clients’ needs.

- Collaborate with underwriters to assess risks and develop insurance policies that align with clients’ specific requirements.

- Monitor sales performance, analyze data, and identify areas for improvement to optimize sales processes and strategies.

Frequently Asked Questions (FAQ’s) For Insurance Sales Supervisor

What are the key responsibilities of an Insurance Sales Supervisor?

An Insurance Sales Supervisor is responsible for leading and managing a team of insurance sales representatives, developing and executing sales strategies, identifying and pursuing new sales opportunities, negotiating and closing insurance deals, managing a portfolio of insurance products, and collaborating with underwriters to assess risks and develop insurance policies.

What qualifications are required to become an Insurance Sales Supervisor?

Typically, an Insurance Sales Supervisor requires a bachelor’s degree in a related field, such as business, finance, or insurance, along with several years of experience in insurance sales and sales management.

What skills are essential for an Insurance Sales Supervisor?

An Insurance Sales Supervisor should possess exceptional sales, leadership, and relationship-building skills, as well as a deep understanding of insurance products and underwriting principles. They should also be proficient in data analysis, market research, and negotiation.

What is the career path for an Insurance Sales Supervisor?

An Insurance Sales Supervisor can advance their career by taking on more senior leadership roles within the insurance industry, such as Sales Manager, Regional Sales Manager, or Vice President of Sales.

What is the earning potential for an Insurance Sales Supervisor?

The earning potential for an Insurance Sales Supervisor can vary depending on experience, performance, and geographic location. According to Salary.com, the average annual salary for an Insurance Sales Supervisor in the United States is around $75,000.

What are the challenges faced by Insurance Sales Supervisors?

Insurance Sales Supervisors may face challenges such as a competitive sales environment, regulatory compliance requirements, and the need to stay up-to-date on industry trends and best practices.

What are the rewards of being an Insurance Sales Supervisor?

The rewards of being an Insurance Sales Supervisor can include a high earning potential, the opportunity to lead and mentor a team, and the satisfaction of helping clients protect their financial well-being.

How can I become a successful Insurance Sales Supervisor?

To become a successful Insurance Sales Supervisor, it is important to develop strong sales and leadership skills, stay knowledgeable about the insurance industry, build a network of relationships, and continuously seek opportunities for professional development.