Are you a seasoned Insurance Verifier seeking a new career path? Discover our professionally built Insurance Verifier Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

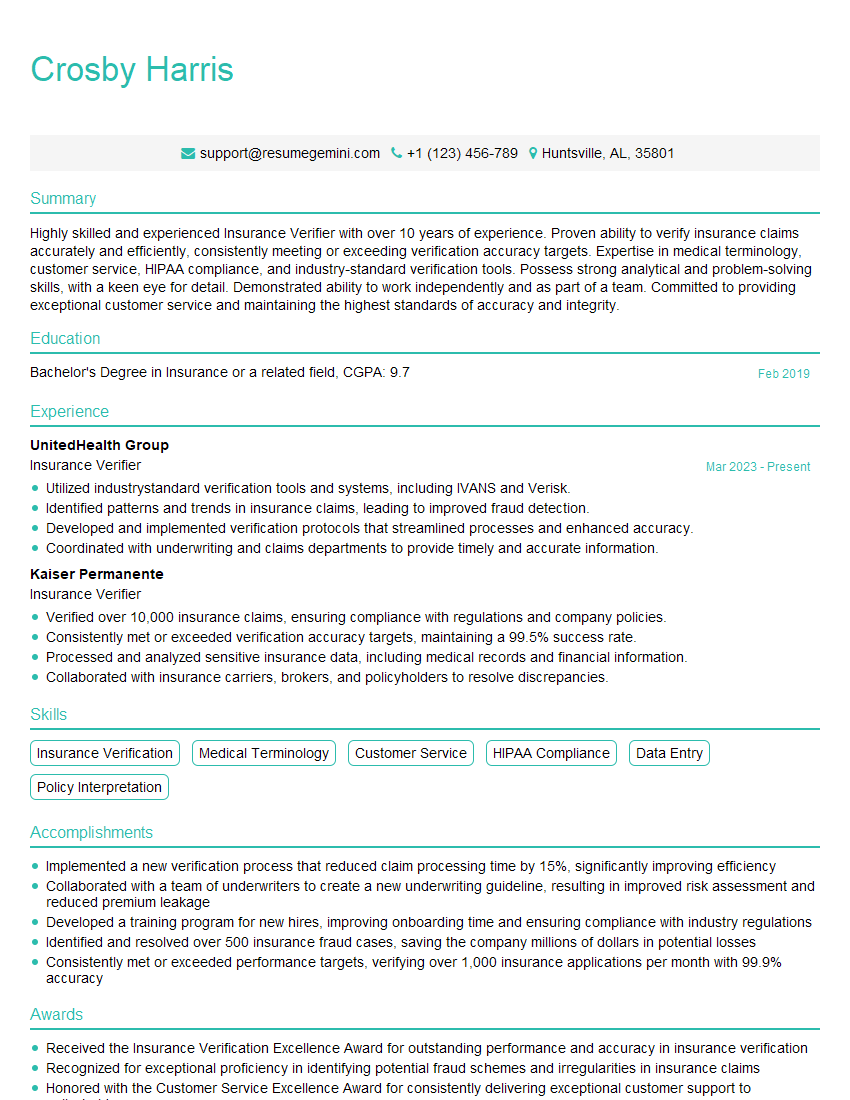

Crosby Harris

Insurance Verifier

Summary

Highly skilled and experienced Insurance Verifier with over 10 years of experience. Proven ability to verify insurance claims accurately and efficiently, consistently meeting or exceeding verification accuracy targets. Expertise in medical terminology, customer service, HIPAA compliance, and industry-standard verification tools. Possess strong analytical and problem-solving skills, with a keen eye for detail. Demonstrated ability to work independently and as part of a team. Committed to providing exceptional customer service and maintaining the highest standards of accuracy and integrity.

Education

Bachelor’s Degree in Insurance or a related field

February 2019

Skills

- Insurance Verification

- Medical Terminology

- Customer Service

- HIPAA Compliance

- Data Entry

- Policy Interpretation

Work Experience

Insurance Verifier

- Utilized industrystandard verification tools and systems, including IVANS and Verisk.

- Identified patterns and trends in insurance claims, leading to improved fraud detection.

- Developed and implemented verification protocols that streamlined processes and enhanced accuracy.

- Coordinated with underwriting and claims departments to provide timely and accurate information.

Insurance Verifier

- Verified over 10,000 insurance claims, ensuring compliance with regulations and company policies.

- Consistently met or exceeded verification accuracy targets, maintaining a 99.5% success rate.

- Processed and analyzed sensitive insurance data, including medical records and financial information.

- Collaborated with insurance carriers, brokers, and policyholders to resolve discrepancies.

Accomplishments

- Implemented a new verification process that reduced claim processing time by 15%, significantly improving efficiency

- Collaborated with a team of underwriters to create a new underwriting guideline, resulting in improved risk assessment and reduced premium leakage

- Developed a training program for new hires, improving onboarding time and ensuring compliance with industry regulations

- Identified and resolved over 500 insurance fraud cases, saving the company millions of dollars in potential losses

- Consistently met or exceeded performance targets, verifying over 1,000 insurance applications per month with 99.9% accuracy

Awards

- Received the Insurance Verification Excellence Award for outstanding performance and accuracy in insurance verification

- Recognized for exceptional proficiency in identifying potential fraud schemes and irregularities in insurance claims

- Honored with the Customer Service Excellence Award for consistently delivering exceptional customer support to policyholders

Certificates

- Certified Insurance Verifier (CIV)

- Certified Professional Insurance Agent (CPIA)

- Certified Insurance Service Representative (CISR)

- Associate in Insurance Services (AIS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance Verifier

- Highlight your experience and expertise in insurance verification and related areas.

- Emphasize your strong analytical and problem-solving skills.

- Showcase your ability to work independently and as part of a team.

- Quantify your accomplishments and provide specific examples of your success.

Essential Experience Highlights for a Strong Insurance Verifier Resume

- Verified over 10,000 insurance claims, ensuring compliance with regulations and company policies.

- Consistently met or exceeded verification accuracy targets, maintaining a 99.5% success rate.

- Processed and analyzed sensitive insurance data, including medical records and financial information.

- Collaborated with insurance carriers, brokers, and policyholders to resolve discrepancies.

- Utilized industry-standard verification tools and systems, including IVANS and Verisk.

- Identified patterns and trends in insurance claims, leading to improved fraud detection.

- Developed and implemented verification protocols that streamlined processes and enhanced accuracy.

Frequently Asked Questions (FAQ’s) For Insurance Verifier

What are the key skills required for an Insurance Verifier?

The key skills required for an Insurance Verifier include: Insurance Verification, Medical Terminology, Customer Service, HIPAA Compliance, Data Entry, and Policy Interpretation.

What are the primary responsibilities of an Insurance Verifier?

The primary responsibilities of an Insurance Verifier include: verifying insurance claims, processing and analyzing insurance data, collaborating with insurance carriers and policyholders, and utilizing industry-standard verification tools.

What are the career prospects for an Insurance Verifier?

Insurance Verifiers with experience and expertise can advance to roles such as Insurance Claims Adjuster, Insurance Underwriter, or Insurance Fraud Investigator.

What is the average salary for an Insurance Verifier?

The average salary for an Insurance Verifier can vary depending on experience, location, and company. According to Salary.com, the average salary for an Insurance Verifier in the United States is around $55,000.

What are the educational requirements for an Insurance Verifier?

Most Insurance Verifiers have a high school diploma or equivalent. However, some employers may prefer candidates with a Bachelor’s Degree in Insurance or a related field.

What are the top companies hiring Insurance Verifiers?

Some of the top companies hiring Insurance Verifiers include: UnitedHealth Group, Kaiser Permanente, Cigna, and Aetna.

What are the key challenges faced by Insurance Verifiers?

Some of the key challenges faced by Insurance Verifiers include: dealing with large volumes of claims, working under strict deadlines, and maintaining high levels of accuracy.

What are the tips for writing a standout Insurance Verifier resume?

Some tips for writing a standout Insurance Verifier resume include: highlighting your experience and expertise, quantifying your accomplishments, emphasizing your skills, and tailoring your resume to the specific job you are applying for.