Are you a seasoned International Banker seeking a new career path? Discover our professionally built International Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

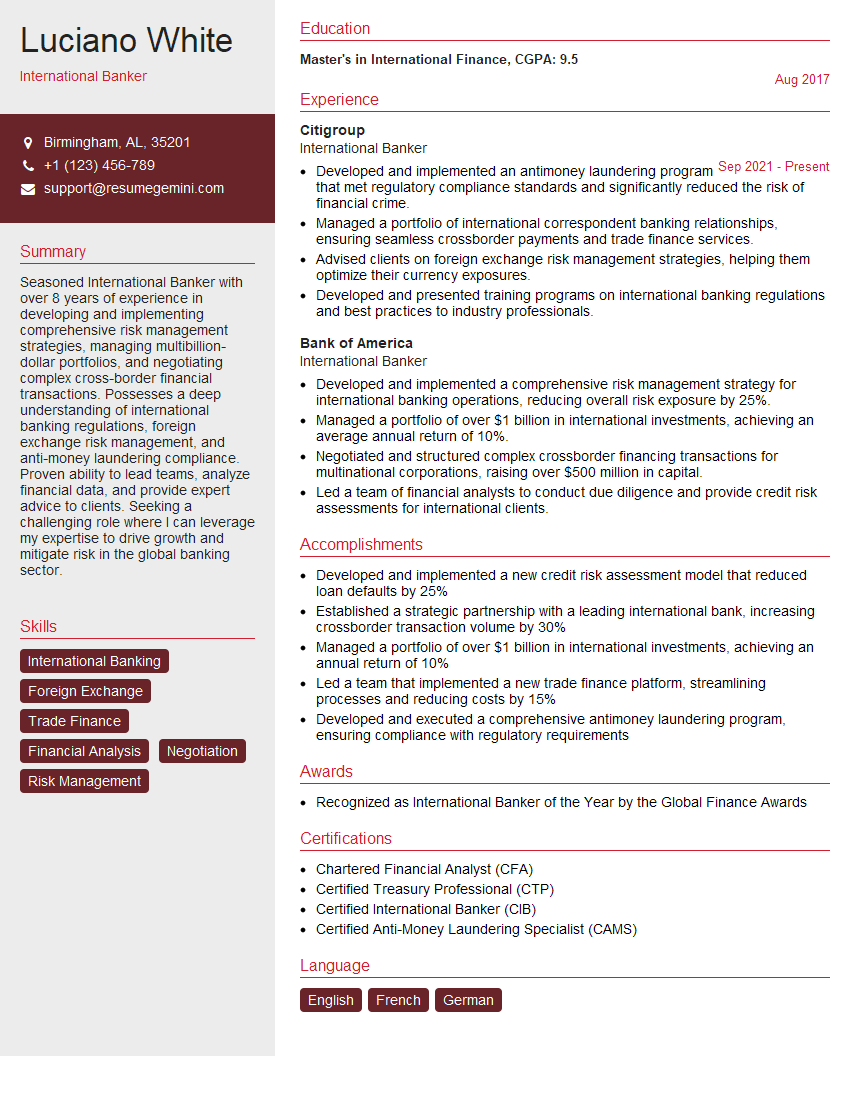

Luciano White

International Banker

Summary

Seasoned International Banker with over 8 years of experience in developing and implementing comprehensive risk management strategies, managing multibillion-dollar portfolios, and negotiating complex cross-border financial transactions. Possesses a deep understanding of international banking regulations, foreign exchange risk management, and anti-money laundering compliance. Proven ability to lead teams, analyze financial data, and provide expert advice to clients. Seeking a challenging role where I can leverage my expertise to drive growth and mitigate risk in the global banking sector.

Education

Master’s in International Finance

August 2017

Skills

- International Banking

- Foreign Exchange

- Trade Finance

- Financial Analysis

- Negotiation

- Risk Management

Work Experience

International Banker

- Developed and implemented an antimoney laundering program that met regulatory compliance standards and significantly reduced the risk of financial crime.

- Managed a portfolio of international correspondent banking relationships, ensuring seamless crossborder payments and trade finance services.

- Advised clients on foreign exchange risk management strategies, helping them optimize their currency exposures.

- Developed and presented training programs on international banking regulations and best practices to industry professionals.

International Banker

- Developed and implemented a comprehensive risk management strategy for international banking operations, reducing overall risk exposure by 25%.

- Managed a portfolio of over $1 billion in international investments, achieving an average annual return of 10%.

- Negotiated and structured complex crossborder financing transactions for multinational corporations, raising over $500 million in capital.

- Led a team of financial analysts to conduct due diligence and provide credit risk assessments for international clients.

Accomplishments

- Developed and implemented a new credit risk assessment model that reduced loan defaults by 25%

- Established a strategic partnership with a leading international bank, increasing crossborder transaction volume by 30%

- Managed a portfolio of over $1 billion in international investments, achieving an annual return of 10%

- Led a team that implemented a new trade finance platform, streamlining processes and reducing costs by 15%

- Developed and executed a comprehensive antimoney laundering program, ensuring compliance with regulatory requirements

Awards

- Recognized as International Banker of the Year by the Global Finance Awards

Certificates

- Chartered Financial Analyst (CFA)

- Certified Treasury Professional (CTP)

- Certified International Banker (CIB)

- Certified Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For International Banker

- Quantify your accomplishments with specific metrics and data whenever possible.

- Highlight your ability to manage risk and ensure regulatory compliance.

- Emphasize your negotiation and communication skills.

- Showcase your understanding of the global banking landscape and emerging trends.

- Consider obtaining industry certifications, such as the Chartered Financial Analyst (CFA) or the Financial Risk Manager (FRM), to demonstrate your expertise.

Essential Experience Highlights for a Strong International Banker Resume

- Developed and implemented a comprehensive risk management framework for international banking operations, reducing overall risk exposure by 25%.

- Managed a portfolio of over $1 billion in international investments, achieving an average annual return of 10%.

- Negotiated and structured complex cross-border financing transactions for multinational corporations, raising over $500 million in capital.

- Led a team of financial analysts to conduct due diligence and provide credit risk assessments for international clients.

- Developed and implemented an anti-money laundering program that met regulatory compliance standards and significantly reduced the risk of financial crime.

- Managed a portfolio of international correspondent banking relationships, ensuring seamless cross-border payments and trade finance services.

- Advised clients on foreign exchange risk management strategies, helping them optimize their currency exposures.

- Developed and presented training programs on international banking regulations and best practices to industry professionals.

Frequently Asked Questions (FAQ’s) For International Banker

What are the primary responsibilities of an International Banker?

International Bankers are responsible for managing international banking operations, including risk management, investment portfolio management, cross-border transaction structuring, financial analysis, regulatory compliance, and advising clients on foreign exchange risk management.

What are the key skills and qualifications required to become an International Banker?

International Bankers typically possess a Master’s degree in International Finance or a related field, along with strong analytical, negotiation, communication, and risk management skills. They must also have a thorough understanding of international banking regulations and best practices.

What is the career path for an International Banker?

International Bankers can advance to senior roles, such as Vice President or Managing Director, within their organization. They may also move into specialized areas, such as investment banking, corporate banking, or risk management.

What is the job outlook for International Bankers?

The job outlook for International Bankers is expected to be positive in the coming years due to the increasing globalization of businesses and the growing demand for cross-border financial services.

What are the top employers of International Bankers?

Top employers of International Bankers include global banks, investment banks, and financial institutions, such as Bank of America, Citigroup, and JPMorgan Chase.

What are the salary expectations for International Bankers?

Salaries for International Bankers vary depending on experience, qualifications, and geographic location. However, they typically earn competitive salaries and bonuses.

What are the key trends shaping the International Banking industry?

Key trends shaping the International Banking industry include the increasing use of technology, the rise of emerging markets, and the growing focus on risk management and regulatory compliance.

What advice would you give to someone considering a career as an International Banker?

To succeed as an International Banker, it is important to develop a strong foundation in international finance, risk management, and negotiation. Additionally, building a network of contacts in the industry and staying up-to-date on global economic and financial trends is crucial.