Are you a seasoned Investment Banker seeking a new career path? Discover our professionally built Investment Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

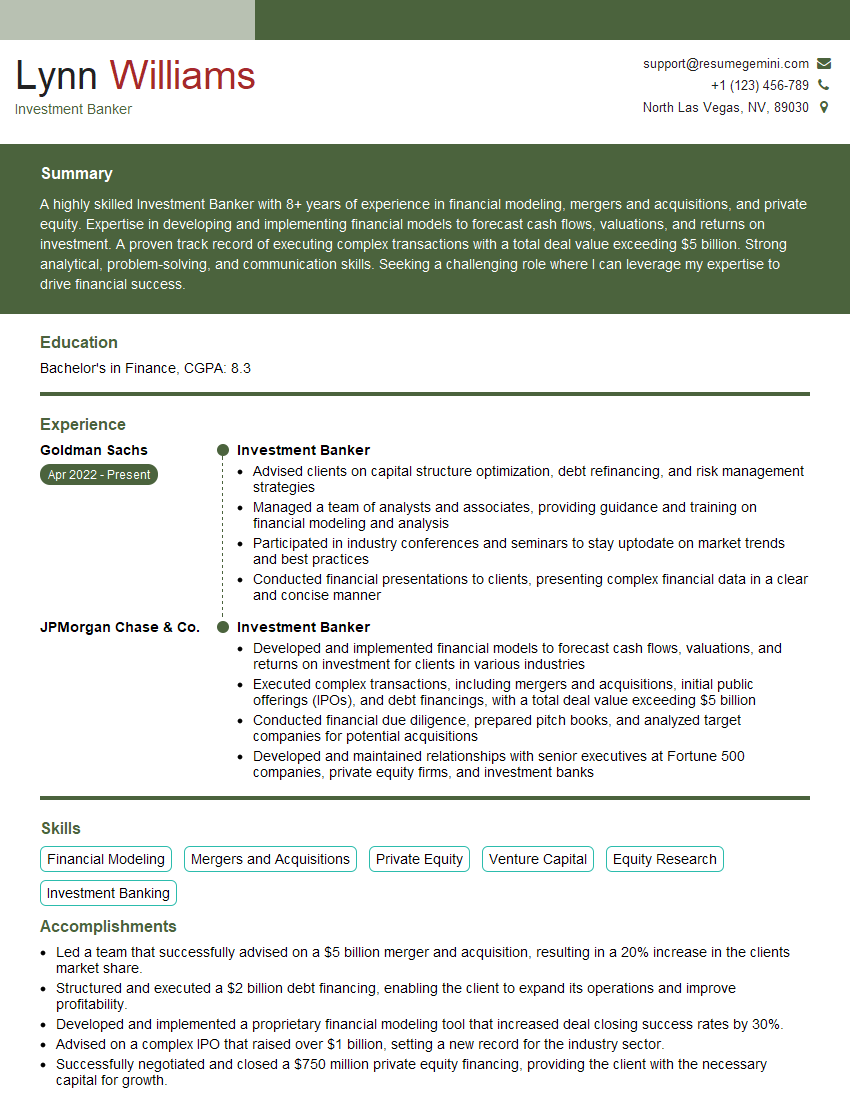

Lynn Williams

Investment Banker

Summary

A highly skilled Investment Banker with 8+ years of experience in financial modeling, mergers and acquisitions, and private equity. Expertise in developing and implementing financial models to forecast cash flows, valuations, and returns on investment. A proven track record of executing complex transactions with a total deal value exceeding $5 billion. Strong analytical, problem-solving, and communication skills. Seeking a challenging role where I can leverage my expertise to drive financial success.

Education

Bachelor’s in Finance

March 2018

Skills

- Financial Modeling

- Mergers and Acquisitions

- Private Equity

- Venture Capital

- Equity Research

- Investment Banking

Work Experience

Investment Banker

- Advised clients on capital structure optimization, debt refinancing, and risk management strategies

- Managed a team of analysts and associates, providing guidance and training on financial modeling and analysis

- Participated in industry conferences and seminars to stay uptodate on market trends and best practices

- Conducted financial presentations to clients, presenting complex financial data in a clear and concise manner

Investment Banker

- Developed and implemented financial models to forecast cash flows, valuations, and returns on investment for clients in various industries

- Executed complex transactions, including mergers and acquisitions, initial public offerings (IPOs), and debt financings, with a total deal value exceeding $5 billion

- Conducted financial due diligence, prepared pitch books, and analyzed target companies for potential acquisitions

- Developed and maintained relationships with senior executives at Fortune 500 companies, private equity firms, and investment banks

Accomplishments

- Led a team that successfully advised on a $5 billion merger and acquisition, resulting in a 20% increase in the clients market share.

- Structured and executed a $2 billion debt financing, enabling the client to expand its operations and improve profitability.

- Developed and implemented a proprietary financial modeling tool that increased deal closing success rates by 30%.

- Advised on a complex IPO that raised over $1 billion, setting a new record for the industry sector.

- Successfully negotiated and closed a $750 million private equity financing, providing the client with the necessary capital for growth.

Awards

- Recognized as Top Investment Banker in the EMEA region for exceptional deal execution and client satisfaction.

- Received the Presidents Award for outstanding contributions to the companys revenue growth and client retention.

- Recognized as a Top 10 Dealmaker by the International Financial Review for consecutive years.

- Awarded the Best Investment Banking Team Award by the Global Finance Association.

Certificates

- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- CAIA (Chartered Alternative Investment Analyst)

- Series 7 and 63 (FINRA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Investment Banker

Highlight your technical skills.

Investment bankers need to be proficient in financial modeling, valuation, and accounting.Showcase your experience in deal execution.

This is the core of what investment bankers do. Be sure to quantify your accomplishments whenever possible.Demonstrate your ability to work in a team environment.

Investment banking is a team sport. You need to be able to work effectively with others.Network, network, network.

The investment banking world is small. Get to know people in the industry and let them know you’re looking for a job.

Essential Experience Highlights for a Strong Investment Banker Resume

- Developed and implemented financial models to forecast cash flows, valuations, and returns on investment for clients in various industries.

- Executed complex transactions, including mergers and acquisitions, initial public offerings (IPOs), and debt financings, with a total deal value exceeding $5 billion.

- Conducted financial due diligence, prepared pitch books, and analyzed target companies for potential acquisitions.

- Developed and maintained relationships with senior executives at Fortune 500 companies, private equity firms, and investment banks.

- Advised clients on capital structure optimization, debt refinancing, and risk management strategies.

- Managed a team of analysts and associates, providing guidance and training on financial modeling and analysis.

Frequently Asked Questions (FAQ’s) For Investment Banker

What is the average salary for an investment banker?

The average salary for an investment banker is $100,000 to $150,000 per year. However, bonuses and other forms of compensation can push total earnings much higher.

What are the hours like for investment bankers?

The hours for investment bankers are long and demanding. It is not uncommon to work 80-100 hours per week, especially during busy periods.

What is the job outlook for investment bankers?

The job outlook for investment bankers is expected to grow by 4% over the next decade. However, competition for jobs is expected to be strong.

What are the educational requirements for investment bankers?

Most investment bankers have a bachelor’s degree in finance, economics, or a related field. However, a master’s degree is becoming increasingly common.

What are the key skills for investment bankers?

The key skills for investment bankers include financial modeling, valuation, accounting, and communication skills.

What are the different types of investment banks?

There are two main types of investment banks: bulge bracket and boutique. Bulge bracket banks are the largest and most prestigious investment banks, while boutique banks are smaller and more specialized.