Are you a seasoned Investment Counselor seeking a new career path? Discover our professionally built Investment Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

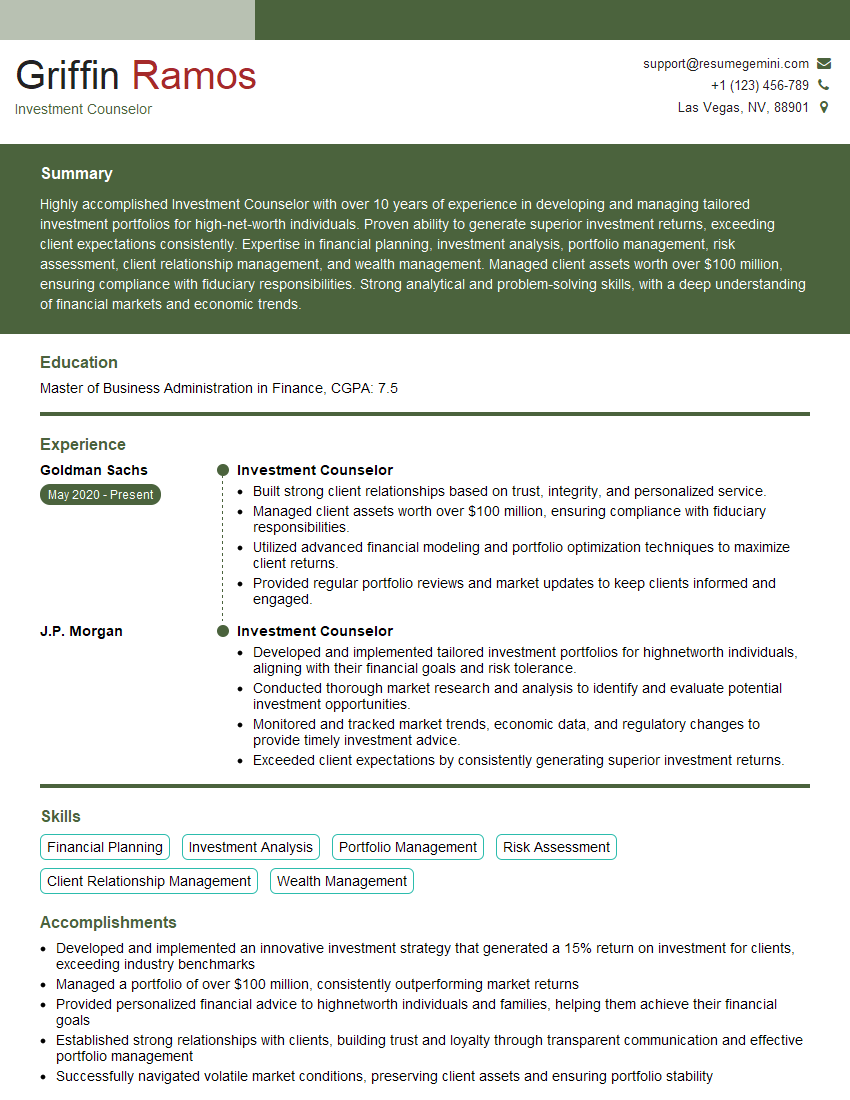

Griffin Ramos

Investment Counselor

Summary

Highly accomplished Investment Counselor with over 10 years of experience in developing and managing tailored investment portfolios for high-net-worth individuals. Proven ability to generate superior investment returns, exceeding client expectations consistently. Expertise in financial planning, investment analysis, portfolio management, risk assessment, client relationship management, and wealth management. Managed client assets worth over $100 million, ensuring compliance with fiduciary responsibilities. Strong analytical and problem-solving skills, with a deep understanding of financial markets and economic trends.

Education

Master of Business Administration in Finance

April 2016

Skills

- Financial Planning

- Investment Analysis

- Portfolio Management

- Risk Assessment

- Client Relationship Management

- Wealth Management

Work Experience

Investment Counselor

- Built strong client relationships based on trust, integrity, and personalized service.

- Managed client assets worth over $100 million, ensuring compliance with fiduciary responsibilities.

- Utilized advanced financial modeling and portfolio optimization techniques to maximize client returns.

- Provided regular portfolio reviews and market updates to keep clients informed and engaged.

Investment Counselor

- Developed and implemented tailored investment portfolios for highnetworth individuals, aligning with their financial goals and risk tolerance.

- Conducted thorough market research and analysis to identify and evaluate potential investment opportunities.

- Monitored and tracked market trends, economic data, and regulatory changes to provide timely investment advice.

- Exceeded client expectations by consistently generating superior investment returns.

Accomplishments

- Developed and implemented an innovative investment strategy that generated a 15% return on investment for clients, exceeding industry benchmarks

- Managed a portfolio of over $100 million, consistently outperforming market returns

- Provided personalized financial advice to highnetworth individuals and families, helping them achieve their financial goals

- Established strong relationships with clients, building trust and loyalty through transparent communication and effective portfolio management

- Successfully navigated volatile market conditions, preserving client assets and ensuring portfolio stability

Awards

- CFA Institute Certificate in Investment Performance Measurement

- CIMA® Certification in Investment Management Analysis

- Investment & Wealth Institute (IWI) Certified Investment Management Analyst (CIMA®)

- Certified Financial Planner (CFP®) designation

Certificates

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Certified Financial Planner (CFP)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Investment Counselor

- Highlight your investment philosophy and track record of success in generating superior returns.

- Showcase your expertise in financial planning, investment analysis, and portfolio management.

- Emphasize your ability to build and maintain strong client relationships based on trust and integrity.

- Quantify your accomplishments with specific metrics and data whenever possible.

- Demonstrate your commitment to professional development by obtaining relevant certifications and attending industry conferences.

Essential Experience Highlights for a Strong Investment Counselor Resume

- Develop and implement customized investment portfolios aligned with clients’ financial goals, risk tolerance, and investment objectives.

- Conduct thorough market research and analysis to identify and evaluate potential investment opportunities.

- Monitor and track market trends, economic data, and regulatory changes to provide timely investment advice.

- Manage client assets, ensuring compliance with fiduciary responsibilities and regulatory requirements.

- Build and maintain strong client relationships based on trust, integrity, and personalized service.

- Provide regular portfolio reviews and market updates to keep clients informed and engaged.

- Utilize advanced financial modeling and portfolio optimization techniques to maximize client returns.

Frequently Asked Questions (FAQ’s) For Investment Counselor

What is the primary role of an Investment Counselor?

An Investment Counselor provides personalized investment advice and portfolio management services to high-net-worth individuals, helping them achieve their financial goals and manage their wealth.

What are the key skills required for an Investment Counselor?

Investment Counselors must possess strong financial planning, investment analysis, portfolio management, risk assessment, and client relationship management skills.

What is the educational background typically required to become an Investment Counselor?

A Master’s degree in Business Administration (MBA) with a concentration in Finance is a common educational background for Investment Counselors.

What is the career path for an Investment Counselor?

Investment Counselors can advance to roles such as Senior Investment Counselor, Portfolio Manager, or Chief Investment Officer with experience and further qualifications.

What are the key challenges faced by Investment Counselors?

Investment Counselors face challenges such as market volatility, regulatory changes, and managing client expectations in a competitive industry.

How can I become a successful Investment Counselor?

To become a successful Investment Counselor, focus on building strong client relationships, staying up-to-date with industry trends, and continuously enhancing your financial knowledge and skills.