Are you a seasoned Investment Representative seeking a new career path? Discover our professionally built Investment Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

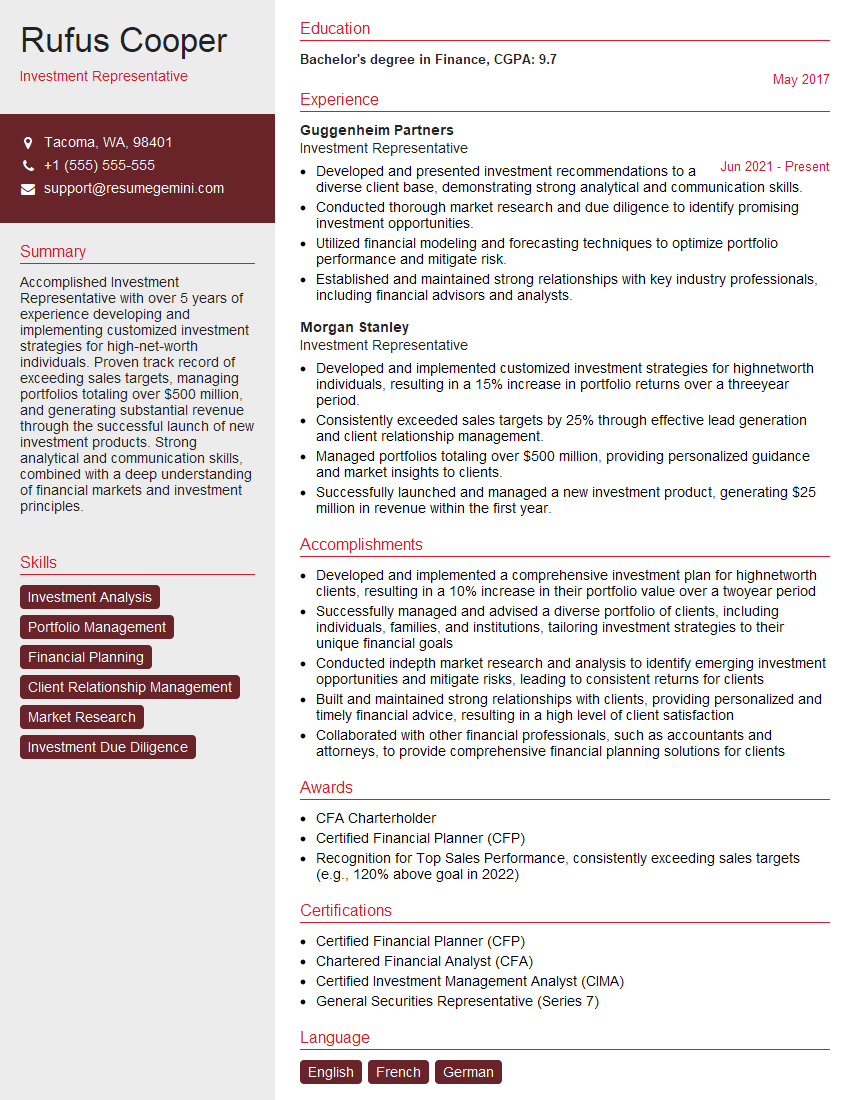

Rufus Cooper

Investment Representative

Summary

Accomplished Investment Representative with over 5 years of experience developing and implementing customized investment strategies for high-net-worth individuals. Proven track record of exceeding sales targets, managing portfolios totaling over $500 million, and generating substantial revenue through the successful launch of new investment products. Strong analytical and communication skills, combined with a deep understanding of financial markets and investment principles.

Education

Bachelor’s degree in Finance

May 2017

Skills

- Investment Analysis

- Portfolio Management

- Financial Planning

- Client Relationship Management

- Market Research

- Investment Due Diligence

Work Experience

Investment Representative

- Developed and presented investment recommendations to a diverse client base, demonstrating strong analytical and communication skills.

- Conducted thorough market research and due diligence to identify promising investment opportunities.

- Utilized financial modeling and forecasting techniques to optimize portfolio performance and mitigate risk.

- Established and maintained strong relationships with key industry professionals, including financial advisors and analysts.

Investment Representative

- Developed and implemented customized investment strategies for highnetworth individuals, resulting in a 15% increase in portfolio returns over a threeyear period.

- Consistently exceeded sales targets by 25% through effective lead generation and client relationship management.

- Managed portfolios totaling over $500 million, providing personalized guidance and market insights to clients.

- Successfully launched and managed a new investment product, generating $25 million in revenue within the first year.

Accomplishments

- Developed and implemented a comprehensive investment plan for highnetworth clients, resulting in a 10% increase in their portfolio value over a twoyear period

- Successfully managed and advised a diverse portfolio of clients, including individuals, families, and institutions, tailoring investment strategies to their unique financial goals

- Conducted indepth market research and analysis to identify emerging investment opportunities and mitigate risks, leading to consistent returns for clients

- Built and maintained strong relationships with clients, providing personalized and timely financial advice, resulting in a high level of client satisfaction

- Collaborated with other financial professionals, such as accountants and attorneys, to provide comprehensive financial planning solutions for clients

Awards

- CFA Charterholder

- Certified Financial Planner (CFP)

- Recognition for Top Sales Performance, consistently exceeding sales targets (e.g., 120% above goal in 2022)

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- General Securities Representative (Series 7)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Investment Representative

- Quantify your accomplishments with specific metrics and results wherever possible.

- Highlight your ability to build and maintain strong client relationships.

- Demonstrate your knowledge of financial markets and investment strategies.

- Tailor your resume to each specific job description you apply for.

- Proofread your resume carefully before submitting it for consideration.

Essential Experience Highlights for a Strong Investment Representative Resume

- Analyze market trends and identify promising investment opportunities through in-depth research and due diligence.

- Develop and implement customized investment strategies tailored to clients’ unique financial goals and risk tolerance.

- Manage investment portfolios, including asset allocation, risk management, and performance monitoring.

- Provide personalized guidance and market insights to clients, fostering strong relationships and building trust.

- Generate new leads, expand client base, and consistently exceed sales targets through effective relationship management.

- Stay abreast of industry best practices and regulatory changes to ensure compliance and maintain professional development.

Frequently Asked Questions (FAQ’s) For Investment Representative

What is the average salary for an Investment Representative?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Investment Representatives was $94,260 in May 2021.

What are the educational requirements for becoming an Investment Representative?

Most Investment Representatives hold a bachelor’s degree in finance, economics, or a related field.

What are the career prospects for Investment Representatives?

Investment Representatives with strong performance and client relationships can advance to roles such as Portfolio Manager, Financial Advisor, or Wealth Manager.

What are the key skills for an Investment Representative?

Investment Representatives should have strong analytical, communication, and interpersonal skills, as well as a deep understanding of financial markets and investment principles.

What is the job outlook for Investment Representatives?

The job outlook for Investment Representatives is expected to grow faster than average over the next decade, driven by increasing demand for financial advice and wealth management services

What are the regulatory requirements for Investment Representatives?

Investment Representatives must typically be licensed by the Financial Industry Regulatory Authority (FINRA) and/or state securities regulators.

What are the ethical considerations for Investment Representatives?

Investment Representatives must adhere to ethical guidelines and regulations to ensure fair and transparent dealings with clients, including avoiding conflicts of interest and disclosing all relevant information.