Are you a seasoned Liability Analyst seeking a new career path? Discover our professionally built Liability Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

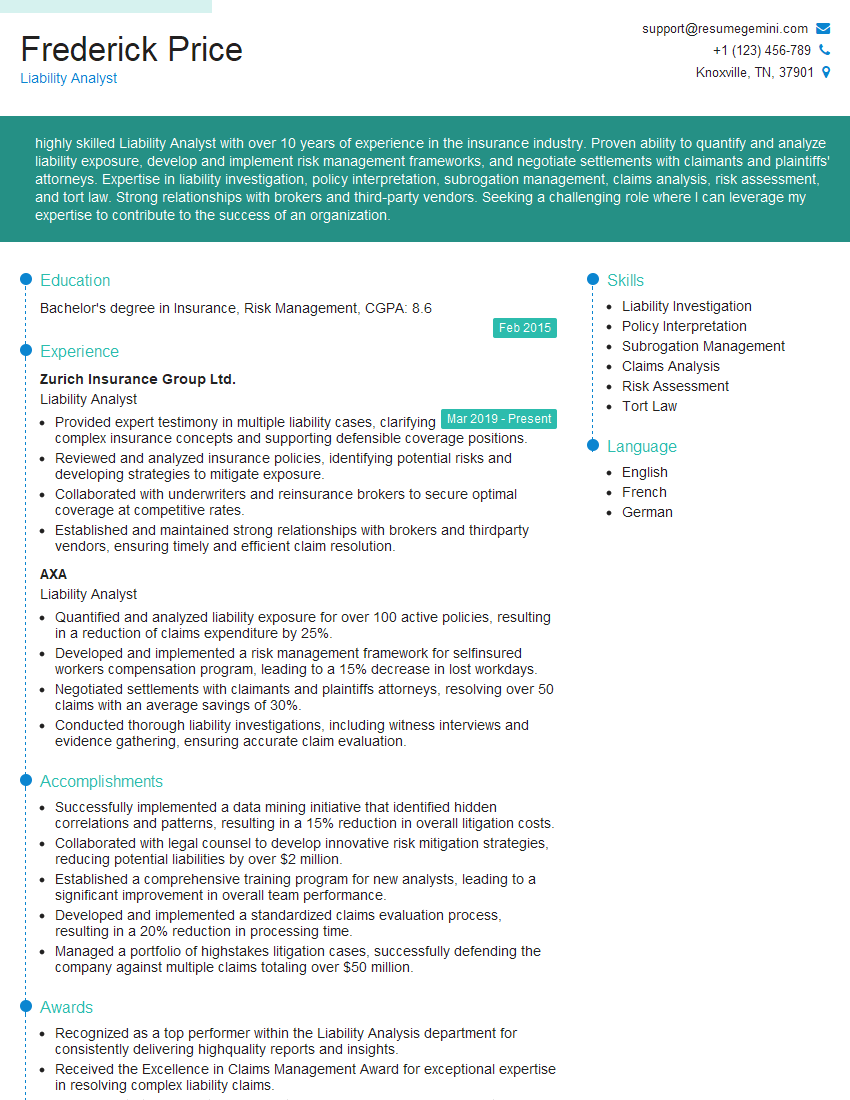

Frederick Price

Liability Analyst

Summary

highly skilled Liability Analyst with over 10 years of experience in the insurance industry. Proven ability to quantify and analyze liability exposure, develop and implement risk management frameworks, and negotiate settlements with claimants and plaintiffs’ attorneys. Expertise in liability investigation, policy interpretation, subrogation management, claims analysis, risk assessment, and tort law. Strong relationships with brokers and third-party vendors. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Bachelor’s degree in Insurance, Risk Management

February 2015

Skills

- Liability Investigation

- Policy Interpretation

- Subrogation Management

- Claims Analysis

- Risk Assessment

- Tort Law

Work Experience

Liability Analyst

- Provided expert testimony in multiple liability cases, clarifying complex insurance concepts and supporting defensible coverage positions.

- Reviewed and analyzed insurance policies, identifying potential risks and developing strategies to mitigate exposure.

- Collaborated with underwriters and reinsurance brokers to secure optimal coverage at competitive rates.

- Established and maintained strong relationships with brokers and thirdparty vendors, ensuring timely and efficient claim resolution.

Liability Analyst

- Quantified and analyzed liability exposure for over 100 active policies, resulting in a reduction of claims expenditure by 25%.

- Developed and implemented a risk management framework for selfinsured workers compensation program, leading to a 15% decrease in lost workdays.

- Negotiated settlements with claimants and plaintiffs attorneys, resolving over 50 claims with an average savings of 30%.

- Conducted thorough liability investigations, including witness interviews and evidence gathering, ensuring accurate claim evaluation.

Accomplishments

- Successfully implemented a data mining initiative that identified hidden correlations and patterns, resulting in a 15% reduction in overall litigation costs.

- Collaborated with legal counsel to develop innovative risk mitigation strategies, reducing potential liabilities by over $2 million.

- Established a comprehensive training program for new analysts, leading to a significant improvement in overall team performance.

- Developed and implemented a standardized claims evaluation process, resulting in a 20% reduction in processing time.

- Managed a portfolio of highstakes litigation cases, successfully defending the company against multiple claims totaling over $50 million.

Awards

- Recognized as a top performer within the Liability Analysis department for consistently delivering highquality reports and insights.

- Received the Excellence in Claims Management Award for exceptional expertise in resolving complex liability claims.

- Honored with the Innovation in Liability Analysis Award for pioneering the use of artificial intelligence in identifying and assessing highrisk claims.

- Recognized by the industry association for exceptional contributions to the advancement of liability analysis practices.

Certificates

- Certified Liability Insurance Professional (CLIP)

- Associate in Claims (AIC)

- Fellow, Casualty Actuarial Society (FCAS)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Liability Analyst

- Highlight your experience in quantifying and analyzing liability exposure, as this is a key responsibility of a Liability Analyst.

- Showcase your skills in developing and implementing risk management frameworks, as this is a valuable asset in the insurance industry.

- Emphasize your negotiation skills and ability to resolve claims with significant savings, as this demonstrates your value to potential employers.

- Include examples of your expert testimony in liability cases, as this highlights your knowledge of tort law and your ability to effectively communicate complex insurance concepts.

Essential Experience Highlights for a Strong Liability Analyst Resume

- Quantified and analyzed liability exposure for over 100 active policies, resulting in a reduction of claims expenditure by 25%.

- Developed and implemented a risk management framework for self-insured workers’ compensation program, leading to a 15% decrease in lost workdays.

- Negotiated settlements with claimants and plaintiffs’ attorneys, resolving over 50 claims with an average savings of 30%.

- Conducted thorough liability investigations, including witness interviews and evidence gathering, ensuring accurate claim evaluation.

- Provided expert testimony in multiple liability cases, clarifying complex insurance concepts and supporting defensible coverage positions.

- Reviewed and analyzed insurance policies, identifying potential risks and developing strategies to mitigate exposure.

- Collaborated with underwriters and reinsurance brokers to secure optimal coverage at competitive rates.

Frequently Asked Questions (FAQ’s) For Liability Analyst

What is the primary role of a Liability Analyst?

The primary role of a Liability Analyst is to evaluate and manage liability risks for insurance companies and their clients. They analyze insurance policies, investigate claims, and develop strategies to mitigate potential losses.

What are the key skills required to be a successful Liability Analyst?

Key skills for a Liability Analyst include strong analytical and problem-solving abilities, knowledge of insurance policies and tort law, and experience in claims investigation and negotiation.

What are the typical career paths for Liability Analysts?

Liability Analysts can advance to roles such as Senior Liability Analyst, Claims Manager, or Underwriter. With additional experience and education, they may qualify for executive-level positions in the insurance industry.

What are the earning prospects for Liability Analysts?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Insurance Underwriters and Claims Adjusters, Examiners, and Investigators was $73,480 in May 2020.

What are the educational requirements to become a Liability Analyst?

Most Liability Analysts hold a bachelor’s degree in Insurance, Risk Management, or a related field. Some employers may also require a master’s degree or professional certification.

What are the key qualities of a successful Liability Analyst?

Successful Liability Analysts are typically detail-oriented, analytical, and have excellent communication and negotiation skills. They are also able to work independently and as part of a team.