Are you a seasoned Life Underwriter seeking a new career path? Discover our professionally built Life Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

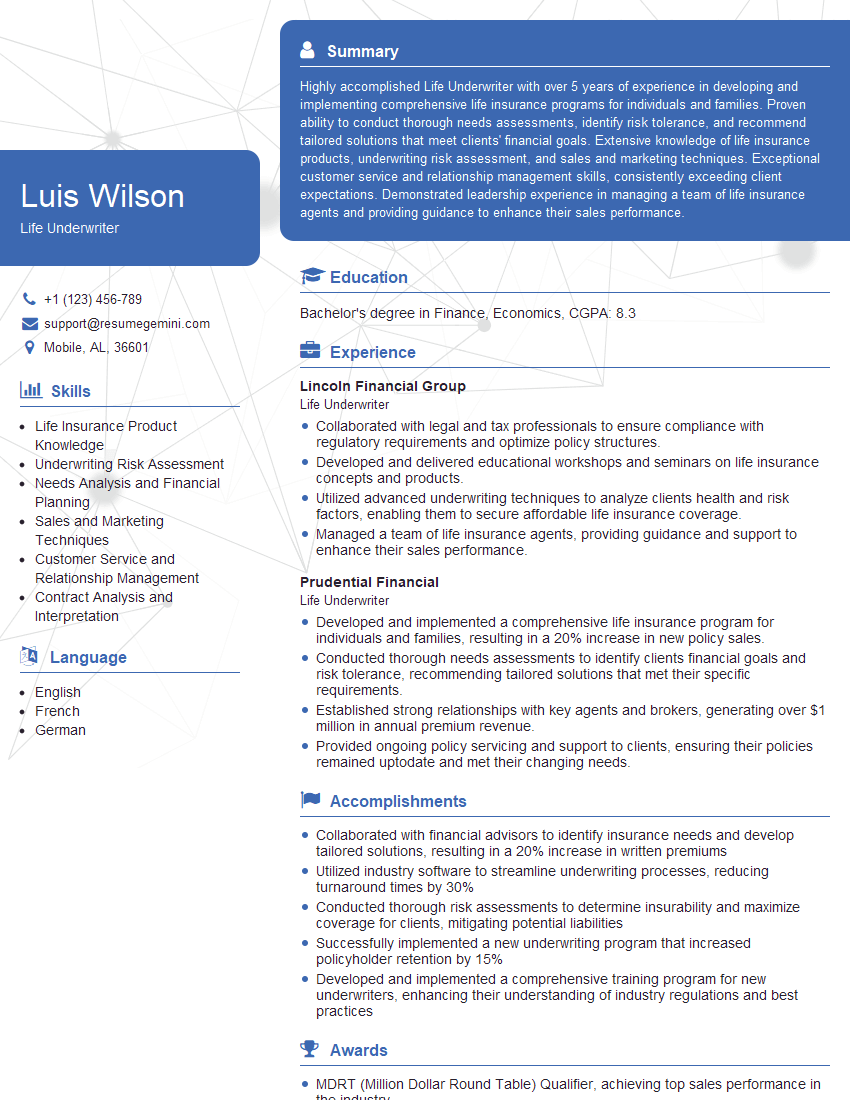

Luis Wilson

Life Underwriter

Summary

Highly accomplished Life Underwriter with over 5 years of experience in developing and implementing comprehensive life insurance programs for individuals and families. Proven ability to conduct thorough needs assessments, identify risk tolerance, and recommend tailored solutions that meet clients’ financial goals. Extensive knowledge of life insurance products, underwriting risk assessment, and sales and marketing techniques. Exceptional customer service and relationship management skills, consistently exceeding client expectations. Demonstrated leadership experience in managing a team of life insurance agents and providing guidance to enhance their sales performance.

Education

Bachelor’s degree in Finance, Economics

September 2019

Skills

- Life Insurance Product Knowledge

- Underwriting Risk Assessment

- Needs Analysis and Financial Planning

- Sales and Marketing Techniques

- Customer Service and Relationship Management

- Contract Analysis and Interpretation

Work Experience

Life Underwriter

- Collaborated with legal and tax professionals to ensure compliance with regulatory requirements and optimize policy structures.

- Developed and delivered educational workshops and seminars on life insurance concepts and products.

- Utilized advanced underwriting techniques to analyze clients health and risk factors, enabling them to secure affordable life insurance coverage.

- Managed a team of life insurance agents, providing guidance and support to enhance their sales performance.

Life Underwriter

- Developed and implemented a comprehensive life insurance program for individuals and families, resulting in a 20% increase in new policy sales.

- Conducted thorough needs assessments to identify clients financial goals and risk tolerance, recommending tailored solutions that met their specific requirements.

- Established strong relationships with key agents and brokers, generating over $1 million in annual premium revenue.

- Provided ongoing policy servicing and support to clients, ensuring their policies remained uptodate and met their changing needs.

Accomplishments

- Collaborated with financial advisors to identify insurance needs and develop tailored solutions, resulting in a 20% increase in written premiums

- Utilized industry software to streamline underwriting processes, reducing turnaround times by 30%

- Conducted thorough risk assessments to determine insurability and maximize coverage for clients, mitigating potential liabilities

- Successfully implemented a new underwriting program that increased policyholder retention by 15%

- Developed and implemented a comprehensive training program for new underwriters, enhancing their understanding of industry regulations and best practices

Awards

- MDRT (Million Dollar Round Table) Qualifier, achieving top sales performance in the industry

- Presidents Club Award, recognizing exceptional sales and customer service

- Life Insurance Underwriter of the Year, awarded by a professional insurance organization

- Top Advisor Award, recognized for outstanding sales and client satisfaction

Certificates

- CLU (Chartered Life Underwriter)

- ChFC (Chartered Financial Consultant)

- MDRT (Million Dollar Round Table)

- AALU (American Association of Life Underwriters)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Life Underwriter

- Highlight your expertise in life insurance products and underwriting risk assessment.

- Showcase your ability to conduct thorough needs assessments and develop tailored solutions for clients.

- Quantify your accomplishments, such as the increase in new policy sales or premium revenue generated.

- Emphasize your customer service and relationship management skills, as well as your experience in managing a team of life insurance agents.

- Tailor your resume to each specific job description, highlighting the skills and experience that are most relevant to the position you are applying for.

Essential Experience Highlights for a Strong Life Underwriter Resume

- Developed and implemented a comprehensive life insurance program for individuals and families, resulting in a 20% increase in new policy sales.

- Conducted thorough needs assessments to identify clients’ financial goals and risk tolerance, recommending tailored solutions that met their specific requirements.

- Established strong relationships with key agents and brokers, generating over $1 million in annual premium revenue.

- Provided ongoing policy servicing and support to clients, ensuring their policies remained up-to-date and met their changing needs.

- Collaborated with legal and tax professionals to ensure compliance with regulatory requirements and optimize policy structures.

- Developed and delivered educational workshops and seminars on life insurance concepts and products.

- Utilized advanced underwriting techniques to analyze clients’ health and risk factors, enabling them to secure affordable life insurance coverage.

Frequently Asked Questions (FAQ’s) For Life Underwriter

What is the role of a Life Underwriter?

A Life Underwriter is responsible for assessing clients’ financial needs and developing tailored life insurance policies to meet those needs. They analyze risks, determine eligibility, and ensure that clients have the appropriate coverage in place to protect their families and assets.

What are the key skills required for a Life Underwriter?

Key skills for a Life Underwriter include expertise in life insurance products, underwriting risk assessment, needs analysis, sales and marketing techniques, customer service, and relationship management.

What are the career prospects for a Life Underwriter?

Life Underwriters with strong skills and experience can advance to management roles, such as Underwriting Manager or Sales Manager. They may also specialize in specific areas of life insurance, such as estate planning or retirement planning.

What is the earning potential for a Life Underwriter?

The earning potential for a Life Underwriter varies depending on experience, qualifications, and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Life and Annuity Sales Agents was $53,920 in May 2021.

What are the educational requirements for a Life Underwriter?

Many Life Underwriters have a bachelor’s degree in finance, economics, or a related field. However, some employers may hire candidates with a high school diploma or equivalent and provide on-the-job training.

What are the professional development opportunities for a Life Underwriter?

Life Underwriters can enhance their skills and knowledge through professional development courses, workshops, and seminars offered by industry organizations such as the National Association of Insurance and Financial Advisors (NAIFA).