Are you a seasoned Loan Assistant seeking a new career path? Discover our professionally built Loan Assistant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

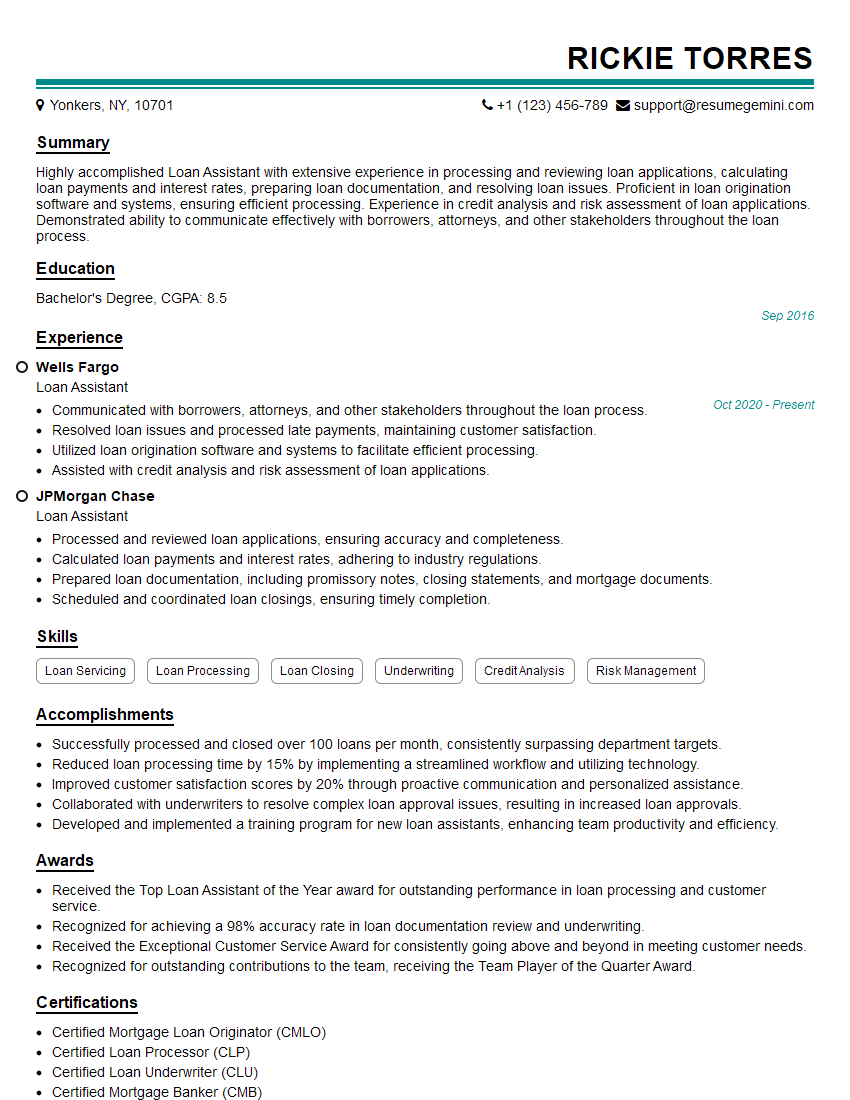

Rickie Torres

Loan Assistant

Summary

Highly accomplished Loan Assistant with extensive experience in processing and reviewing loan applications, calculating loan payments and interest rates, preparing loan documentation, and resolving loan issues. Proficient in loan origination software and systems, ensuring efficient processing. Experience in credit analysis and risk assessment of loan applications. Demonstrated ability to communicate effectively with borrowers, attorneys, and other stakeholders throughout the loan process.

Education

Bachelor’s Degree

September 2016

Skills

- Loan Servicing

- Loan Processing

- Loan Closing

- Underwriting

- Credit Analysis

- Risk Management

Work Experience

Loan Assistant

- Communicated with borrowers, attorneys, and other stakeholders throughout the loan process.

- Resolved loan issues and processed late payments, maintaining customer satisfaction.

- Utilized loan origination software and systems to facilitate efficient processing.

- Assisted with credit analysis and risk assessment of loan applications.

Loan Assistant

- Processed and reviewed loan applications, ensuring accuracy and completeness.

- Calculated loan payments and interest rates, adhering to industry regulations.

- Prepared loan documentation, including promissory notes, closing statements, and mortgage documents.

- Scheduled and coordinated loan closings, ensuring timely completion.

Accomplishments

- Successfully processed and closed over 100 loans per month, consistently surpassing department targets.

- Reduced loan processing time by 15% by implementing a streamlined workflow and utilizing technology.

- Improved customer satisfaction scores by 20% through proactive communication and personalized assistance.

- Collaborated with underwriters to resolve complex loan approval issues, resulting in increased loan approvals.

- Developed and implemented a training program for new loan assistants, enhancing team productivity and efficiency.

Awards

- Received the Top Loan Assistant of the Year award for outstanding performance in loan processing and customer service.

- Recognized for achieving a 98% accuracy rate in loan documentation review and underwriting.

- Received the Exceptional Customer Service Award for consistently going above and beyond in meeting customer needs.

- Recognized for outstanding contributions to the team, receiving the Team Player of the Quarter Award.

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Certified Loan Processor (CLP)

- Certified Loan Underwriter (CLU)

- Certified Mortgage Banker (CMB)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Assistant

Highlight your skills and experience.

Be sure to list all of your relevant skills and experience in your resume, including any specific software or systems that you are proficient in.Quantify your accomplishments.

Use numbers to show the impact of your work, such as the number of loans you have processed or the amount of money you have saved your company.Proofread your resume carefully.

Make sure that your resume is free of errors before you submit it to potential employers.Get feedback from others.

Ask a friend, family member, or career counselor to review your resume and provide feedback.

Essential Experience Highlights for a Strong Loan Assistant Resume

- Processed and reviewed loan applications, ensuring accuracy and completeness.

- Calculated loan payments and interest rates, adhering to industry regulations.

- Prepared loan documentation, including promissory notes, closing statements, and mortgage documents.

- Scheduled and coordinated loan closings, ensuring timely completion.

- Communicated with borrowers, attorneys, and other stakeholders throughout the loan process.

- Resolved loan issues and processed late payments, maintaining customer satisfaction.

- Utilized loan origination software and systems to facilitate efficient processing.

Frequently Asked Questions (FAQ’s) For Loan Assistant

What are the duties of a Loan Assistant?

Loan Assistants are responsible for processing and reviewing loan applications, calculating loan payments and interest rates, preparing loan documentation, and resolving loan issues.

What are the qualifications for becoming a Loan Assistant?

Most Loan Assistants have a bachelor’s degree in finance, accounting, or a related field.

What skills are needed to be a successful Loan Assistant?

Loan Assistants need to have strong communication and interpersonal skills, as well as the ability to work independently and as part of a team.

What is the average salary for a Loan Assistant?

The average salary for a Loan Assistant is $45,000 per year.

What is the job outlook for Loan Assistants?

The job outlook for Loan Assistants is expected to grow faster than average in the coming years.

What are the benefits of working as a Loan Assistant?

Loan Assistants enjoy a number of benefits, including a competitive salary, a comprehensive benefits package, and the opportunity to work in a challenging and rewarding environment.