Are you a seasoned Loan Consultant seeking a new career path? Discover our professionally built Loan Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

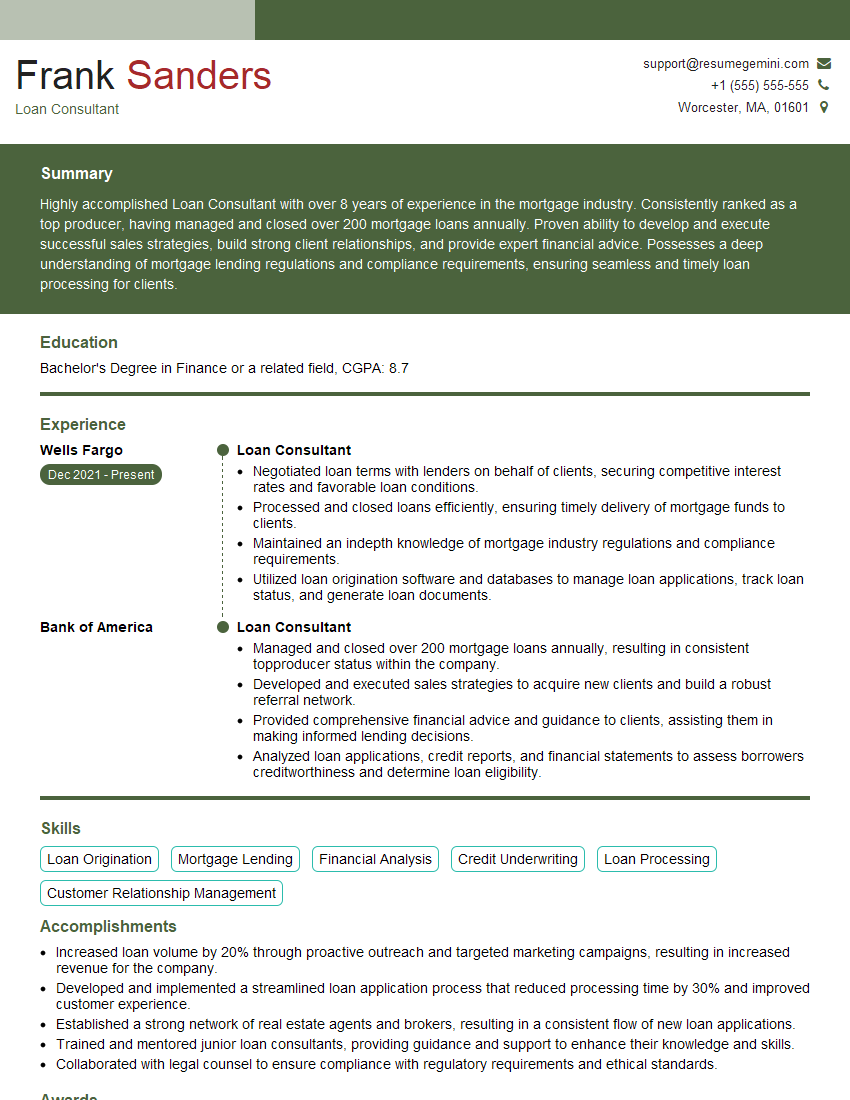

Frank Sanders

Loan Consultant

Summary

Highly accomplished Loan Consultant with over 8 years of experience in the mortgage industry. Consistently ranked as a top producer, having managed and closed over 200 mortgage loans annually. Proven ability to develop and execute successful sales strategies, build strong client relationships, and provide expert financial advice. Possesses a deep understanding of mortgage lending regulations and compliance requirements, ensuring seamless and timely loan processing for clients.

Education

Bachelor’s Degree in Finance or a related field

November 2017

Skills

- Loan Origination

- Mortgage Lending

- Financial Analysis

- Credit Underwriting

- Loan Processing

- Customer Relationship Management

Work Experience

Loan Consultant

- Negotiated loan terms with lenders on behalf of clients, securing competitive interest rates and favorable loan conditions.

- Processed and closed loans efficiently, ensuring timely delivery of mortgage funds to clients.

- Maintained an indepth knowledge of mortgage industry regulations and compliance requirements.

- Utilized loan origination software and databases to manage loan applications, track loan status, and generate loan documents.

Loan Consultant

- Managed and closed over 200 mortgage loans annually, resulting in consistent topproducer status within the company.

- Developed and executed sales strategies to acquire new clients and build a robust referral network.

- Provided comprehensive financial advice and guidance to clients, assisting them in making informed lending decisions.

- Analyzed loan applications, credit reports, and financial statements to assess borrowers creditworthiness and determine loan eligibility.

Accomplishments

- Increased loan volume by 20% through proactive outreach and targeted marketing campaigns, resulting in increased revenue for the company.

- Developed and implemented a streamlined loan application process that reduced processing time by 30% and improved customer experience.

- Established a strong network of real estate agents and brokers, resulting in a consistent flow of new loan applications.

- Trained and mentored junior loan consultants, providing guidance and support to enhance their knowledge and skills.

- Collaborated with legal counsel to ensure compliance with regulatory requirements and ethical standards.

Awards

- Received the Presidents Club Award for consistently exceeding sales targets and providing exceptional customer service.

- Recognized as Loan Officer of the Year for achieving outstanding performance in loan approvals and customer satisfaction.

- Honored with the Customer Excellence Award for consistently providing exceptional support and resolving customer inquiries promptly.

- Received the Sales Achievement Award for surpassing sales goals and demonstrating exceptional sales skills.

Certificates

- Certified Mortgage Planner (CMP)

- Certified Financial Planner (CFP)

- Certified Residential Mortgage Specialist (CRMS)

- Certified Mortgage Marketing Professional (CMMP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Consultant

- Highlight your top achievements and quantifiable results in your resume summary

- Showcase your expertise in mortgage lending and financial analysis by using specific industry terminology

- Include testimonials or recommendations from satisfied clients to demonstrate your exceptional customer service skills

- Review your resume carefully for any errors or inconsistencies

- Tailor your resume to each specific job application, highlighting skills and experience that are most relevant to the position

Essential Experience Highlights for a Strong Loan Consultant Resume

- Managed and closed over 200 mortgage loans annually, consistently achieving top producer status

- Developed and implemented sales strategies to acquire new clients and cultivate a robust referral network

- Provided comprehensive financial advice and guidance to clients, assisting them in making informed lending decisions

- Analyzed loan applications, credit reports, and financial statements to assess borrowers’ creditworthiness and determine loan eligibility

- Negotiated loan terms with lenders on behalf of clients, securing competitive interest rates and favorable loan conditions

- Processed and closed loans efficiently, ensuring timely delivery of mortgage funds to clients

- Maintained an in-depth knowledge of mortgage industry regulations and compliance requirements

Frequently Asked Questions (FAQ’s) For Loan Consultant

What are the key skills required for a Loan Consultant?

Loan Origination, Mortgage Lending, Financial Analysis, Credit Underwriting, Loan Processing, Customer Relationship Management

What is the average salary for a Loan Consultant?

The average salary for a Loan Consultant in the United States is around $65,000 per year

What are the career prospects for a Loan Consultant?

Loan Consultants with experience and a strong track record can advance to roles such as Loan Officer, Mortgage Broker, or Branch Manager

What are the educational requirements for a Loan Consultant?

Most Loan Consultants have a Bachelor’s Degree in Finance or a related field

What are the challenges faced by Loan Consultants?

Loan Consultants face challenges such as fluctuating interest rates, evolving regulations, and competition from other lenders

How can I become a successful Loan Consultant?

To become a successful Loan Consultant, focus on building strong relationships, staying up-to-date on industry trends, and providing excellent customer service

What is the difference between a Loan Consultant and a Mortgage Broker?

Loan Consultants typically work for a specific lender, while Mortgage Brokers work with multiple lenders to find the best loan options for their clients