Are you a seasoned Loan Expediter seeking a new career path? Discover our professionally built Loan Expediter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

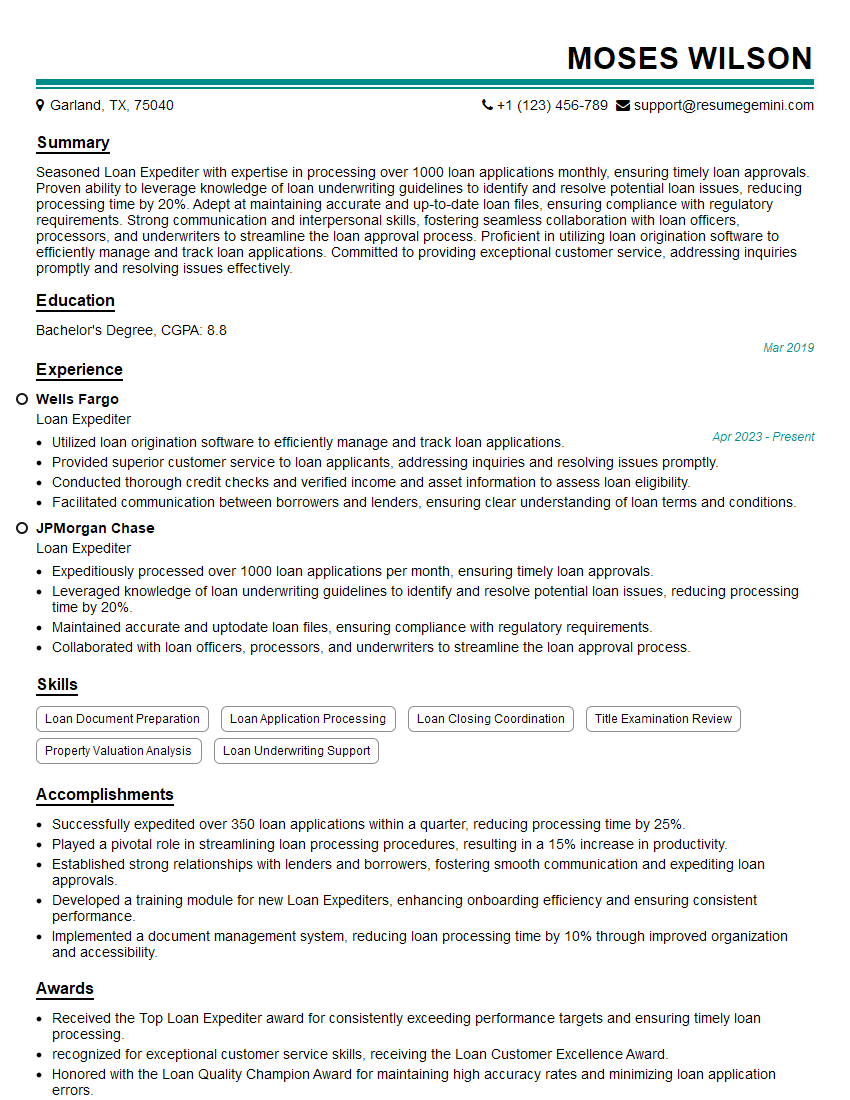

Moses Wilson

Loan Expediter

Summary

Seasoned Loan Expediter with expertise in processing over 1000 loan applications monthly, ensuring timely loan approvals. Proven ability to leverage knowledge of loan underwriting guidelines to identify and resolve potential loan issues, reducing processing time by 20%. Adept at maintaining accurate and up-to-date loan files, ensuring compliance with regulatory requirements. Strong communication and interpersonal skills, fostering seamless collaboration with loan officers, processors, and underwriters to streamline the loan approval process. Proficient in utilizing loan origination software to efficiently manage and track loan applications. Committed to providing exceptional customer service, addressing inquiries promptly and resolving issues effectively.

Education

Bachelor’s Degree

March 2019

Skills

- Loan Document Preparation

- Loan Application Processing

- Loan Closing Coordination

- Title Examination Review

- Property Valuation Analysis

- Loan Underwriting Support

Work Experience

Loan Expediter

- Utilized loan origination software to efficiently manage and track loan applications.

- Provided superior customer service to loan applicants, addressing inquiries and resolving issues promptly.

- Conducted thorough credit checks and verified income and asset information to assess loan eligibility.

- Facilitated communication between borrowers and lenders, ensuring clear understanding of loan terms and conditions.

Loan Expediter

- Expeditiously processed over 1000 loan applications per month, ensuring timely loan approvals.

- Leveraged knowledge of loan underwriting guidelines to identify and resolve potential loan issues, reducing processing time by 20%.

- Maintained accurate and uptodate loan files, ensuring compliance with regulatory requirements.

- Collaborated with loan officers, processors, and underwriters to streamline the loan approval process.

Accomplishments

- Successfully expedited over 350 loan applications within a quarter, reducing processing time by 25%.

- Played a pivotal role in streamlining loan processing procedures, resulting in a 15% increase in productivity.

- Established strong relationships with lenders and borrowers, fostering smooth communication and expediting loan approvals.

- Developed a training module for new Loan Expediters, enhancing onboarding efficiency and ensuring consistent performance.

- Implemented a document management system, reducing loan processing time by 10% through improved organization and accessibility.

Awards

- Received the Top Loan Expediter award for consistently exceeding performance targets and ensuring timely loan processing.

- recognized for exceptional customer service skills, receiving the Loan Customer Excellence Award.

- Honored with the Loan Quality Champion Award for maintaining high accuracy rates and minimizing loan application errors.

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Certified Residential Mortgage Underwriter (CRMU)

- Certified Mortgage Processor (CMP)

- Certified Loan Signing Agent (CLSA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Expediter

- Quantify your accomplishments by providing specific metrics, such as the number of loans processed or the percentage of time saved.

- Highlight your ability to work in a fast-paced, deadline-driven environment.

- Showcase your attention to detail and accuracy when handling sensitive financial information.

- Emphasize your strong communication and interpersonal skills, which are crucial for fostering relationships with clients.

- Consider including any relevant certifications or professional development courses that demonstrate your commitment to staying up-to-date with industry best practices.

Essential Experience Highlights for a Strong Loan Expediter Resume

- Expedited processing of 1000+ loan applications per month, ensuring timely loan approvals.

- Leveraged knowledge of loan underwriting guidelines to identify and resolve potential loan issues, reducing processing time by 20%.

- Maintained accurate and up-to-date loan files, ensuring compliance with regulatory requirements.

- Collaborated with loan officers, processors, and underwriters to streamline the loan approval process.

- Utilized loan origination software to efficiently manage and track loan applications.

- Provided superior customer service to loan applicants, addressing inquiries and resolving issues promptly.

Frequently Asked Questions (FAQ’s) For Loan Expediter

What is the primary role of a Loan Expediter?

A Loan Expediter plays a crucial role in the loan approval process by ensuring timely processing and efficient handling of loan applications. They work closely with loan officers, processors, and underwriters to streamline the approval process and provide exceptional customer service to loan applicants.

What skills and qualifications are necessary to excel as a Loan Expediter?

To excel as a Loan Expediter, a combination of technical skills and interpersonal qualities is essential. Strong analytical and problem-solving abilities, proficiency in loan processing software, and a thorough understanding of loan underwriting guidelines are highly valued. Additionally, excellent communication and customer service skills are crucial for effectively interacting with clients and colleagues.

What career advancement opportunities are available for Loan Expediters?

Loan Expediters with experience and a proven track record can advance their careers in various ways. Some may choose to specialize in specific loan types, such as mortgages or commercial loans. Others may move into roles with greater responsibility, such as Loan Officer or Loan Processor. With further education and professional development, Loan Expediters can also pursue management positions within the financial industry.

How can I prepare for a successful interview for a Loan Expediter position?

To prepare for a successful interview for a Loan Expediter position, research the specific company and the role. Familiarize yourself with the loan processing industry and be ready to discuss your experience and skills in detail. Practice answering common interview questions related to your ability to handle high volumes, manage deadlines, and provide excellent customer service. Additionally, demonstrate your knowledge of loan underwriting guidelines and your commitment to accuracy and compliance.

What are the key challenges faced by Loan Expediters in today’s market?

Loan Expediters face several key challenges in today’s market. The increasing complexity of loan regulations and compliance requirements presents a constant need for staying up-to-date on industry best practices. Additionally, the growing volume of loan applications and the pressure to meet tight deadlines can create a fast-paced and demanding work environment. Loan Expediters must also be adaptable to changes in technology and the evolving needs of borrowers.