Are you a seasoned Loan Processing Supervisor seeking a new career path? Discover our professionally built Loan Processing Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

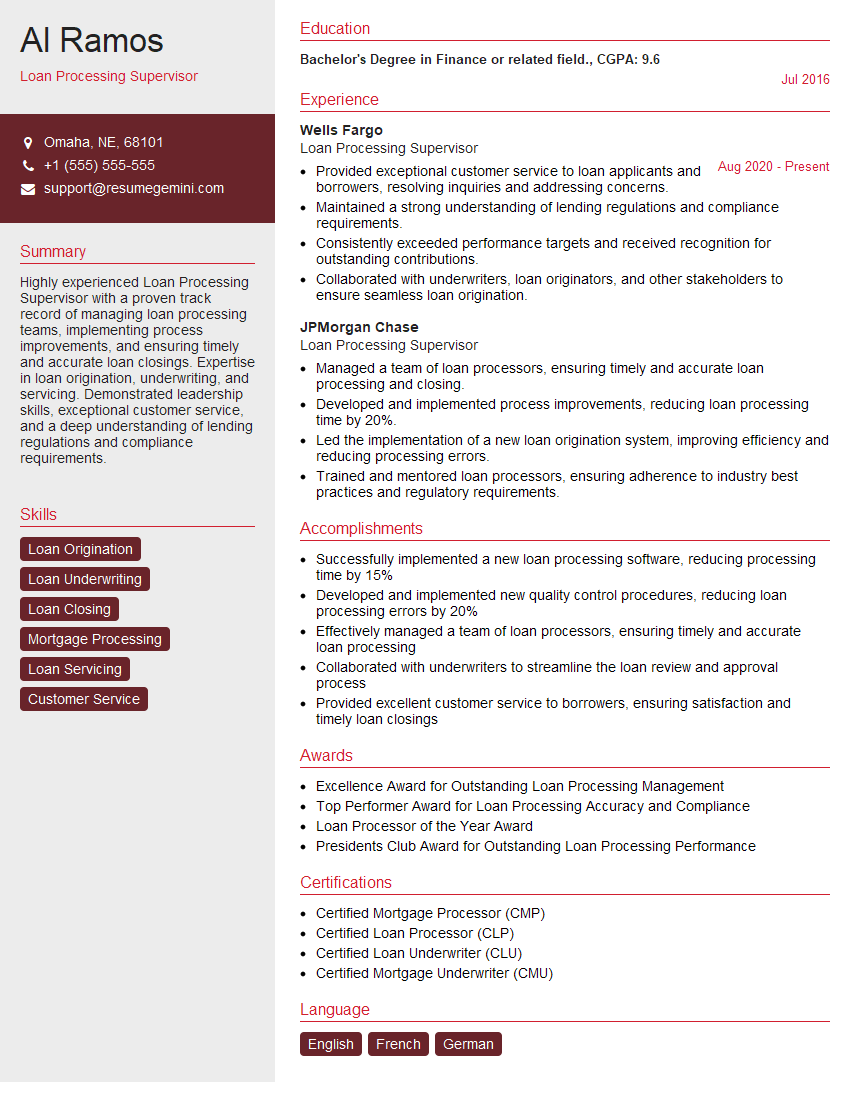

Al Ramos

Loan Processing Supervisor

Summary

Highly experienced Loan Processing Supervisor with a proven track record of managing loan processing teams, implementing process improvements, and ensuring timely and accurate loan closings. Expertise in loan origination, underwriting, and servicing. Demonstrated leadership skills, exceptional customer service, and a deep understanding of lending regulations and compliance requirements.

Education

Bachelor’s Degree in Finance or related field.

July 2016

Skills

- Loan Origination

- Loan Underwriting

- Loan Closing

- Mortgage Processing

- Loan Servicing

- Customer Service

Work Experience

Loan Processing Supervisor

- Provided exceptional customer service to loan applicants and borrowers, resolving inquiries and addressing concerns.

- Maintained a strong understanding of lending regulations and compliance requirements.

- Consistently exceeded performance targets and received recognition for outstanding contributions.

- Collaborated with underwriters, loan originators, and other stakeholders to ensure seamless loan origination.

Loan Processing Supervisor

- Managed a team of loan processors, ensuring timely and accurate loan processing and closing.

- Developed and implemented process improvements, reducing loan processing time by 20%.

- Led the implementation of a new loan origination system, improving efficiency and reducing processing errors.

- Trained and mentored loan processors, ensuring adherence to industry best practices and regulatory requirements.

Accomplishments

- Successfully implemented a new loan processing software, reducing processing time by 15%

- Developed and implemented new quality control procedures, reducing loan processing errors by 20%

- Effectively managed a team of loan processors, ensuring timely and accurate loan processing

- Collaborated with underwriters to streamline the loan review and approval process

- Provided excellent customer service to borrowers, ensuring satisfaction and timely loan closings

Awards

- Excellence Award for Outstanding Loan Processing Management

- Top Performer Award for Loan Processing Accuracy and Compliance

- Loan Processor of the Year Award

- Presidents Club Award for Outstanding Loan Processing Performance

Certificates

- Certified Mortgage Processor (CMP)

- Certified Loan Processor (CLP)

- Certified Loan Underwriter (CLU)

- Certified Mortgage Underwriter (CMU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Processing Supervisor

- Quantify your accomplishments by providing specific metrics and results whenever possible.

- Highlight your expertise in loan processing, underwriting, and servicing, and demonstrate your knowledge of industry best practices and regulations.

- Emphasize your leadership and management skills, and provide examples of how you have successfully motivated and developed your team.

- Showcase your customer service skills and provide examples of how you have gone above and beyond to resolve customer inquiries and concerns.

Essential Experience Highlights for a Strong Loan Processing Supervisor Resume

- Manage and supervise a team of loan processors, ensuring adherence to industry best practices and regulatory requirements.

- Develop and implement process improvements to streamline loan processing, reduce processing time, and improve efficiency.

- Train and mentor loan processors, providing guidance and support to ensure they are well-equipped to handle all aspects of loan processing.

- Provide exceptional customer service to loan applicants and borrowers, resolving inquiries, addressing concerns, and ensuring a positive experience throughout the loan process.

- Work closely with underwriters, loan officers, and other stakeholders to ensure seamless loan origination, underwriting, and closing.

- Maintain a strong understanding of lending regulations and compliance requirements, and ensure that all loan processing activities are conducted in accordance with applicable laws and regulations.

- Consistently exceed performance targets and receive recognition for outstanding contributions to the team and the organization.

Frequently Asked Questions (FAQ’s) For Loan Processing Supervisor

What are the key responsibilities of a Loan Processing Supervisor?

The key responsibilities of a Loan Processing Supervisor include managing and supervising a team of loan processors, developing and implementing process improvements, training and mentoring loan processors, providing exceptional customer service, and ensuring compliance with lending regulations and requirements.

What are the qualifications for a Loan Processing Supervisor?

The qualifications for a Loan Processing Supervisor typically include a bachelor’s degree in finance or a related field, as well as several years of experience in loan processing and management.

What are the career prospects for a Loan Processing Supervisor?

Loan Processing Supervisors can advance to roles such as Loan Operations Manager, Senior Loan Processor, or Loan Underwriter.

What are the challenges of being a Loan Processing Supervisor?

The challenges of being a Loan Processing Supervisor can include managing a large workload, meeting tight deadlines, and ensuring the accuracy and completeness of loan applications.

What are the rewards of being a Loan Processing Supervisor?

The rewards of being a Loan Processing Supervisor can include a competitive salary, benefits package, and the opportunity to make a difference in the lives of others by helping them to secure financing for their homes or businesses.

What are the skills required for a Loan Processing Supervisor?

The skills required for a Loan Processing Supervisor include strong communication and interpersonal skills, the ability to manage multiple projects and priorities, and a deep understanding of lending regulations and requirements.