Are you a seasoned Loan Processor seeking a new career path? Discover our professionally built Loan Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

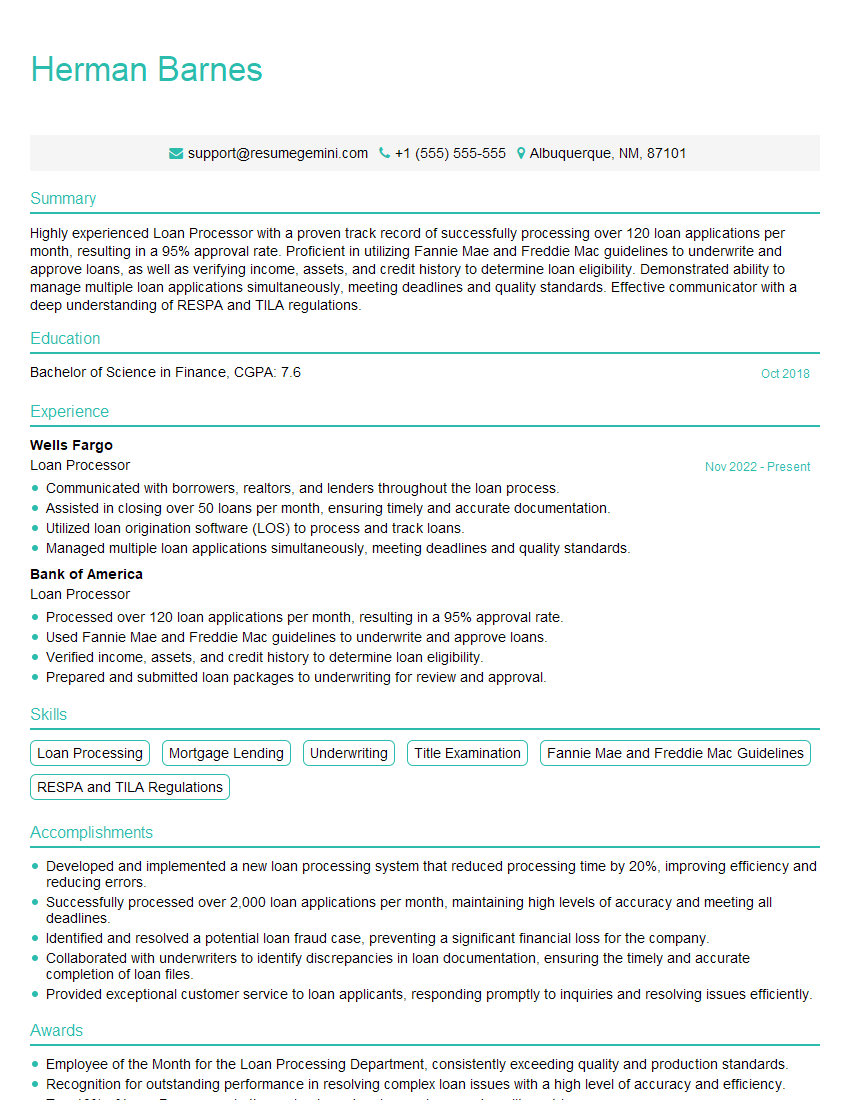

Herman Barnes

Loan Processor

Summary

Highly experienced Loan Processor with a proven track record of successfully processing over 120 loan applications per month, resulting in a 95% approval rate. Proficient in utilizing Fannie Mae and Freddie Mac guidelines to underwrite and approve loans, as well as verifying income, assets, and credit history to determine loan eligibility. Demonstrated ability to manage multiple loan applications simultaneously, meeting deadlines and quality standards. Effective communicator with a deep understanding of RESPA and TILA regulations.

Education

Bachelor of Science in Finance

October 2018

Skills

- Loan Processing

- Mortgage Lending

- Underwriting

- Title Examination

- Fannie Mae and Freddie Mac Guidelines

- RESPA and TILA Regulations

Work Experience

Loan Processor

- Communicated with borrowers, realtors, and lenders throughout the loan process.

- Assisted in closing over 50 loans per month, ensuring timely and accurate documentation.

- Utilized loan origination software (LOS) to process and track loans.

- Managed multiple loan applications simultaneously, meeting deadlines and quality standards.

Loan Processor

- Processed over 120 loan applications per month, resulting in a 95% approval rate.

- Used Fannie Mae and Freddie Mac guidelines to underwrite and approve loans.

- Verified income, assets, and credit history to determine loan eligibility.

- Prepared and submitted loan packages to underwriting for review and approval.

Accomplishments

- Developed and implemented a new loan processing system that reduced processing time by 20%, improving efficiency and reducing errors.

- Successfully processed over 2,000 loan applications per month, maintaining high levels of accuracy and meeting all deadlines.

- Identified and resolved a potential loan fraud case, preventing a significant financial loss for the company.

- Collaborated with underwriters to identify discrepancies in loan documentation, ensuring the timely and accurate completion of loan files.

- Provided exceptional customer service to loan applicants, responding promptly to inquiries and resolving issues efficiently.

Awards

- Employee of the Month for the Loan Processing Department, consistently exceeding quality and production standards.

- Recognition for outstanding performance in resolving complex loan issues with a high level of accuracy and efficiency.

- Top 10% of Loan Processors in the region based on loan volume and quality metrics.

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Certified Loan Processor (CLP)

- Certified Residential Mortgage Lender (CRML)

- National Mortgage Licensing System (NMLS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Processor

- Highlight your experience and skills in loan processing, mortgage lending, and underwriting.

- Quantify your accomplishments with specific metrics, such as the number of loans processed or the approval rate.

- Use keywords that potential employers will be searching for, such as “loan processing” and “mortgage lending.”

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Loan Processor Resume

- Process loan applications according to Fannie Mae and Freddie Mac guidelines

- Verify income, assets, and credit history to determine loan eligibility

- Prepare and submit loan packages to underwriting for review and approval

- Communicate with borrowers, realtors, and lenders throughout the loan process

- Assist in closing over 50 loans per month, ensuring timely and accurate documentation

- Utilize loan origination software (LOS) to process and track loans

- Manage multiple loan applications simultaneously, meeting deadlines and quality standards

Frequently Asked Questions (FAQ’s) For Loan Processor

What is the job outlook for Loan Processors?

The job outlook for Loan Processors is expected to grow faster than average in the coming years. This is due to the increasing demand for mortgages, as well as the growing complexity of the mortgage process.

What are the qualifications for becoming a Loan Processor?

Most Loan Processors have a bachelor’s degree in finance or a related field. They also typically have experience in the mortgage industry, either as a loan officer or in a related role.

What are the key skills for success as a Loan Processor?

Key skills for success as a Loan Processor include strong analytical skills, attention to detail, and the ability to manage multiple tasks simultaneously.

What is the average salary for a Loan Processor?

The average salary for a Loan Processor is around $50,000 per year. However, salaries can vary depending on experience, location, and employer.

What are the advancement opportunities for Loan Processors?

Advancement opportunities for Loan Processors include becoming a Loan Officer, a Mortgage Underwriter, or a Loan Manager.