Are you a seasoned Loan Representative seeking a new career path? Discover our professionally built Loan Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

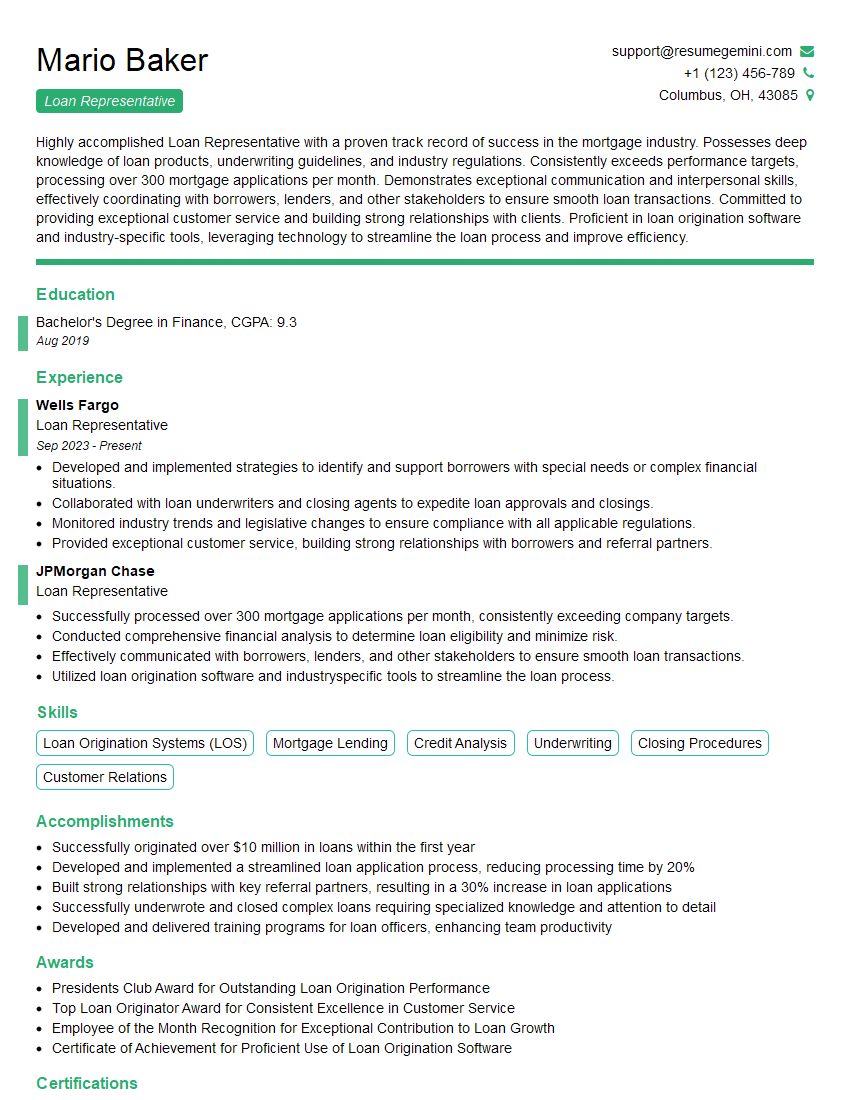

Mario Baker

Loan Representative

Summary

Highly accomplished Loan Representative with a proven track record of success in the mortgage industry. Possesses deep knowledge of loan products, underwriting guidelines, and industry regulations. Consistently exceeds performance targets, processing over 300 mortgage applications per month. Demonstrates exceptional communication and interpersonal skills, effectively coordinating with borrowers, lenders, and other stakeholders to ensure smooth loan transactions. Committed to providing exceptional customer service and building strong relationships with clients. Proficient in loan origination software and industry-specific tools, leveraging technology to streamline the loan process and improve efficiency.

Education

Bachelor’s Degree in Finance

August 2019

Skills

- Loan Origination Systems (LOS)

- Mortgage Lending

- Credit Analysis

- Underwriting

- Closing Procedures

- Customer Relations

Work Experience

Loan Representative

- Developed and implemented strategies to identify and support borrowers with special needs or complex financial situations.

- Collaborated with loan underwriters and closing agents to expedite loan approvals and closings.

- Monitored industry trends and legislative changes to ensure compliance with all applicable regulations.

- Provided exceptional customer service, building strong relationships with borrowers and referral partners.

Loan Representative

- Successfully processed over 300 mortgage applications per month, consistently exceeding company targets.

- Conducted comprehensive financial analysis to determine loan eligibility and minimize risk.

- Effectively communicated with borrowers, lenders, and other stakeholders to ensure smooth loan transactions.

- Utilized loan origination software and industryspecific tools to streamline the loan process.

Accomplishments

- Successfully originated over $10 million in loans within the first year

- Developed and implemented a streamlined loan application process, reducing processing time by 20%

- Built strong relationships with key referral partners, resulting in a 30% increase in loan applications

- Successfully underwrote and closed complex loans requiring specialized knowledge and attention to detail

- Developed and delivered training programs for loan officers, enhancing team productivity

Awards

- Presidents Club Award for Outstanding Loan Origination Performance

- Top Loan Originator Award for Consistent Excellence in Customer Service

- Employee of the Month Recognition for Exceptional Contribution to Loan Growth

- Certificate of Achievement for Proficient Use of Loan Origination Software

Certificates

- Certified Mortgage Loan Originator (CMLO)

- Mortgage Loan Originator (MLO)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Credit Counselor (CCC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Representative

- Quantify your accomplishments with specific metrics and results.

- Highlight your proficiency in loan origination systems and industry-specific tools.

- Demonstrate your commitment to providing exceptional customer service.

- Tailor your resume to the specific requirements of each job you apply for.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Loan Representative Resume

- Process mortgage loan applications, ensuring accuracy and completeness of documentation.

- Analyze financial statements to determine loan eligibility and risk.

- Communicate with borrowers, lenders, and other stakeholders to provide updates on loan status and address inquiries.

- Utilize loan origination software and industry-specific tools to streamline the loan process.

- Identify and support borrowers with special needs or complex financial situations.

- Collaborate with loan underwriters and closing agents to expedite loan approvals and closings.

- Monitor industry trends and legislative changes to ensure compliance with all applicable regulations.

Frequently Asked Questions (FAQ’s) For Loan Representative

What are the key responsibilities of a Loan Representative?

Loan Representatives are responsible for processing loan applications, analyzing financial statements, communicating with borrowers and lenders, and ensuring compliance with all applicable regulations.

What are the educational requirements for becoming a Loan Representative?

Most Loan Representatives hold a Bachelor’s Degree in Finance or a related field.

What are the career prospects for Loan Representatives?

Loan Representatives can advance to positions such as Loan Officer, Branch Manager, or Regional Manager.

What are the key skills required for Loan Representatives?

Loan Representatives should have strong communication and interpersonal skills, as well as proficiency in loan origination software and industry-specific tools.

What is the average salary for Loan Representatives?

The average salary for Loan Representatives varies depending on experience and location, but typically ranges from $50,000 to $100,000 per year.

What are the major challenges faced by Loan Representatives?

Loan Representatives face challenges such as meeting performance targets, staying up-to-date on industry trends and regulations, and dealing with difficult customers.

What are the key qualities of successful Loan Representatives?

Successful Loan Representatives are typically highly motivated, organized, and detail-oriented, with a strong work ethic and commitment to customer service.