Are you a seasoned Loan Review Analyst seeking a new career path? Discover our professionally built Loan Review Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

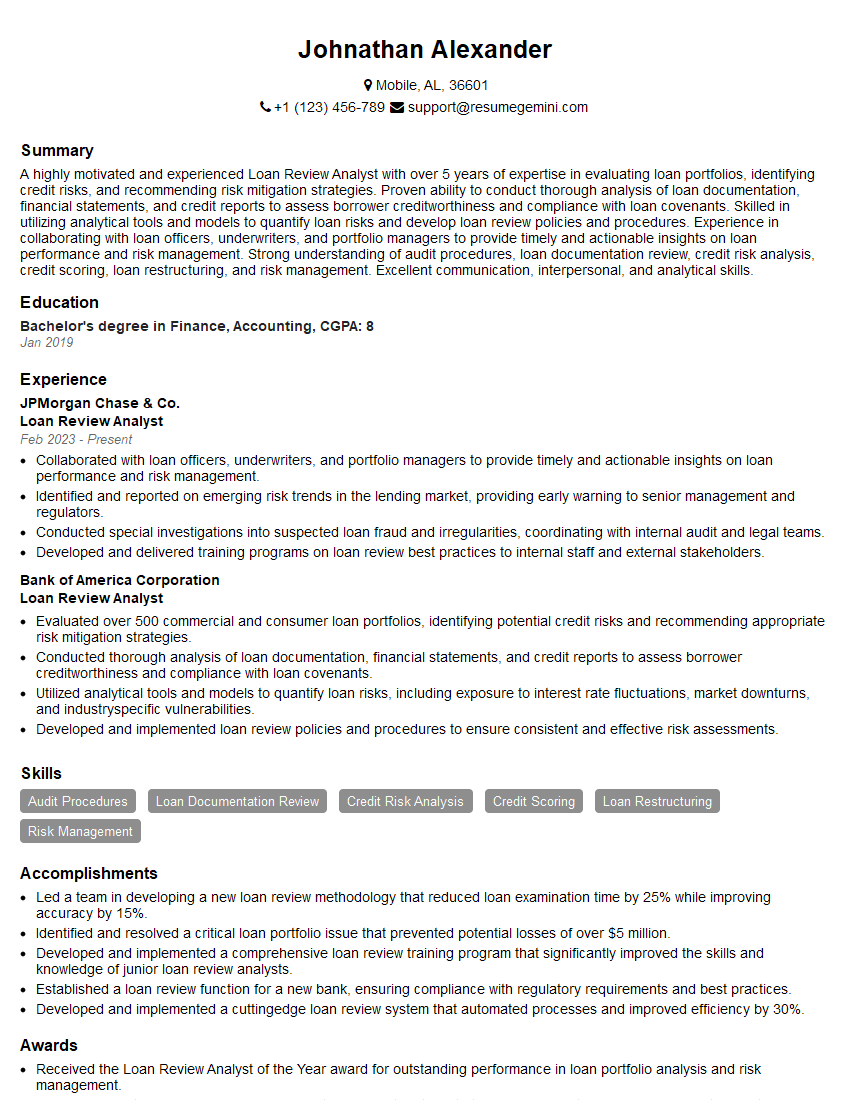

Johnathan Alexander

Loan Review Analyst

Summary

A highly motivated and experienced Loan Review Analyst with over 5 years of expertise in evaluating loan portfolios, identifying credit risks, and recommending risk mitigation strategies. Proven ability to conduct thorough analysis of loan documentation, financial statements, and credit reports to assess borrower creditworthiness and compliance with loan covenants. Skilled in utilizing analytical tools and models to quantify loan risks and develop loan review policies and procedures. Experience in collaborating with loan officers, underwriters, and portfolio managers to provide timely and actionable insights on loan performance and risk management. Strong understanding of audit procedures, loan documentation review, credit risk analysis, credit scoring, loan restructuring, and risk management. Excellent communication, interpersonal, and analytical skills.

Education

Bachelor’s degree in Finance, Accounting

January 2019

Skills

- Audit Procedures

- Loan Documentation Review

- Credit Risk Analysis

- Credit Scoring

- Loan Restructuring

- Risk Management

Work Experience

Loan Review Analyst

- Collaborated with loan officers, underwriters, and portfolio managers to provide timely and actionable insights on loan performance and risk management.

- Identified and reported on emerging risk trends in the lending market, providing early warning to senior management and regulators.

- Conducted special investigations into suspected loan fraud and irregularities, coordinating with internal audit and legal teams.

- Developed and delivered training programs on loan review best practices to internal staff and external stakeholders.

Loan Review Analyst

- Evaluated over 500 commercial and consumer loan portfolios, identifying potential credit risks and recommending appropriate risk mitigation strategies.

- Conducted thorough analysis of loan documentation, financial statements, and credit reports to assess borrower creditworthiness and compliance with loan covenants.

- Utilized analytical tools and models to quantify loan risks, including exposure to interest rate fluctuations, market downturns, and industryspecific vulnerabilities.

- Developed and implemented loan review policies and procedures to ensure consistent and effective risk assessments.

Accomplishments

- Led a team in developing a new loan review methodology that reduced loan examination time by 25% while improving accuracy by 15%.

- Identified and resolved a critical loan portfolio issue that prevented potential losses of over $5 million.

- Developed and implemented a comprehensive loan review training program that significantly improved the skills and knowledge of junior loan review analysts.

- Established a loan review function for a new bank, ensuring compliance with regulatory requirements and best practices.

- Developed and implemented a cuttingedge loan review system that automated processes and improved efficiency by 30%.

Awards

- Received the Loan Review Analyst of the Year award for outstanding performance in loan portfolio analysis and risk management.

- Recognized by the American Banking Association for contributions to the advancement of loan review industry practices.

- Received the Excellence in Loan Review award for consistently exceeding performance expectations in loan portfolio analysis and risk identification.

- Recognized by the Federal Deposit Insurance Corporation (FDIC) for exceptional contributions to the safety and soundness of the banking industry.

Certificates

- Certified Bank Auditor (CBA)

- Certified Credit Analyst (CCA)

- Certified Commercial Lender (CCL)

- Certified Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Review Analyst

- Highlight your experience in evaluating loan portfolios and identifying credit risks.

- Showcase your skills in analyzing loan documentation, financial statements, and credit reports.

- Demonstrate your proficiency in using analytical tools and models to quantify loan risks.

- Emphasize your ability to develop and implement loan review policies and procedures.

- Mention your experience in collaborating with loan officers, underwriters, and portfolio managers.

Essential Experience Highlights for a Strong Loan Review Analyst Resume

- Evaluated over 500 commercial and consumer loan portfolios, identifying potential credit risks and recommending appropriate risk mitigation strategies.

- Conducted thorough analysis of loan documentation, financial statements, and credit reports to assess borrower creditworthiness and compliance with loan covenants.

- Utilized analytical tools and models to quantify loan risks, including exposure to interest rate fluctuations, market downturns, and industry-specific vulnerabilities.

- Developed and implemented loan review policies and procedures to ensure consistent and effective risk assessments.

- Collaborated with loan officers, underwriters, and portfolio managers to provide timely and actionable insights on loan performance and risk management.

- Identified and reported on emerging risk trends in the lending market, providing early warning to senior management and regulators.

- Conducted special investigations into suspected loan fraud and irregularities, coordinating with internal audit and legal teams.

Frequently Asked Questions (FAQ’s) For Loan Review Analyst

What is the role of a Loan Review Analyst?

A Loan Review Analyst evaluates loan portfolios, identifies credit risks, and recommends risk mitigation strategies. They analyze loan documentation, financial statements, and credit reports to assess borrower creditworthiness and compliance with loan covenants. They also utilize analytical tools and models to quantify loan risks and develop loan review policies and procedures.

What skills are required to be a successful Loan Review Analyst?

Successful Loan Review Analysts have a strong understanding of audit procedures, loan documentation review, credit risk analysis, credit scoring, loan restructuring, and risk management. They also possess excellent communication, interpersonal, and analytical skills.

What are the career prospects for Loan Review Analysts?

Loan Review Analysts can advance to roles such as Senior Loan Review Analyst, Risk Manager, or Portfolio Manager. With additional experience and qualifications, they may also move into leadership positions within the financial industry.

What is the salary range for Loan Review Analysts?

The salary range for Loan Review Analysts varies depending on experience, location, and company size. According to Salary.com, the average salary for a Loan Review Analyst in the United States is around $75,000 per year.

What are the challenges faced by Loan Review Analysts?

Loan Review Analysts face challenges such as the need to stay up-to-date on industry regulations and best practices, the pressure to meet deadlines, and the potential for conflicts of interest. They must also be able to work independently and as part of a team.

What is the job outlook for Loan Review Analysts?

The job outlook for Loan Review Analysts is expected to grow in the coming years due to the increasing need for financial institutions to manage risk. According to the U.S. Bureau of Labor Statistics, the employment of financial analysts, which includes Loan Review Analysts, is projected to grow by 6% from 2020 to 2030.

What are the educational requirements for Loan Review Analysts?

Loan Review Analysts typically need a bachelor’s degree in finance, accounting, or a related field. Some employers may also require a master’s degree in finance or a related field.

What certifications are available for Loan Review Analysts?

Loan Review Analysts can obtain certifications such as the Certified Loan Review Analyst (CLRA) certification from the Loan Review Institute and the Certified Risk Analyst (CRA) certification from the Risk Management Association.