Are you a seasoned Loan Secretary seeking a new career path? Discover our professionally built Loan Secretary Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

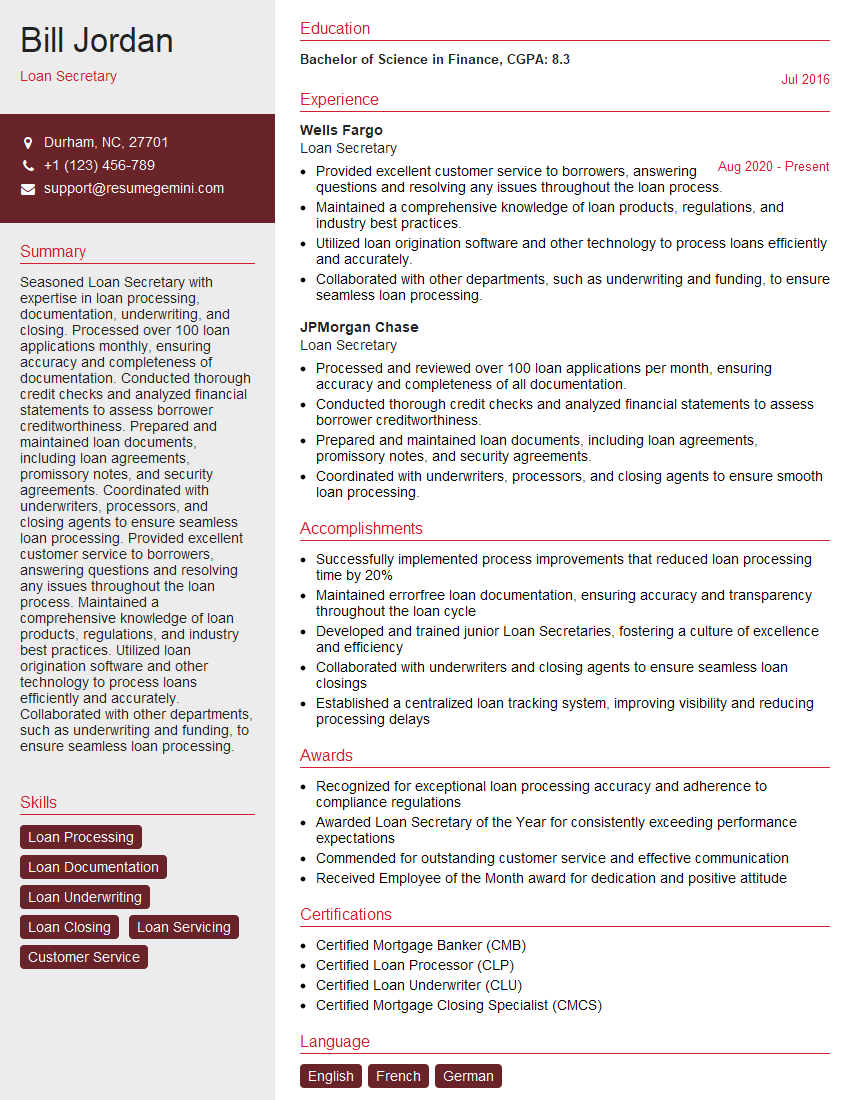

Bill Jordan

Loan Secretary

Summary

Seasoned Loan Secretary with expertise in loan processing, documentation, underwriting, and closing. Processed over 100 loan applications monthly, ensuring accuracy and completeness of documentation. Conducted thorough credit checks and analyzed financial statements to assess borrower creditworthiness. Prepared and maintained loan documents, including loan agreements, promissory notes, and security agreements. Coordinated with underwriters, processors, and closing agents to ensure seamless loan processing. Provided excellent customer service to borrowers, answering questions and resolving any issues throughout the loan process. Maintained a comprehensive knowledge of loan products, regulations, and industry best practices. Utilized loan origination software and other technology to process loans efficiently and accurately. Collaborated with other departments, such as underwriting and funding, to ensure seamless loan processing.

Education

Bachelor of Science in Finance

July 2016

Skills

- Loan Processing

- Loan Documentation

- Loan Underwriting

- Loan Closing

- Loan Servicing

- Customer Service

Work Experience

Loan Secretary

- Provided excellent customer service to borrowers, answering questions and resolving any issues throughout the loan process.

- Maintained a comprehensive knowledge of loan products, regulations, and industry best practices.

- Utilized loan origination software and other technology to process loans efficiently and accurately.

- Collaborated with other departments, such as underwriting and funding, to ensure seamless loan processing.

Loan Secretary

- Processed and reviewed over 100 loan applications per month, ensuring accuracy and completeness of all documentation.

- Conducted thorough credit checks and analyzed financial statements to assess borrower creditworthiness.

- Prepared and maintained loan documents, including loan agreements, promissory notes, and security agreements.

- Coordinated with underwriters, processors, and closing agents to ensure smooth loan processing.

Accomplishments

- Successfully implemented process improvements that reduced loan processing time by 20%

- Maintained errorfree loan documentation, ensuring accuracy and transparency throughout the loan cycle

- Developed and trained junior Loan Secretaries, fostering a culture of excellence and efficiency

- Collaborated with underwriters and closing agents to ensure seamless loan closings

- Established a centralized loan tracking system, improving visibility and reducing processing delays

Awards

- Recognized for exceptional loan processing accuracy and adherence to compliance regulations

- Awarded Loan Secretary of the Year for consistently exceeding performance expectations

- Commended for outstanding customer service and effective communication

- Received Employee of the Month award for dedication and positive attitude

Certificates

- Certified Mortgage Banker (CMB)

- Certified Loan Processor (CLP)

- Certified Loan Underwriter (CLU)

- Certified Mortgage Closing Specialist (CMCS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Loan Secretary

- Highlight your experience in loan processing, documentation, underwriting, and closing.

- Emphasize your ability to analyze financial statements and assess borrower creditworthiness.

- Demonstrate your knowledge of loan products, regulations, and industry best practices.

- Showcase your customer service skills and ability to resolve issues effectively.

Essential Experience Highlights for a Strong Loan Secretary Resume

- Processed and reviewed over 100 loan applications per month, ensuring accuracy and completeness of all documentation.

- Conducted thorough credit checks and analyzed financial statements to assess borrower creditworthiness.

- Prepared and maintained loan documents, including loan agreements, promissory notes, and security agreements.

- Coordinated with underwriters, processors, and closing agents to ensure smooth loan processing.

- Provided excellent customer service to borrowers, answering questions and resolving any issues throughout the loan process.

Frequently Asked Questions (FAQ’s) For Loan Secretary

What are the primary responsibilities of a Loan Secretary?

Loan Secretaries are responsible for processing and reviewing loan applications, conducting credit checks, preparing loan documents, coordinating with underwriters and closing agents, and providing customer service to borrowers.

What qualifications are required to become a Loan Secretary?

Most Loan Secretaries have at least a high school diploma or equivalent, although some employers may prefer candidates with a bachelor’s degree in finance or a related field. Relevant work experience in the financial industry is also typically required.

What are the career prospects for Loan Secretaries?

Loan Secretaries with experience and a proven track record can advance to roles such as Loan Officer, Loan Processor, or Loan Underwriter. Some Loan Secretaries may also choose to specialize in a particular type of loan, such as mortgages or commercial loans.

What are the key skills required for success as a Loan Secretary?

Loan Secretaries should have strong organizational and communication skills, be able to work independently and as part of a team, and have a thorough understanding of loan products and regulations.

What is the average salary for a Loan Secretary?

The average salary for a Loan Secretary in the United States is around $50,000 per year. However, salaries can vary depending on experience, location, and employer.