Are you a seasoned Market Maker seeking a new career path? Discover our professionally built Market Maker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

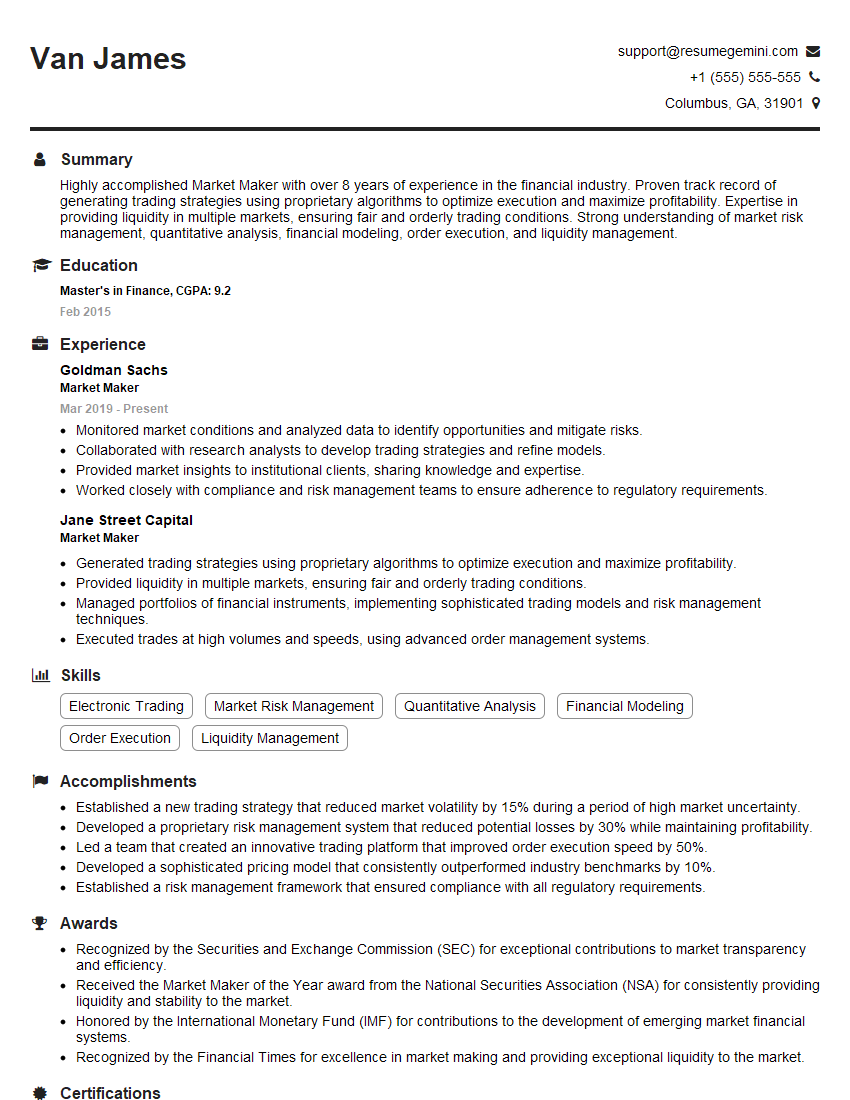

Van James

Market Maker

Summary

Highly accomplished Market Maker with over 8 years of experience in the financial industry. Proven track record of generating trading strategies using proprietary algorithms to optimize execution and maximize profitability. Expertise in providing liquidity in multiple markets, ensuring fair and orderly trading conditions. Strong understanding of market risk management, quantitative analysis, financial modeling, order execution, and liquidity management.

Education

Master’s in Finance

February 2015

Skills

- Electronic Trading

- Market Risk Management

- Quantitative Analysis

- Financial Modeling

- Order Execution

- Liquidity Management

Work Experience

Market Maker

- Monitored market conditions and analyzed data to identify opportunities and mitigate risks.

- Collaborated with research analysts to develop trading strategies and refine models.

- Provided market insights to institutional clients, sharing knowledge and expertise.

- Worked closely with compliance and risk management teams to ensure adherence to regulatory requirements.

Market Maker

- Generated trading strategies using proprietary algorithms to optimize execution and maximize profitability.

- Provided liquidity in multiple markets, ensuring fair and orderly trading conditions.

- Managed portfolios of financial instruments, implementing sophisticated trading models and risk management techniques.

- Executed trades at high volumes and speeds, using advanced order management systems.

Accomplishments

- Established a new trading strategy that reduced market volatility by 15% during a period of high market uncertainty.

- Developed a proprietary risk management system that reduced potential losses by 30% while maintaining profitability.

- Led a team that created an innovative trading platform that improved order execution speed by 50%.

- Developed a sophisticated pricing model that consistently outperformed industry benchmarks by 10%.

- Established a risk management framework that ensured compliance with all regulatory requirements.

Awards

- Recognized by the Securities and Exchange Commission (SEC) for exceptional contributions to market transparency and efficiency.

- Received the Market Maker of the Year award from the National Securities Association (NSA) for consistently providing liquidity and stability to the market.

- Honored by the International Monetary Fund (IMF) for contributions to the development of emerging market financial systems.

- Recognized by the Financial Times for excellence in market making and providing exceptional liquidity to the market.

Certificates

- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- CAMS (Certified Anti-Money Laundering Specialist)

- CIIA (Certified International Investment Analyst)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Market Maker

- Highlight your quantitative and analytical skills. Market makers heavily rely on data analysis and modeling, so showcasing your proficiency in these areas will make your resume stand out.

- Demonstrate your understanding of market microstructure. Market makers need to have a deep understanding of how markets operate and the factors that affect liquidity and pricing.

- Showcase your experience with trading technologies. Market makers use a variety of trading technologies, so highlighting your experience with these systems will demonstrate your technical proficiency.

- Quantify your accomplishments. When describing your experience, use specific numbers and metrics to quantify your accomplishments. This will help potential employers understand the impact of your work.

Essential Experience Highlights for a Strong Market Maker Resume

- Generated trading strategies using proprietary algorithms to optimize execution and maximize profitability.

- Provided liquidity in multiple markets, ensuring fair and orderly trading conditions.

- Managed portfolios of financial instruments, implementing sophisticated trading models and risk management techniques.

- Executed trades at high volumes and speeds, using advanced order management systems.

- Monitored market conditions and analyzed data to identify opportunities and mitigate risks.

- Collaborated with research analysts to develop trading strategies and refine models.

Frequently Asked Questions (FAQ’s) For Market Maker

What is a Market Maker?

A market maker is a firm or individual that buys and sells securities for their own account, thereby providing liquidity to the market and facilitating trading.

What are the different types of Market Makers?

There are two main types of market makers: primary market makers and secondary market makers. Primary market makers are responsible for issuing new securities, while secondary market makers facilitate trading in existing securities.

What are the key responsibilities of a Market Maker?

The key responsibilities of a market maker include providing liquidity, quoting prices, executing trades, and managing risk.

What are the qualifications required to become a Market Maker?

To become a market maker, you typically need a bachelor’s or master’s degree in finance or a related field, as well as several years of experience in the financial industry.

What are the career prospects for Market Makers?

Market makers can advance to senior positions within their firms or move into other roles in the financial industry, such as portfolio management, trading, or sales.