Are you a seasoned Market Risk Analyst seeking a new career path? Discover our professionally built Market Risk Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

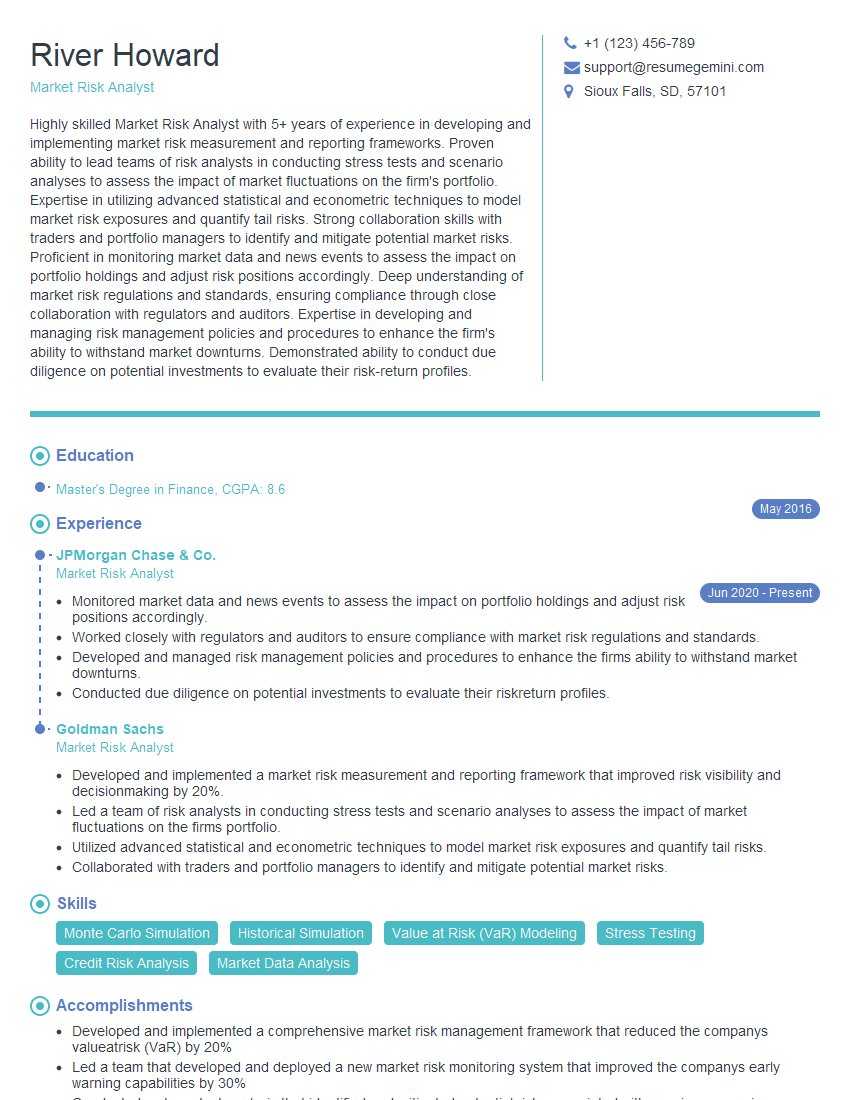

River Howard

Market Risk Analyst

Summary

Highly skilled Market Risk Analyst with 5+ years of experience in developing and implementing market risk measurement and reporting frameworks. Proven ability to lead teams of risk analysts in conducting stress tests and scenario analyses to assess the impact of market fluctuations on the firm’s portfolio. Expertise in utilizing advanced statistical and econometric techniques to model market risk exposures and quantify tail risks. Strong collaboration skills with traders and portfolio managers to identify and mitigate potential market risks. Proficient in monitoring market data and news events to assess the impact on portfolio holdings and adjust risk positions accordingly. Deep understanding of market risk regulations and standards, ensuring compliance through close collaboration with regulators and auditors. Expertise in developing and managing risk management policies and procedures to enhance the firm’s ability to withstand market downturns. Demonstrated ability to conduct due diligence on potential investments to evaluate their risk-return profiles.

Education

Master’s Degree in Finance

May 2016

Skills

- Monte Carlo Simulation

- Historical Simulation

- Value at Risk (VaR) Modeling

- Stress Testing

- Credit Risk Analysis

- Market Data Analysis

Work Experience

Market Risk Analyst

- Monitored market data and news events to assess the impact on portfolio holdings and adjust risk positions accordingly.

- Worked closely with regulators and auditors to ensure compliance with market risk regulations and standards.

- Developed and managed risk management policies and procedures to enhance the firms ability to withstand market downturns.

- Conducted due diligence on potential investments to evaluate their riskreturn profiles.

Market Risk Analyst

- Developed and implemented a market risk measurement and reporting framework that improved risk visibility and decisionmaking by 20%.

- Led a team of risk analysts in conducting stress tests and scenario analyses to assess the impact of market fluctuations on the firms portfolio.

- Utilized advanced statistical and econometric techniques to model market risk exposures and quantify tail risks.

- Collaborated with traders and portfolio managers to identify and mitigate potential market risks.

Accomplishments

- Developed and implemented a comprehensive market risk management framework that reduced the companys valueatrisk (VaR) by 20%

- Led a team that developed and deployed a new market risk monitoring system that improved the companys early warning capabilities by 30%

- Conducted a stress test analysis that identified and mitigated potential risks associated with a major economic downturn

- Developed and implemented a risk management training program for the companys trading desk, improving their understanding of market risks by 40%

- Collaborated with portfolio managers to develop investment strategies that met the companys risk appetite and return objectives

Awards

- GARP Financial Risk Manager (FRM) certification

- Professional Risk Manager (PRM) certification

- Market Risk Certificate from the Global Association of Risk Professionals (GARP)

- Top 10% performer in the Market Risk Analyst category at the annual Risk Management Association (RMA) conference

Certificates

- FRM

- CFA

- CQR

- GARP Risk Manager

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Market Risk Analyst

- Highlight your technical skills in Monte Carlo Simulation, Historical Simulation, Value at Risk (VaR) Modeling, Stress Testing, Credit Risk Analysis, and Market Data Analysis.

- Showcase your ability to work independently and as part of a team.

- Quantify your accomplishments with specific metrics, such as the 20% improvement in risk visibility and decision-making.

- Emphasize your understanding of market risk regulations and standards, and your ability to ensure compliance.

- Tailor your resume to the specific requirements of each job you apply for.

Essential Experience Highlights for a Strong Market Risk Analyst Resume

- Developed and implemented a market risk measurement and reporting framework that improved risk visibility and decision-making by 20%.

- Led a team of risk analysts in conducting stress tests and scenario analyses to assess the impact of market fluctuations on the firm’s portfolio.

- Utilized advanced statistical and econometric techniques to model market risk exposures and quantify tail risks.

- Collaborated with traders and portfolio managers to identify and mitigate potential market risks.

- Monitored market data and news events to assess the impact on portfolio holdings and adjust risk positions accordingly.

- Worked closely with regulators and auditors to ensure compliance with market risk regulations and standards.

Frequently Asked Questions (FAQ’s) For Market Risk Analyst

What is the role of a Market Risk Analyst?

A Market Risk Analyst is responsible for assessing and managing the financial risks faced by a company due to market fluctuations. They develop and implement risk measurement and reporting frameworks, conduct stress tests and scenario analyses, and collaborate with traders and portfolio managers to identify and mitigate potential risks.

What are the key skills required for a Market Risk Analyst?

Key skills for a Market Risk Analyst include strong analytical and problem-solving skills, proficiency in quantitative techniques such as Monte Carlo Simulation and Value at Risk (VaR) Modeling, and a deep understanding of market risk regulations and standards.

What are the career prospects for a Market Risk Analyst?

Market Risk Analysts can advance to senior roles within risk management, such as Risk Manager or Chief Risk Officer. They may also move into other areas of finance, such as portfolio management or trading.

What is the average salary for a Market Risk Analyst?

The average salary for a Market Risk Analyst varies depending on experience, skills, and location. According to Glassdoor, the average base salary for a Market Risk Analyst in the United States is around $100,000 per year.

How can I prepare for a career as a Market Risk Analyst?

To prepare for a career as a Market Risk Analyst, you should earn a Master’s Degree in Finance or a related field, develop strong analytical and problem-solving skills, and gain proficiency in quantitative techniques such as Monte Carlo Simulation and Value at Risk (VaR) Modeling. You should also stay up-to-date on market risk regulations and standards.