Are you a seasoned Medical Accountant seeking a new career path? Discover our professionally built Medical Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

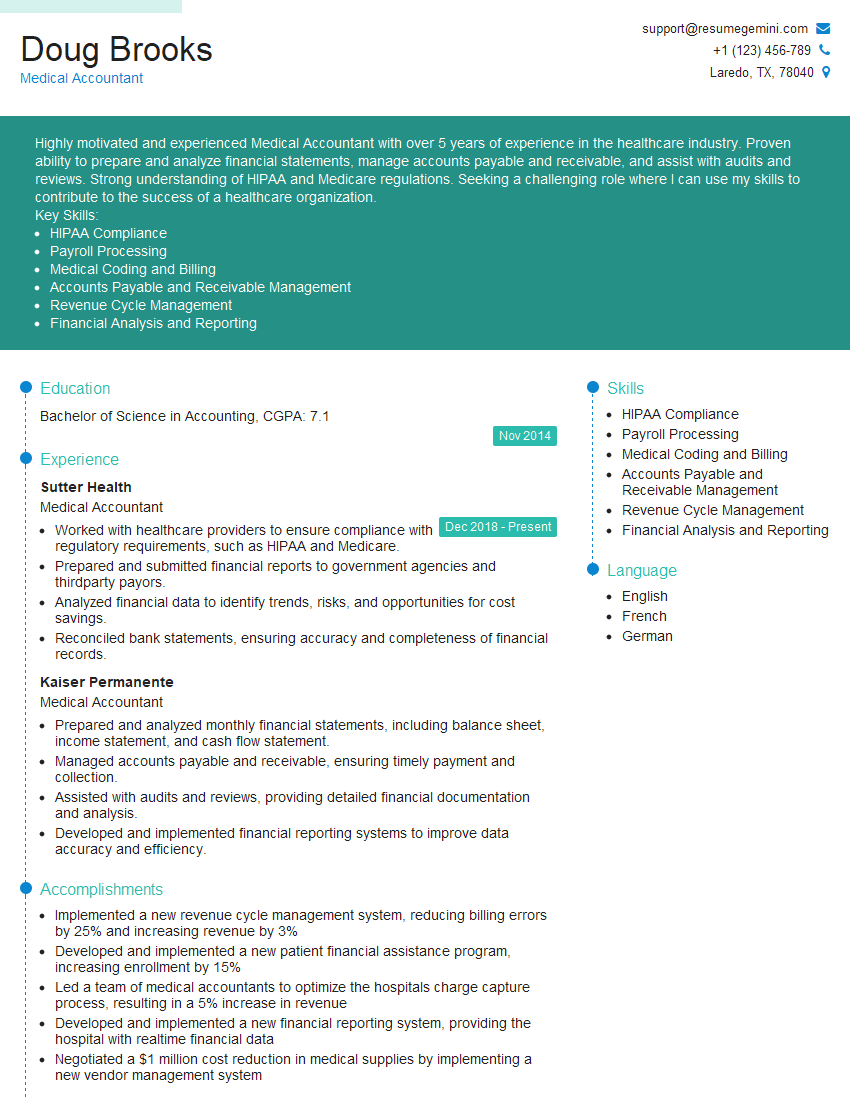

Doug Brooks

Medical Accountant

Summary

Highly motivated and experienced Medical Accountant with over 5 years of experience in the healthcare industry. Proven ability to prepare and analyze financial statements, manage accounts payable and receivable, and assist with audits and reviews. Strong understanding of HIPAA and Medicare regulations. Seeking a challenging role where I can use my skills to contribute to the success of a healthcare organization.

Key Skills:

- HIPAA Compliance

- Payroll Processing

- Medical Coding and Billing

- Accounts Payable and Receivable Management

- Revenue Cycle Management

- Financial Analysis and Reporting

Education

Bachelor of Science in Accounting

November 2014

Skills

- HIPAA Compliance

- Payroll Processing

- Medical Coding and Billing

- Accounts Payable and Receivable Management

- Revenue Cycle Management

- Financial Analysis and Reporting

Work Experience

Medical Accountant

- Worked with healthcare providers to ensure compliance with regulatory requirements, such as HIPAA and Medicare.

- Prepared and submitted financial reports to government agencies and thirdparty payors.

- Analyzed financial data to identify trends, risks, and opportunities for cost savings.

- Reconciled bank statements, ensuring accuracy and completeness of financial records.

Medical Accountant

- Prepared and analyzed monthly financial statements, including balance sheet, income statement, and cash flow statement.

- Managed accounts payable and receivable, ensuring timely payment and collection.

- Assisted with audits and reviews, providing detailed financial documentation and analysis.

- Developed and implemented financial reporting systems to improve data accuracy and efficiency.

Accomplishments

- Implemented a new revenue cycle management system, reducing billing errors by 25% and increasing revenue by 3%

- Developed and implemented a new patient financial assistance program, increasing enrollment by 15%

- Led a team of medical accountants to optimize the hospitals charge capture process, resulting in a 5% increase in revenue

- Developed and implemented a new financial reporting system, providing the hospital with realtime financial data

- Negotiated a $1 million cost reduction in medical supplies by implementing a new vendor management system

Awards

- Medical Accountant of the Year Award, American Health Information Management Association (AHIMA)

- Excellence in Healthcare Financial Management Award, Healthcare Financial Management Association (HFMA)

- Medical Accounting Manager of the Year Award, National Association of Healthcare Business Management (NAHBM)

- CFO Innovation Award, American Hospital Association (AHA)

Certificates

- Certified Medical Accountant (CMA)

- Fellow of the Health Care Financial Management Association (FHFMA)

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Medical Accountant

- Highlight your experience in the healthcare industry.

- Quantify your accomplishments with specific metrics.

- Showcase your knowledge of HIPAA and Medicare regulations.

- Tailor your resume to each job you apply for.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Medical Accountant Resume

- Prepare and analyze monthly financial statements, including balance sheet, income statement, and cash flow statement.

- Manage accounts payable and receivable, ensuring timely payment and collection.

- Assist with audits and reviews, providing detailed financial documentation and analysis.

- Develop and implement financial reporting systems to improve data accuracy and efficiency.

- Work with healthcare providers to ensure compliance with regulatory requirements, such as HIPAA and Medicare.

- Prepare and submit financial reports to government agencies and third-party payors.

- Analyze financial data to identify trends, risks, and opportunities for cost savings.

Frequently Asked Questions (FAQ’s) For Medical Accountant

What are the key skills required for a Medical Accountant?

The key skills required for a Medical Accountant include HIPAA compliance, payroll processing, medical coding and billing, accounts payable and receivable management, revenue cycle management, financial analysis and reporting.

What are the primary responsibilities of a Medical Accountant?

The primary responsibilities of a Medical Accountant include preparing and analyzing financial statements, managing accounts payable and receivable, assisting with audits and reviews, developing and implementing financial reporting systems, working with healthcare providers to ensure compliance with regulatory requirements, preparing and submitting financial reports to government agencies and third-party payors, and analyzing financial data to identify trends, risks, and opportunities for cost savings.

What are the career prospects for a Medical Accountant?

The career prospects for a Medical Accountant are excellent. The healthcare industry is growing rapidly, and there is a high demand for qualified Medical Accountants. With experience, Medical Accountants can advance to positions such as Senior Medical Accountant, Controller, or Chief Financial Officer.

What is the salary range for a Medical Accountant?

The salary range for a Medical Accountant varies depending on experience, location, and employer. According to Salary.com, the average salary for a Medical Accountant in the United States is $75,000.

What are the educational requirements for a Medical Accountant?

The educational requirements for a Medical Accountant include a bachelor’s degree in accounting or a related field. Some employers may also require a master’s degree in accounting or healthcare administration.

What are the certification requirements for a Medical Accountant?

There are a number of certifications available for Medical Accountants, including the Certified Medical Accountant (CMA) and the Certified Healthcare Financial Professional (CHFP). These certifications can help Medical Accountants demonstrate their knowledge and skills in the healthcare industry.

What professional organizations are available for Medical Accountants?

There are a number of professional organizations available for Medical Accountants, including the Healthcare Financial Management Association (HFMA) and the American Health Information Management Association (AHIMA).

What are the current trends in Medical Accounting?

The current trends in Medical Accounting include the use of technology to improve efficiency and accuracy, the increasing focus on cost containment, and the growing importance of regulatory compliance.