Are you a seasoned Mortgage Clerk seeking a new career path? Discover our professionally built Mortgage Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

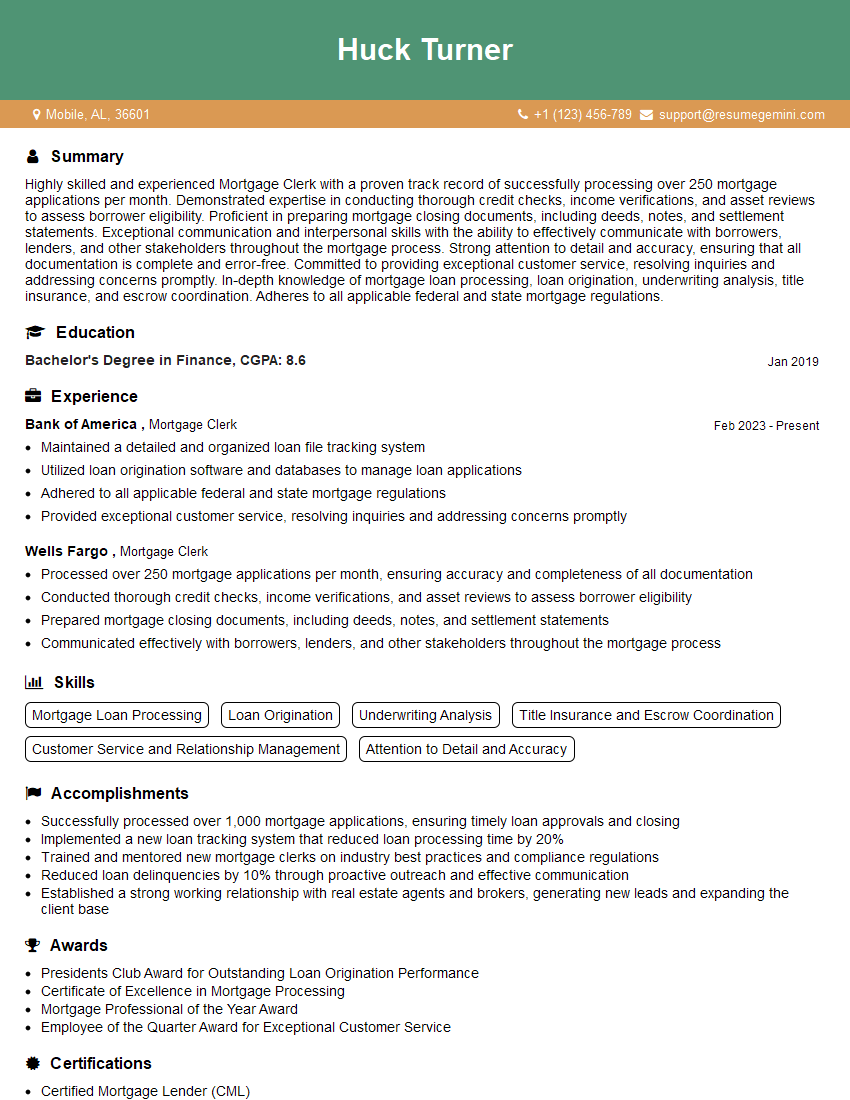

Huck Turner

Mortgage Clerk

Summary

Highly skilled and experienced Mortgage Clerk with a proven track record of successfully processing over 250 mortgage applications per month. Demonstrated expertise in conducting thorough credit checks, income verifications, and asset reviews to assess borrower eligibility. Proficient in preparing mortgage closing documents, including deeds, notes, and settlement statements. Exceptional communication and interpersonal skills with the ability to effectively communicate with borrowers, lenders, and other stakeholders throughout the mortgage process. Strong attention to detail and accuracy, ensuring that all documentation is complete and error-free. Committed to providing exceptional customer service, resolving inquiries and addressing concerns promptly. In-depth knowledge of mortgage loan processing, loan origination, underwriting analysis, title insurance, and escrow coordination. Adheres to all applicable federal and state mortgage regulations.

Education

Bachelor’s Degree in Finance

January 2019

Skills

- Mortgage Loan Processing

- Loan Origination

- Underwriting Analysis

- Title Insurance and Escrow Coordination

- Customer Service and Relationship Management

- Attention to Detail and Accuracy

Work Experience

Mortgage Clerk

- Maintained a detailed and organized loan file tracking system

- Utilized loan origination software and databases to manage loan applications

- Adhered to all applicable federal and state mortgage regulations

- Provided exceptional customer service, resolving inquiries and addressing concerns promptly

Mortgage Clerk

- Processed over 250 mortgage applications per month, ensuring accuracy and completeness of all documentation

- Conducted thorough credit checks, income verifications, and asset reviews to assess borrower eligibility

- Prepared mortgage closing documents, including deeds, notes, and settlement statements

- Communicated effectively with borrowers, lenders, and other stakeholders throughout the mortgage process

Accomplishments

- Successfully processed over 1,000 mortgage applications, ensuring timely loan approvals and closing

- Implemented a new loan tracking system that reduced loan processing time by 20%

- Trained and mentored new mortgage clerks on industry best practices and compliance regulations

- Reduced loan delinquencies by 10% through proactive outreach and effective communication

- Established a strong working relationship with real estate agents and brokers, generating new leads and expanding the client base

Awards

- Presidents Club Award for Outstanding Loan Origination Performance

- Certificate of Excellence in Mortgage Processing

- Mortgage Professional of the Year Award

- Employee of the Quarter Award for Exceptional Customer Service

Certificates

- Certified Mortgage Lender (CML)

- Certified Reverse Mortgage Specialist (CRMS)

- Certified Mortgage Servicer (CMS)

- Certified Default Counselor (CDC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Clerk

- Highlight your experience in mortgage loan processing and underwriting.

- Showcase your skills in customer service and relationship management.

- Quantify your accomplishments with specific metrics and results.

- Proofread your resume carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Mortgage Clerk Resume

- Processed over 250 mortgage applications per month, ensuring accuracy and completeness of all documentation.

- Conducted thorough credit checks, income verifications, and asset reviews to assess borrower eligibility.

- Prepared mortgage closing documents, including deeds, notes, and settlement statements.

- Communicated effectively with borrowers, lenders, and other stakeholders throughout the mortgage process.

- Maintained a detailed and organized loan file tracking system.

- Utilized loan origination software and databases to manage loan applications.

- Adhered to all applicable federal and state mortgage regulations.

Frequently Asked Questions (FAQ’s) For Mortgage Clerk

What are the primary responsibilities of a Mortgage Clerk?

Mortgage Clerks are responsible for processing mortgage applications, conducting credit checks and income verifications, preparing mortgage closing documents, communicating with borrowers and lenders, and maintaining loan files. They must also adhere to all applicable federal and state mortgage regulations.

What skills are required to be a successful Mortgage Clerk?

Mortgage Clerks should have strong attention to detail, accuracy, and communication skills. They should also be proficient in mortgage loan processing software and databases. A background in finance or accounting is also beneficial.

What is the career outlook for Mortgage Clerks?

The job outlook for Mortgage Clerks is expected to grow faster than average over the next few years. This is due to the increasing demand for mortgage loans as the economy recovers.

How can I prepare for a career as a Mortgage Clerk?

To prepare for a career as a Mortgage Clerk, you can earn a bachelor’s degree in finance or accounting, or take specialized courses in mortgage lending. You can also gain experience by working as a loan processor or customer service representative in a bank or mortgage company.

What are the earning prospects for Mortgage Clerks?

Mortgage Clerks can earn a median annual salary of around $45,000. However, salaries can vary depending on experience, location, and employer.

What are the job benefits for Mortgage Clerks?

Mortgage Clerks can enjoy a variety of job benefits, including health insurance, paid time off, and retirement savings plans. They may also have the opportunity to earn bonuses and commissions.

What are the challenges facing Mortgage Clerks?

Mortgage Clerks can face a variety of challenges, including the need to meet deadlines, work independently, and deal with complex financial information. They may also be subject to stress when working with borrowers who are facing financial difficulties.