Are you a seasoned Mortgage Closing Clerk seeking a new career path? Discover our professionally built Mortgage Closing Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

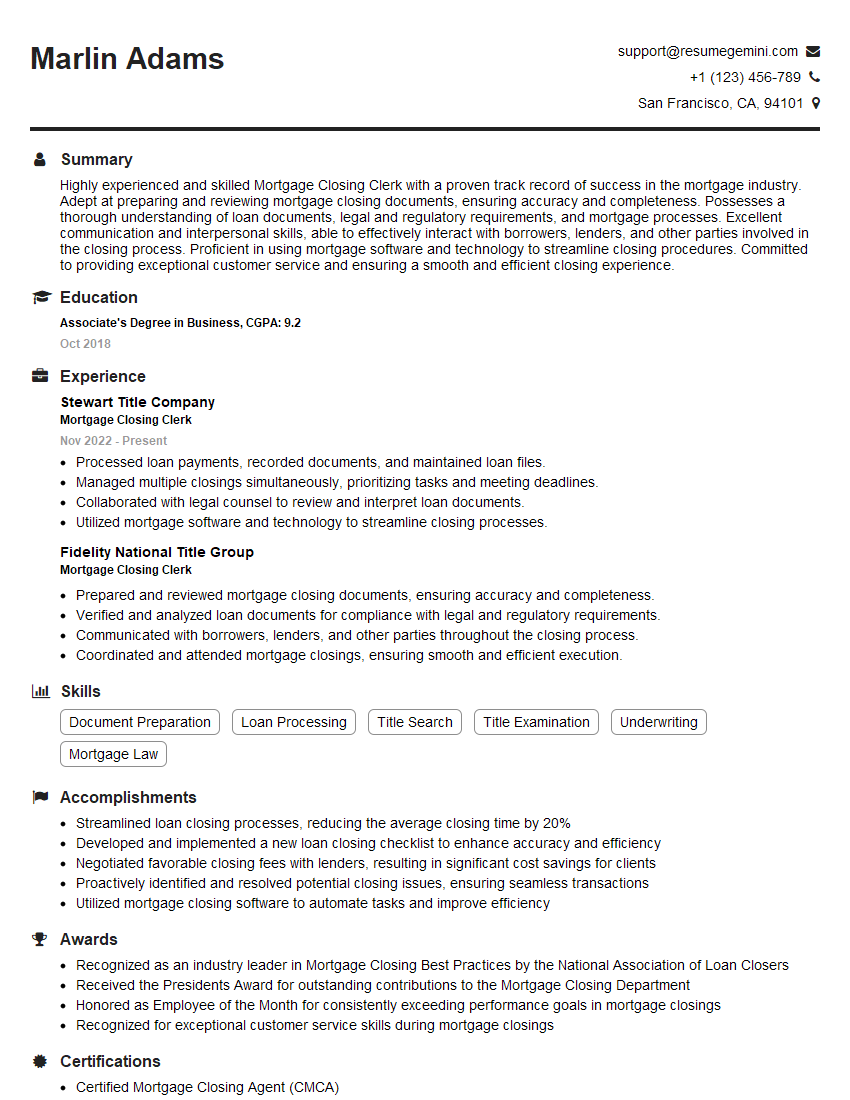

Marlin Adams

Mortgage Closing Clerk

Summary

Highly experienced and skilled Mortgage Closing Clerk with a proven track record of success in the mortgage industry. Adept at preparing and reviewing mortgage closing documents, ensuring accuracy and completeness. Possesses a thorough understanding of loan documents, legal and regulatory requirements, and mortgage processes. Excellent communication and interpersonal skills, able to effectively interact with borrowers, lenders, and other parties involved in the closing process. Proficient in using mortgage software and technology to streamline closing procedures. Committed to providing exceptional customer service and ensuring a smooth and efficient closing experience.

Education

Associate’s Degree in Business

October 2018

Skills

- Document Preparation

- Loan Processing

- Title Search

- Title Examination

- Underwriting

- Mortgage Law

Work Experience

Mortgage Closing Clerk

- Processed loan payments, recorded documents, and maintained loan files.

- Managed multiple closings simultaneously, prioritizing tasks and meeting deadlines.

- Collaborated with legal counsel to review and interpret loan documents.

- Utilized mortgage software and technology to streamline closing processes.

Mortgage Closing Clerk

- Prepared and reviewed mortgage closing documents, ensuring accuracy and completeness.

- Verified and analyzed loan documents for compliance with legal and regulatory requirements.

- Communicated with borrowers, lenders, and other parties throughout the closing process.

- Coordinated and attended mortgage closings, ensuring smooth and efficient execution.

Accomplishments

- Streamlined loan closing processes, reducing the average closing time by 20%

- Developed and implemented a new loan closing checklist to enhance accuracy and efficiency

- Negotiated favorable closing fees with lenders, resulting in significant cost savings for clients

- Proactively identified and resolved potential closing issues, ensuring seamless transactions

- Utilized mortgage closing software to automate tasks and improve efficiency

Awards

- Recognized as an industry leader in Mortgage Closing Best Practices by the National Association of Loan Closers

- Received the Presidents Award for outstanding contributions to the Mortgage Closing Department

- Honored as Employee of the Month for consistently exceeding performance goals in mortgage closings

- Recognized for exceptional customer service skills during mortgage closings

Certificates

- Certified Mortgage Closing Agent (CMCA)

- Certified Escrow Officer (CEO)

- Real Estate Closing Agent License

- Notary Public Commission

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Closing Clerk

- Highlight your experience and skills in preparing and reviewing mortgage closing documents.

- Demonstrate your knowledge of loan documents, legal and regulatory requirements, and mortgage processes.

- Emphasize your ability to effectively communicate and interact with borrowers, lenders, and other parties involved in the closing process.

- Showcase your proficiency in using mortgage software and technology to streamline closing procedures.

- Provide specific examples of your accomplishments and contributions in previous roles.

Essential Experience Highlights for a Strong Mortgage Closing Clerk Resume

- Preparing and reviewing mortgage closing documents to ensure accuracy and completeness.

- Verifying and analyzing loan documents for compliance with legal and regulatory requirements.

- Coordinating and attending mortgage closings, ensuring smooth and efficient execution.

- Processing loan payments, recording documents, and maintaining loan files.

- Managing multiple closings simultaneously, prioritizing tasks and meeting deadlines.

- Collaborating with legal counsel to review and interpret loan documents.

- Utilizing mortgage software and technology to streamline closing processes.

Frequently Asked Questions (FAQ’s) For Mortgage Closing Clerk

What are the primary responsibilities of a Mortgage Closing Clerk?

Mortgage Closing Clerks are responsible for preparing and reviewing mortgage closing documents, verifying loan documents for compliance, coordinating and attending mortgage closings, processing loan payments, and maintaining loan files.

What qualifications are required to become a Mortgage Closing Clerk?

Typically, a high school diploma or an Associate’s degree in Business or a related field is required to become a Mortgage Closing Clerk. Some employers may also prefer candidates with experience in the mortgage industry or related fields.

What skills are essential for a Mortgage Closing Clerk?

Mortgage Closing Clerks should possess strong communication and interpersonal skills, as well as proficiency in using mortgage software and technology. They should also have a thorough understanding of loan documents, legal and regulatory requirements, and mortgage processes.

What is the job outlook for Mortgage Closing Clerks?

The job outlook for Mortgage Closing Clerks is expected to be positive in the coming years due to the increasing demand for mortgage services as the housing market recovers.

What are the earning prospects for Mortgage Closing Clerks?

The earning potential for Mortgage Closing Clerks varies depending on experience, location, and employer. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for Loan Officers was $63,380 in May 2020.

What are the career advancement opportunities for Mortgage Closing Clerks?

Mortgage Closing Clerks with experience and additional qualifications may advance to roles such as Loan Processor, Loan Officer, or Mortgage Underwriter.