Are you a seasoned Mortgage Loan Closer seeking a new career path? Discover our professionally built Mortgage Loan Closer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

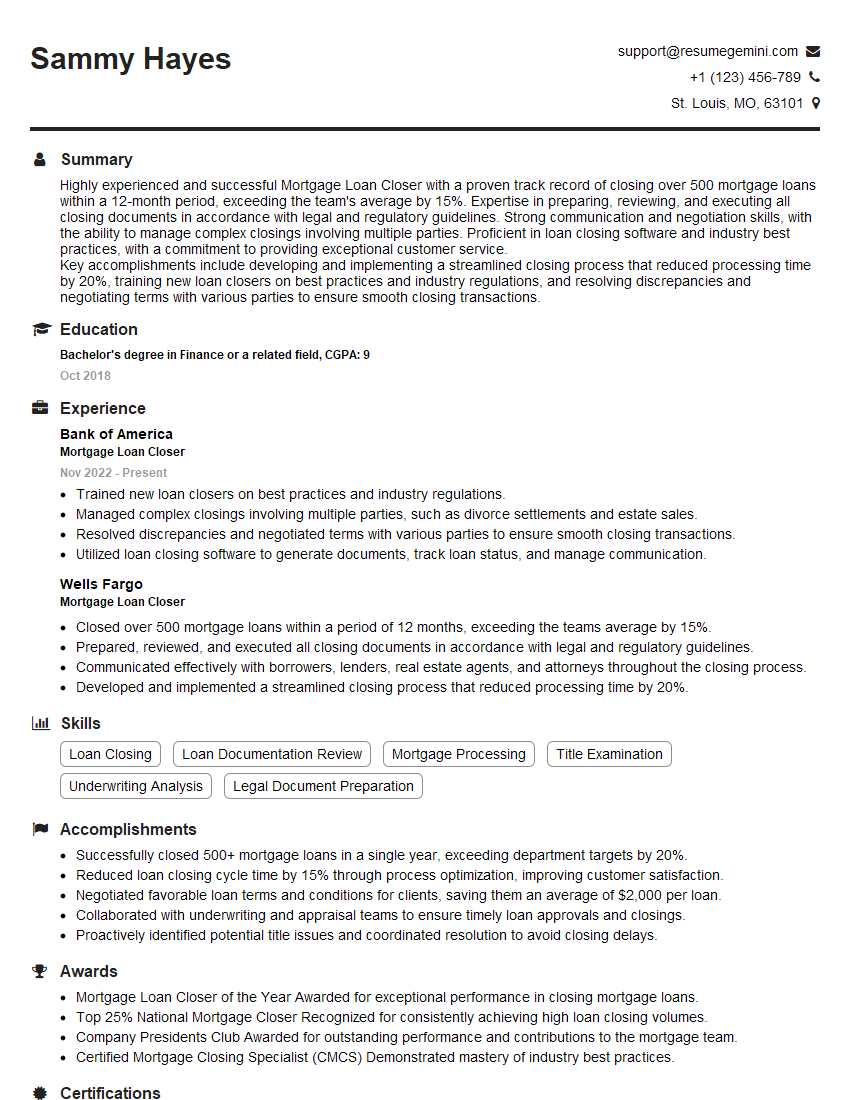

Sammy Hayes

Mortgage Loan Closer

Summary

Highly experienced and successful Mortgage Loan Closer with a proven track record of closing over 500 mortgage loans within a 12-month period, exceeding the team’s average by 15%. Expertise in preparing, reviewing, and executing all closing documents in accordance with legal and regulatory guidelines. Strong communication and negotiation skills, with the ability to manage complex closings involving multiple parties. Proficient in loan closing software and industry best practices, with a commitment to providing exceptional customer service.

Key accomplishments include developing and implementing a streamlined closing process that reduced processing time by 20%, training new loan closers on best practices and industry regulations, and resolving discrepancies and negotiating terms with various parties to ensure smooth closing transactions.

Education

Bachelor’s degree in Finance or a related field

October 2018

Skills

- Loan Closing

- Loan Documentation Review

- Mortgage Processing

- Title Examination

- Underwriting Analysis

- Legal Document Preparation

Work Experience

Mortgage Loan Closer

- Trained new loan closers on best practices and industry regulations.

- Managed complex closings involving multiple parties, such as divorce settlements and estate sales.

- Resolved discrepancies and negotiated terms with various parties to ensure smooth closing transactions.

- Utilized loan closing software to generate documents, track loan status, and manage communication.

Mortgage Loan Closer

- Closed over 500 mortgage loans within a period of 12 months, exceeding the teams average by 15%.

- Prepared, reviewed, and executed all closing documents in accordance with legal and regulatory guidelines.

- Communicated effectively with borrowers, lenders, real estate agents, and attorneys throughout the closing process.

- Developed and implemented a streamlined closing process that reduced processing time by 20%.

Accomplishments

- Successfully closed 500+ mortgage loans in a single year, exceeding department targets by 20%.

- Reduced loan closing cycle time by 15% through process optimization, improving customer satisfaction.

- Negotiated favorable loan terms and conditions for clients, saving them an average of $2,000 per loan.

- Collaborated with underwriting and appraisal teams to ensure timely loan approvals and closings.

- Proactively identified potential title issues and coordinated resolution to avoid closing delays.

Awards

- Mortgage Loan Closer of the Year Awarded for exceptional performance in closing mortgage loans.

- Top 25% National Mortgage Closer Recognized for consistently achieving high loan closing volumes.

- Company Presidents Club Awarded for outstanding performance and contributions to the mortgage team.

- Certified Mortgage Closing Specialist (CMCS) Demonstrated mastery of industry best practices.

Certificates

- Certified Mortgage Loan Closer (CMLC)

- Certified Residential Closer (CRC)

- Licensed Title Agent

- National Mortgage Licensing System (NMLS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Loan Closer

- Highlight your experience and expertise in mortgage loan closing, emphasizing the number of loans you have closed and any achievements or awards you have received.

- Showcase your strong communication and interpersonal skills, as well as your ability to work effectively with various parties involved in the closing process.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on the team or organization.

- Demonstrate your knowledge of industry best practices and regulatory guidelines, and highlight any training or certifications you have obtained.

- Proofread your resume carefully for any errors in grammar or spelling, as attention to detail is crucial in this role.

Essential Experience Highlights for a Strong Mortgage Loan Closer Resume

- Prepare, review, and execute all closing documents, ensuring compliance with legal and regulatory guidelines

- Communicate effectively with borrowers, lenders, real estate agents, and attorneys throughout the closing process

- Manage complex closings involving multiple parties, such as divorce settlements and estate sales

- Resolve discrepancies and negotiate terms with various parties to ensure smooth closing transactions

- Utilize loan closing software to generate documents, track loan status, and manage communication

- Stay up-to-date on industry best practices and regulatory changes

- Provide exceptional customer service to ensure a positive closing experience for all parties involved

Frequently Asked Questions (FAQ’s) For Mortgage Loan Closer

What are the primary responsibilities of a Mortgage Loan Closer?

Mortgage Loan Closers are responsible for preparing, reviewing, and executing all closing documents, ensuring compliance with legal and regulatory guidelines. They also communicate with borrowers, lenders, real estate agents, and attorneys throughout the closing process, and manage complex closings involving multiple parties.

What skills are required to be a successful Mortgage Loan Closer?

Successful Mortgage Loan Closers possess strong communication and interpersonal skills, as well as the ability to work effectively with various parties involved in the closing process. They are also proficient in loan closing software and industry best practices, and stay up-to-date on regulatory changes.

What is the job outlook for Mortgage Loan Closers?

The job outlook for Mortgage Loan Closers is expected to be positive in the coming years, as the demand for mortgage loans continues to grow. With the increasing complexity of mortgage regulations, qualified and experienced Mortgage Loan Closers will be in high demand.

What are the earning prospects for Mortgage Loan Closers?

Earning prospects for Mortgage Loan Closers vary depending on experience, qualifications, and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Loan Officers was $66,380 in May 2021.

What are the educational requirements to become a Mortgage Loan Closer?

While there are no specific educational requirements to become a Mortgage Loan Closer, many employers prefer candidates with a bachelor’s degree in finance or a related field. Some employers may also require candidates to have a mortgage loan originator license.

What is the difference between a Mortgage Loan Closer and a Loan Officer?

Mortgage Loan Closers are responsible for the final steps of the mortgage loan process, including preparing and executing closing documents. Loan Officers, on the other hand, are responsible for originating and underwriting mortgage loans.

What is the typical work environment for Mortgage Loan Closers?

Mortgage Loan Closers typically work in an office environment, although they may also work remotely. They may work regular business hours or extended hours to accommodate closing deadlines.