Are you a seasoned Mortgage Loan Officer seeking a new career path? Discover our professionally built Mortgage Loan Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

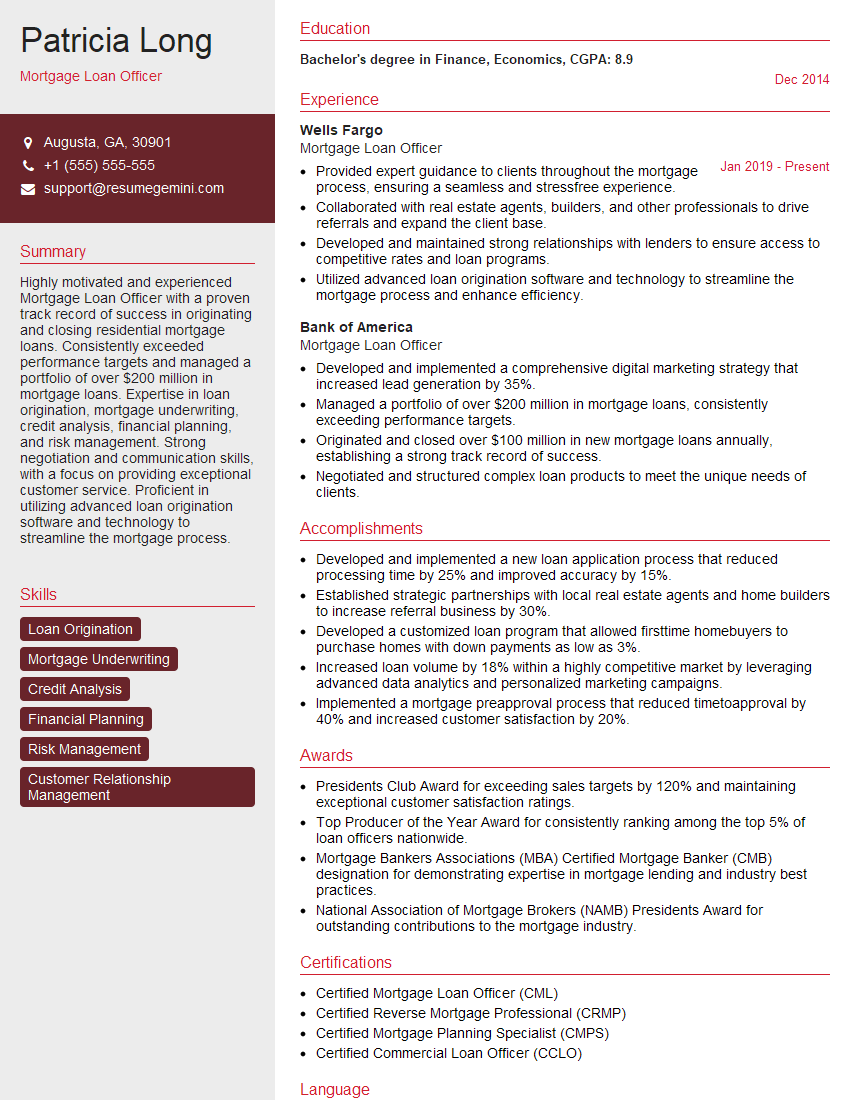

Patricia Long

Mortgage Loan Officer

Summary

Highly motivated and experienced Mortgage Loan Officer with a proven track record of success in originating and closing residential mortgage loans. Consistently exceeded performance targets and managed a portfolio of over $200 million in mortgage loans. Expertise in loan origination, mortgage underwriting, credit analysis, financial planning, and risk management. Strong negotiation and communication skills, with a focus on providing exceptional customer service. Proficient in utilizing advanced loan origination software and technology to streamline the mortgage process.

Education

Bachelor’s degree in Finance, Economics

December 2014

Skills

- Loan Origination

- Mortgage Underwriting

- Credit Analysis

- Financial Planning

- Risk Management

- Customer Relationship Management

Work Experience

Mortgage Loan Officer

- Provided expert guidance to clients throughout the mortgage process, ensuring a seamless and stressfree experience.

- Collaborated with real estate agents, builders, and other professionals to drive referrals and expand the client base.

- Developed and maintained strong relationships with lenders to ensure access to competitive rates and loan programs.

- Utilized advanced loan origination software and technology to streamline the mortgage process and enhance efficiency.

Mortgage Loan Officer

- Developed and implemented a comprehensive digital marketing strategy that increased lead generation by 35%.

- Managed a portfolio of over $200 million in mortgage loans, consistently exceeding performance targets.

- Originated and closed over $100 million in new mortgage loans annually, establishing a strong track record of success.

- Negotiated and structured complex loan products to meet the unique needs of clients.

Accomplishments

- Developed and implemented a new loan application process that reduced processing time by 25% and improved accuracy by 15%.

- Established strategic partnerships with local real estate agents and home builders to increase referral business by 30%.

- Developed a customized loan program that allowed firsttime homebuyers to purchase homes with down payments as low as 3%.

- Increased loan volume by 18% within a highly competitive market by leveraging advanced data analytics and personalized marketing campaigns.

- Implemented a mortgage preapproval process that reduced timetoapproval by 40% and increased customer satisfaction by 20%.

Awards

- Presidents Club Award for exceeding sales targets by 120% and maintaining exceptional customer satisfaction ratings.

- Top Producer of the Year Award for consistently ranking among the top 5% of loan officers nationwide.

- Mortgage Bankers Associations (MBA) Certified Mortgage Banker (CMB) designation for demonstrating expertise in mortgage lending and industry best practices.

- National Association of Mortgage Brokers (NAMB) Presidents Award for outstanding contributions to the mortgage industry.

Certificates

- Certified Mortgage Loan Officer (CML)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Mortgage Planning Specialist (CMPS)

- Certified Commercial Loan Officer (CCLO)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Loan Officer

- Highlight your experience and accomplishments with specific metrics and quantifiable results.

- Showcase your expertise in loan origination, underwriting, and risk management.

- Emphasize your ability to build and maintain strong relationships with clients and industry professionals.

- Demonstrate your proficiency in utilizing technology and software to streamline the mortgage process.

- Tailor your resume to each specific job application, highlighting the skills and experience most relevant to the position.

Essential Experience Highlights for a Strong Mortgage Loan Officer Resume

- Originate and close mortgage loans, exceeding assigned targets.

- Develop and implement digital marketing strategies to generate leads and expand the client base.

- Negotiate and structure complex loan products tailored to clients’ unique financial needs.

- Provide expert guidance and support to clients throughout the mortgage process, ensuring a seamless experience.

- Collaborate with real estate agents, builders, and other professionals to drive referrals and build relationships.

- Maintain strong relationships with lenders to secure competitive rates and loan programs.

- Stay abreast of industry trends, regulations, and best practices.

Frequently Asked Questions (FAQ’s) For Mortgage Loan Officer

What are the key skills required to be a successful Mortgage Loan Officer?

The key skills required for a successful Mortgage Loan Officer include loan origination, mortgage underwriting, credit analysis, financial planning, risk management, customer relationship management, and proficiency in loan origination software.

What are the different types of mortgage loans available?

There are various types of mortgage loans available, including fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, and jumbo loans.

What factors affect mortgage interest rates?

Mortgage interest rates are influenced by various factors such as the Federal Reserve’s interest rate policy, economic conditions, inflation, and the borrower’s creditworthiness.

How can I improve my chances of getting approved for a mortgage?

To improve your chances of getting approved for a mortgage, you should have a good credit score, a stable income, and a low debt-to-income ratio.

What are the closing costs associated with a mortgage?

Closing costs associated with a mortgage typically include loan origination fees, title insurance, attorney fees, and appraisal fees.

What is the role of a Mortgage Loan Officer in the home buying process?

A Mortgage Loan Officer assists homebuyers by guiding them through the mortgage application process, helping them understand different loan options, and ensuring a smooth closing.