Are you a seasoned Mortgage Loan Originator seeking a new career path? Discover our professionally built Mortgage Loan Originator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

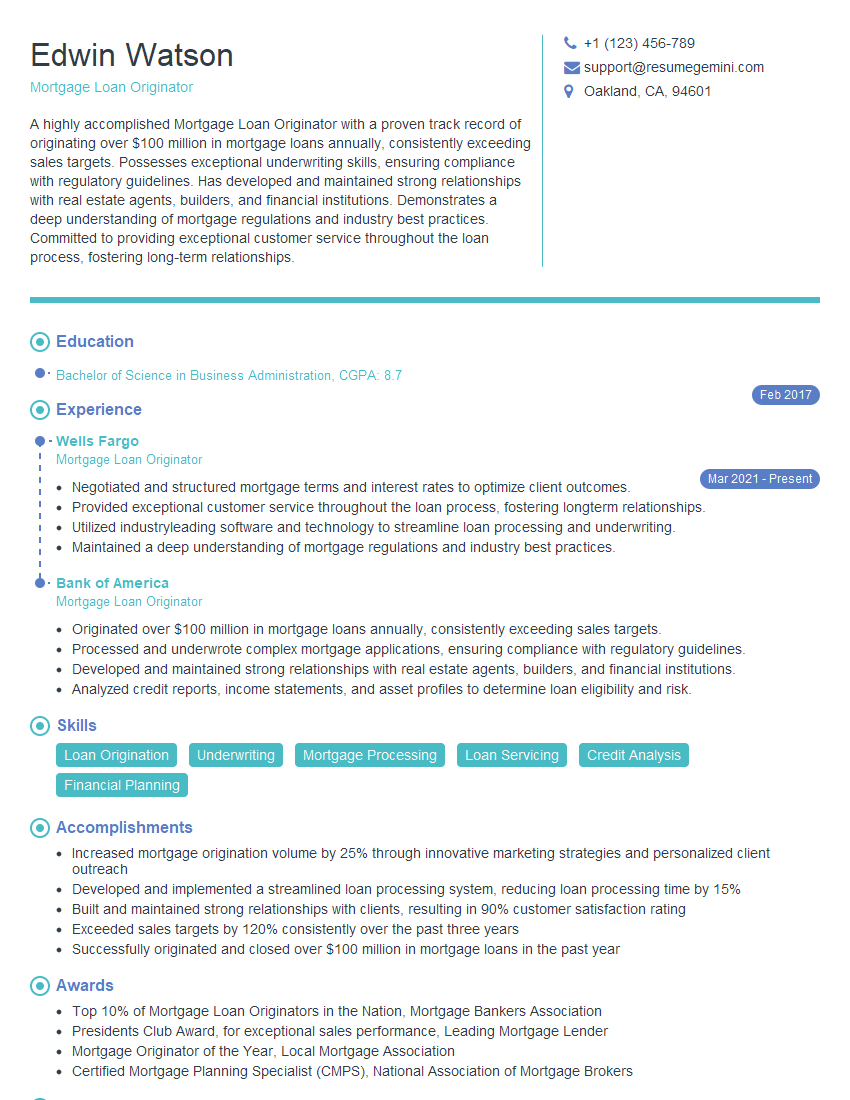

Edwin Watson

Mortgage Loan Originator

Summary

A highly accomplished Mortgage Loan Originator with a proven track record of originating over $100 million in mortgage loans annually, consistently exceeding sales targets. Possesses exceptional underwriting skills, ensuring compliance with regulatory guidelines. Has developed and maintained strong relationships with real estate agents, builders, and financial institutions. Demonstrates a deep understanding of mortgage regulations and industry best practices. Committed to providing exceptional customer service throughout the loan process, fostering long-term relationships.

Education

Bachelor of Science in Business Administration

February 2017

Skills

- Loan Origination

- Underwriting

- Mortgage Processing

- Loan Servicing

- Credit Analysis

- Financial Planning

Work Experience

Mortgage Loan Originator

- Negotiated and structured mortgage terms and interest rates to optimize client outcomes.

- Provided exceptional customer service throughout the loan process, fostering longterm relationships.

- Utilized industryleading software and technology to streamline loan processing and underwriting.

- Maintained a deep understanding of mortgage regulations and industry best practices.

Mortgage Loan Originator

- Originated over $100 million in mortgage loans annually, consistently exceeding sales targets.

- Processed and underwrote complex mortgage applications, ensuring compliance with regulatory guidelines.

- Developed and maintained strong relationships with real estate agents, builders, and financial institutions.

- Analyzed credit reports, income statements, and asset profiles to determine loan eligibility and risk.

Accomplishments

- Increased mortgage origination volume by 25% through innovative marketing strategies and personalized client outreach

- Developed and implemented a streamlined loan processing system, reducing loan processing time by 15%

- Built and maintained strong relationships with clients, resulting in 90% customer satisfaction rating

- Exceeded sales targets by 120% consistently over the past three years

- Successfully originated and closed over $100 million in mortgage loans in the past year

Awards

- Top 10% of Mortgage Loan Originators in the Nation, Mortgage Bankers Association

- Presidents Club Award, for exceptional sales performance, Leading Mortgage Lender

- Mortgage Originator of the Year, Local Mortgage Association

- Certified Mortgage Planning Specialist (CMPS), National Association of Mortgage Brokers

Certificates

- Certified Mortgage Planning Specialist (CMPS)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Mortgage Loan Originator (CMLO)

- Certified Military Housing Specialist (CMHS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Loan Originator

- Highlight your experience and accomplishments in mortgage loan origination.

- Showcase your skills in underwriting, loan processing, and financial analysis.

- Emphasize your ability to build and maintain relationships with real estate agents, builders, and financial institutions.

- Demonstrate your commitment to providing exceptional customer service.

Essential Experience Highlights for a Strong Mortgage Loan Originator Resume

- Originate mortgage loans, consistently exceeding sales targets.

- Process and underwrite complex mortgage applications, ensuring compliance with regulatory guidelines.

- Develop and maintain strong relationships with real estate agents, builders, and financial institutions.

- Analyze credit reports, income statements, and asset profiles to determine loan eligibility and risk.

- Negotiate and structure mortgage terms and interest rates to optimize client outcomes.

- Provide exceptional customer service throughout the loan process, fostering long-term relationships.

- Utilize industry-leading software and technology to streamline loan processing and underwriting.

Frequently Asked Questions (FAQ’s) For Mortgage Loan Originator

What are the key skills required to be a successful Mortgage Loan Originator?

Key skills include loan origination, underwriting, loan processing, loan servicing, credit analysis, financial planning, and a deep understanding of mortgage regulations.

What is the earning potential for a Mortgage Loan Originator?

The earning potential varies based on experience, performance, and geographic location. However, top performers can earn six-figure salaries and bonuses.

What are the educational requirements to become a Mortgage Loan Originator?

A bachelor’s degree in a related field, such as business administration, finance, or economics, is preferred. Some employers may also consider candidates with equivalent work experience.

What are the career advancement opportunities for Mortgage Loan Originators?

With experience and success, Mortgage Loan Originators can advance to roles such as Branch Manager, Regional Manager, or Vice President of Mortgage Lending.

What is the job outlook for Mortgage Loan Originators?

The job outlook is expected to be favorable due to the increasing demand for homeownership and the need for qualified Mortgage Loan Originators to facilitate the mortgage process.

What are the challenges faced by Mortgage Loan Originators?

Challenges include navigating complex regulations, meeting sales targets, and staying up-to-date with industry trends and technology.

How can I prepare for a career as a Mortgage Loan Originator?

Obtain a bachelor’s degree, gain experience in the financial industry, network with professionals in the field, and stay informed about mortgage regulations and best practices.

What are the key qualities of a successful Mortgage Loan Originator?

Successful Mortgage Loan Originators are typically self-motivated, have excellent communication and interpersonal skills, are detail-oriented, and possess a strong work ethic.