Are you a seasoned Mortgage Loan Processor seeking a new career path? Discover our professionally built Mortgage Loan Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

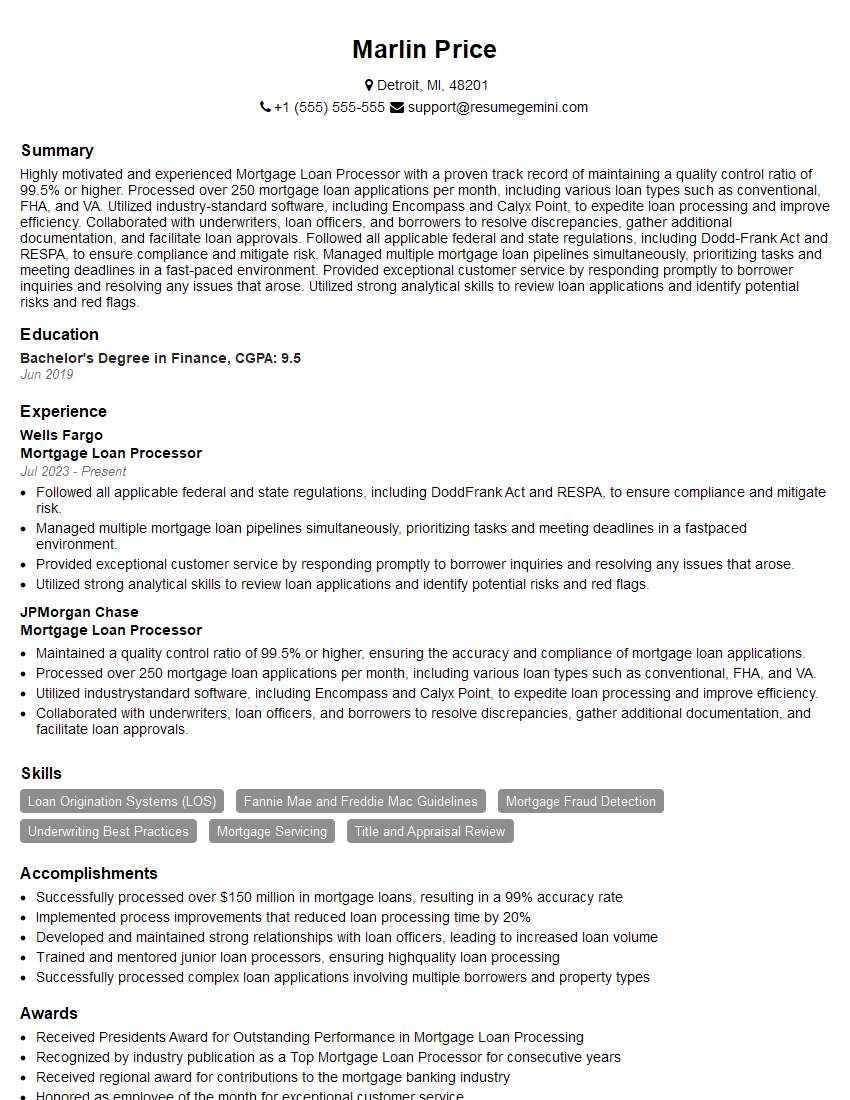

Marlin Price

Mortgage Loan Processor

Summary

Highly motivated and experienced Mortgage Loan Processor with a proven track record of maintaining a quality control ratio of 99.5% or higher. Processed over 250 mortgage loan applications per month, including various loan types such as conventional, FHA, and VA. Utilized industry-standard software, including Encompass and Calyx Point, to expedite loan processing and improve efficiency. Collaborated with underwriters, loan officers, and borrowers to resolve discrepancies, gather additional documentation, and facilitate loan approvals. Followed all applicable federal and state regulations, including Dodd-Frank Act and RESPA, to ensure compliance and mitigate risk. Managed multiple mortgage loan pipelines simultaneously, prioritizing tasks and meeting deadlines in a fast-paced environment. Provided exceptional customer service by responding promptly to borrower inquiries and resolving any issues that arose. Utilized strong analytical skills to review loan applications and identify potential risks and red flags.

Education

Bachelor’s Degree in Finance

June 2019

Skills

- Loan Origination Systems (LOS)

- Fannie Mae and Freddie Mac Guidelines

- Mortgage Fraud Detection

- Underwriting Best Practices

- Mortgage Servicing

- Title and Appraisal Review

Work Experience

Mortgage Loan Processor

- Followed all applicable federal and state regulations, including DoddFrank Act and RESPA, to ensure compliance and mitigate risk.

- Managed multiple mortgage loan pipelines simultaneously, prioritizing tasks and meeting deadlines in a fastpaced environment.

- Provided exceptional customer service by responding promptly to borrower inquiries and resolving any issues that arose.

- Utilized strong analytical skills to review loan applications and identify potential risks and red flags.

Mortgage Loan Processor

- Maintained a quality control ratio of 99.5% or higher, ensuring the accuracy and compliance of mortgage loan applications.

- Processed over 250 mortgage loan applications per month, including various loan types such as conventional, FHA, and VA.

- Utilized industrystandard software, including Encompass and Calyx Point, to expedite loan processing and improve efficiency.

- Collaborated with underwriters, loan officers, and borrowers to resolve discrepancies, gather additional documentation, and facilitate loan approvals.

Accomplishments

- Successfully processed over $150 million in mortgage loans, resulting in a 99% accuracy rate

- Implemented process improvements that reduced loan processing time by 20%

- Developed and maintained strong relationships with loan officers, leading to increased loan volume

- Trained and mentored junior loan processors, ensuring highquality loan processing

- Successfully processed complex loan applications involving multiple borrowers and property types

Awards

- Received Presidents Award for Outstanding Performance in Mortgage Loan Processing

- Recognized by industry publication as a Top Mortgage Loan Processor for consecutive years

- Received regional award for contributions to the mortgage banking industry

- Honored as employee of the month for exceptional customer service

Certificates

- Certified Mortgage Banker (CMB)

- Certified Mortgage Loan Originator (CMLO)

- Certified Reverse Mortgage Professional (CRMP)

- Certified Mortgage Servicing Specialist (CMSS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Loan Processor

- Highlight your experience and skills in mortgage loan processing, including your ability to maintain a high-quality control ratio.

- Demonstrate your knowledge of industry-standard software and regulations.

- Emphasize your ability to work independently and as part of a team.

- Showcase your customer service skills and ability to resolve issues effectively.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Mortgage Loan Processor Resume

- Processed over 250 mortgage loan applications per month, including various loan types such as conventional, FHA, and VA.

- Utilized industry-standard software, including Encompass and Calyx Point, to expedite loan processing and improve efficiency.

- Collaborated with underwriters, loan officers, and borrowers to resolve discrepancies, gather additional documentation, and facilitate loan approvals.

- Followed all applicable federal and state regulations, including Dodd-Frank Act and RESPA, to ensure compliance and mitigate risk.

- Managed multiple mortgage loan pipelines simultaneously, prioritizing tasks and meeting deadlines in a fast-paced environment.

- Provided exceptional customer service by responding promptly to borrower inquiries and resolving any issues that arose.

- Utilized strong analytical skills to review loan applications and identify potential risks and red flags.

Frequently Asked Questions (FAQ’s) For Mortgage Loan Processor

What are the primary responsibilities of a Mortgage Loan Processor?

The primary responsibilities of a Mortgage Loan Processor include processing loan applications, verifying documentation, communicating with borrowers and lenders, and ensuring that all loan documents are complete and accurate.

What are the key skills required for a Mortgage Loan Processor?

Key skills for a Mortgage Loan Processor include attention to detail, strong organizational skills, and the ability to work independently and as part of a team.

What is the average salary for a Mortgage Loan Processor?

According to the U.S. Bureau of Labor Statistics, the median annual salary for a Mortgage Loan Processor was $65,810 in May 2021.

What is the job outlook for Mortgage Loan Processors?

The job outlook for Mortgage Loan Processors is expected to grow 7% from 2021 to 2031, faster than the average for all occupations.

What are the educational requirements for a Mortgage Loan Processor?

Most Mortgage Loan Processors have at least a high school diploma or equivalent. Some employers may prefer candidates with a bachelor’s degree in a related field, such as finance or business.

What are the certification requirements for a Mortgage Loan Processor?

Some Mortgage Loan Processors choose to obtain certification from organizations such as the National Association of Mortgage Brokers (NAMB) or the American Association of Residential Mortgage Regulators (AARMR).

What are the career advancement opportunities for a Mortgage Loan Processor?

Mortgage Loan Processors can advance to roles such as Mortgage Underwriter, Loan Officer, or Branch Manager.

What are the challenges of being a Mortgage Loan Processor?

Challenges of being a Mortgage Loan Processor include the need to stay up-to-date on industry regulations, the potential for high workload, and the need to work independently.