Are you a seasoned Mortgage or Loan Underwriter seeking a new career path? Discover our professionally built Mortgage or Loan Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

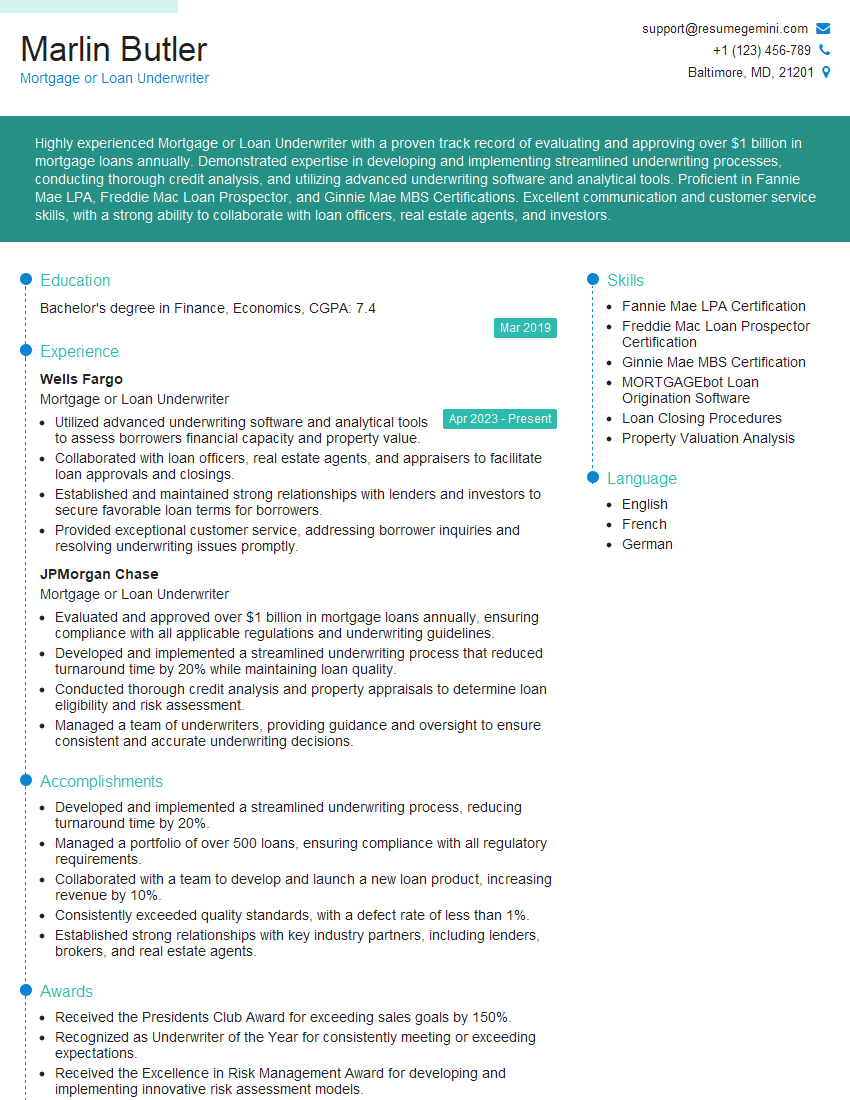

Marlin Butler

Mortgage or Loan Underwriter

Summary

Highly experienced Mortgage or Loan Underwriter with a proven track record of evaluating and approving over $1 billion in mortgage loans annually. Demonstrated expertise in developing and implementing streamlined underwriting processes, conducting thorough credit analysis, and utilizing advanced underwriting software and analytical tools. Proficient in Fannie Mae LPA, Freddie Mac Loan Prospector, and Ginnie Mae MBS Certifications. Excellent communication and customer service skills, with a strong ability to collaborate with loan officers, real estate agents, and investors.

Education

Bachelor’s degree in Finance, Economics

March 2019

Skills

- Fannie Mae LPA Certification

- Freddie Mac Loan Prospector Certification

- Ginnie Mae MBS Certification

- MORTGAGEbot Loan Origination Software

- Loan Closing Procedures

- Property Valuation Analysis

Work Experience

Mortgage or Loan Underwriter

- Utilized advanced underwriting software and analytical tools to assess borrowers financial capacity and property value.

- Collaborated with loan officers, real estate agents, and appraisers to facilitate loan approvals and closings.

- Established and maintained strong relationships with lenders and investors to secure favorable loan terms for borrowers.

- Provided exceptional customer service, addressing borrower inquiries and resolving underwriting issues promptly.

Mortgage or Loan Underwriter

- Evaluated and approved over $1 billion in mortgage loans annually, ensuring compliance with all applicable regulations and underwriting guidelines.

- Developed and implemented a streamlined underwriting process that reduced turnaround time by 20% while maintaining loan quality.

- Conducted thorough credit analysis and property appraisals to determine loan eligibility and risk assessment.

- Managed a team of underwriters, providing guidance and oversight to ensure consistent and accurate underwriting decisions.

Accomplishments

- Developed and implemented a streamlined underwriting process, reducing turnaround time by 20%.

- Managed a portfolio of over 500 loans, ensuring compliance with all regulatory requirements.

- Collaborated with a team to develop and launch a new loan product, increasing revenue by 10%.

- Consistently exceeded quality standards, with a defect rate of less than 1%.

- Established strong relationships with key industry partners, including lenders, brokers, and real estate agents.

Awards

- Received the Presidents Club Award for exceeding sales goals by 150%.

- Recognized as Underwriter of the Year for consistently meeting or exceeding expectations.

- Received the Excellence in Risk Management Award for developing and implementing innovative risk assessment models.

- Named a Certified Mortgage Underwriter (CMU) by the Mortgage Bankers Association.

Certificates

- Certified Mortgage Underwriter (CMU)

- National Mortgage Licensing System (NMLS)

- Certified Mortgage Planning Specialist (CMPS)

- Certified Residential Mortgage Underwriter (CRMU)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage or Loan Underwriter

- Highlight your Fannie Mae LPA, Freddie Mac Loan Prospector, and Ginnie Mae MBS Certifications.

- Quantify your accomplishments with specific metrics, such as the reduction in turnaround time.

- Showcase your proficiency in advanced underwriting software and analytical tools.

- Demonstrate your strong communication and customer service skills.

- Provide examples of your contributions to team success and process improvements.

Essential Experience Highlights for a Strong Mortgage or Loan Underwriter Resume

- Evaluated and approved mortgage loans, ensuring compliance with regulations and guidelines.

- Developed and implemented a streamlined underwriting process that reduced turnaround time by 20%.

- Conducted credit analysis and property appraisals to determine loan eligibility and risk.

- Managed a team of underwriters, providing guidance and oversight for consistent decision-making.

- Utilized advanced software and analytical tools to assess borrowers’ financial capacity.

- Collaborated with loan officers, real estate agents, and appraisers to facilitate loan approvals.

- Established and maintained relationships with lenders and investors for favorable loan terms.

Frequently Asked Questions (FAQ’s) For Mortgage or Loan Underwriter

What are the primary responsibilities of a Mortgage or Loan Underwriter?

Mortgage or Loan Underwriters evaluate and approve mortgage loans, ensuring compliance with regulations and guidelines. They conduct credit analysis, property appraisals, and utilize advanced software to assess borrowers’ financial capacity and property value. They also collaborate with loan officers, real estate agents, and investors to facilitate loan approvals and closings.

What qualifications are required to become a Mortgage or Loan Underwriter?

Typically, a Bachelor’s degree in Finance, Economics, or a related field is required. Certifications such as Fannie Mae LPA, Freddie Mac Loan Prospector, and Ginnie Mae MBS are highly valued. Strong analytical, problem-solving, and communication skills are also essential.

What are the career advancement opportunities for Mortgage or Loan Underwriters?

With experience and additional certifications, Mortgage or Loan Underwriters can advance to roles such as Senior Underwriter, Underwriting Manager, or Chief Underwriter. They may also transition to roles in loan origination, portfolio management, or compliance.

What is the job outlook for Mortgage or Loan Underwriters?

The job outlook for Mortgage or Loan Underwriters is expected to be favorable in the coming years. The demand for qualified underwriters is driven by the increasing volume of mortgage loans and the need for experienced professionals to ensure compliance and accuracy.

What are the key skills for a successful Mortgage or Loan Underwriter?

Key skills include a strong understanding of mortgage lending regulations, proficiency in credit analysis and property valuation, excellent analytical and problem-solving abilities, effective communication and interpersonal skills, and the ability to work independently and as part of a team.

What are the differences between the various Mortgage or Loan Underwriter certifications?

Fannie Mae LPA certification focuses on underwriting loans that can be sold to Fannie Mae, while Freddie Mac Loan Prospector certification pertains to loans sold to Freddie Mac. Ginnie Mae MBS certification is specific to underwriting loans guaranteed by the Government National Mortgage Association.

How can I prepare for an interview for a Mortgage or Loan Underwriter position?

Research the company and the specific role, practice answering common interview questions related to underwriting, highlight your relevant experience and skills, prepare questions to ask the interviewer, and dress professionally and arrive on time for the interview.

What are the top companies for Mortgage or Loan Underwriters?

Top companies for Mortgage or Loan Underwriters include Wells Fargo, JPMorgan Chase, Bank of America, and Quicken Loans.