Are you a seasoned Mortgage Originator seeking a new career path? Discover our professionally built Mortgage Originator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

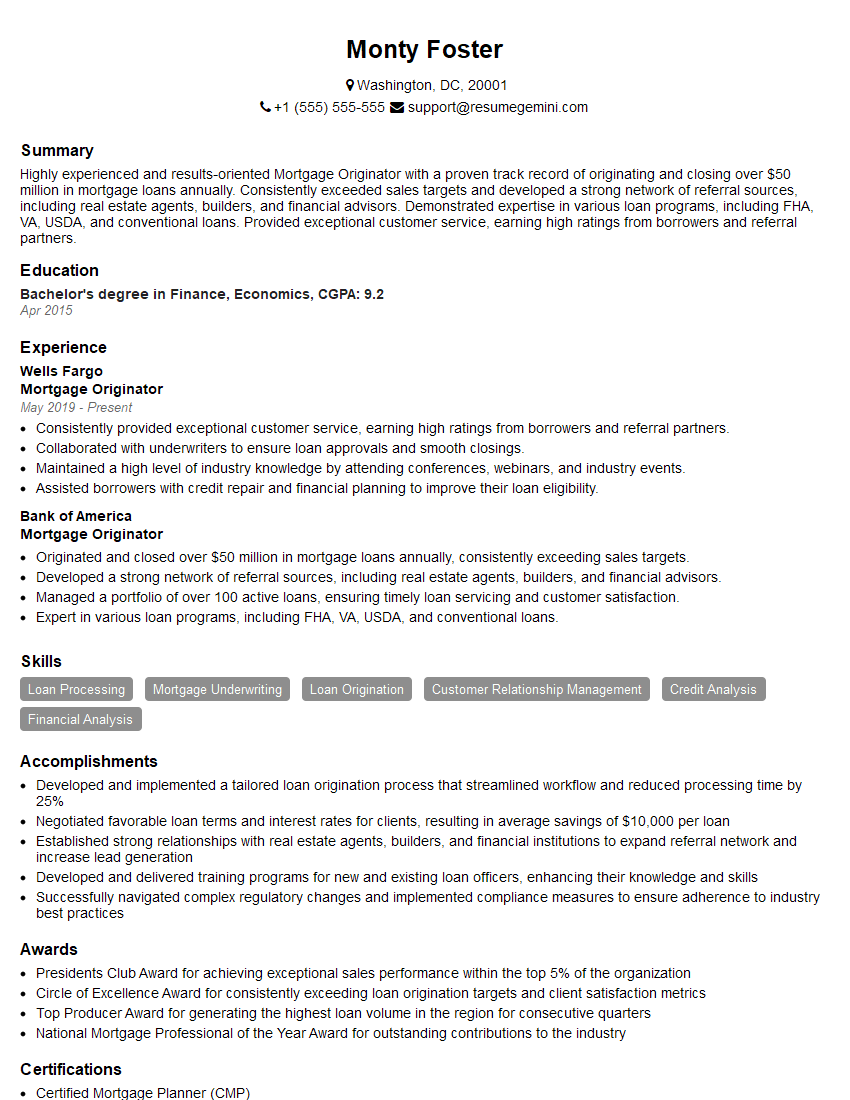

Monty Foster

Mortgage Originator

Summary

Highly experienced and results-oriented Mortgage Originator with a proven track record of originating and closing over $50 million in mortgage loans annually. Consistently exceeded sales targets and developed a strong network of referral sources, including real estate agents, builders, and financial advisors. Demonstrated expertise in various loan programs, including FHA, VA, USDA, and conventional loans. Provided exceptional customer service, earning high ratings from borrowers and referral partners.

Education

Bachelor’s degree in Finance, Economics

April 2015

Skills

- Loan Processing

- Mortgage Underwriting

- Loan Origination

- Customer Relationship Management

- Credit Analysis

- Financial Analysis

Work Experience

Mortgage Originator

- Consistently provided exceptional customer service, earning high ratings from borrowers and referral partners.

- Collaborated with underwriters to ensure loan approvals and smooth closings.

- Maintained a high level of industry knowledge by attending conferences, webinars, and industry events.

- Assisted borrowers with credit repair and financial planning to improve their loan eligibility.

Mortgage Originator

- Originated and closed over $50 million in mortgage loans annually, consistently exceeding sales targets.

- Developed a strong network of referral sources, including real estate agents, builders, and financial advisors.

- Managed a portfolio of over 100 active loans, ensuring timely loan servicing and customer satisfaction.

- Expert in various loan programs, including FHA, VA, USDA, and conventional loans.

Accomplishments

- Developed and implemented a tailored loan origination process that streamlined workflow and reduced processing time by 25%

- Negotiated favorable loan terms and interest rates for clients, resulting in average savings of $10,000 per loan

- Established strong relationships with real estate agents, builders, and financial institutions to expand referral network and increase lead generation

- Developed and delivered training programs for new and existing loan officers, enhancing their knowledge and skills

- Successfully navigated complex regulatory changes and implemented compliance measures to ensure adherence to industry best practices

Awards

- Presidents Club Award for achieving exceptional sales performance within the top 5% of the organization

- Circle of Excellence Award for consistently exceeding loan origination targets and client satisfaction metrics

- Top Producer Award for generating the highest loan volume in the region for consecutive quarters

- National Mortgage Professional of the Year Award for outstanding contributions to the industry

Certificates

- Certified Mortgage Planner (CMP)

- Certified Residential Mortgage Specialist (CRMS)

- Certified Mortgage Originator (CMO)

- National Mortgage Licensing System (NMLS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Originator

Highlight your experience and accomplishments.

Quantify your results whenever possible, using specific numbers and metrics to demonstrate your impact.Showcase your industry knowledge.

Mention any relevant certifications or designations you have obtained, and describe your involvement in industry events and organizations.Emphasize your customer service skills.

This is a critical aspect of being a successful mortgage originator, so make sure to highlight your ability to build rapport, communicate effectively, and resolve issues promptly.Tailor your resume to each job you apply for.

Take the time to read the job description carefully and identify the key skills and experience that the employer is looking for.Proofread your resume carefully before submitting it.

Make sure there are no errors in grammar or spelling, and that your resume is well-organized and easy to read.

Essential Experience Highlights for a Strong Mortgage Originator Resume

- Originate and close mortgage loans in accordance with company guidelines.

- Develop and maintain relationships with real estate agents, builders, and other referral sources.

- Analyze loan applications, order credit reports, and verify income and assets.

- Prepare and submit loan packages to underwriting for approval.

- Work closely with borrowers throughout the loan process to ensure a smooth and timely closing.

- Review loan documents and ensure that all necessary signatures and disclosures are obtained.

- Provide excellent customer service to borrowers and referral partners.

Frequently Asked Questions (FAQ’s) For Mortgage Originator

What is the job outlook for mortgage originators?

The job outlook for mortgage originators is expected to be good over the next few years. As the economy continues to improve, more and more people are expected to buy homes, which will lead to increased demand for mortgage originators.

What are the key skills that mortgage originators need?

Mortgage originators need to have a strong understanding of the mortgage process, as well as excellent communication and interpersonal skills. They also need to be able to work independently and as part of a team.

What are the different types of mortgage loans that mortgage originators can originate?

Mortgage originators can originate a variety of different types of mortgage loans, including fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, and USDA loans.

What is the average salary for a mortgage originator?

The average salary for a mortgage originator is around $60,000 per year. However, salaries can vary depending on a number of factors, such as experience, location, and company size.

What are the career advancement opportunities for mortgage originators?

Mortgage originators can advance their careers by becoming loan officers, branch managers, or regional managers. They can also start their own mortgage brokerage firms.

What are the challenges that mortgage originators face?

Mortgage originators face a number of challenges, such as the need to stay up-to-date on the latest mortgage regulations and the need to compete with other lenders for business.

What are the rewards of being a mortgage originator?

The rewards of being a mortgage originator include the satisfaction of helping people achieve their dream of homeownership, the opportunity to earn a good income, and the chance to build a successful career.