Are you a seasoned Mortgage Processor seeking a new career path? Discover our professionally built Mortgage Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

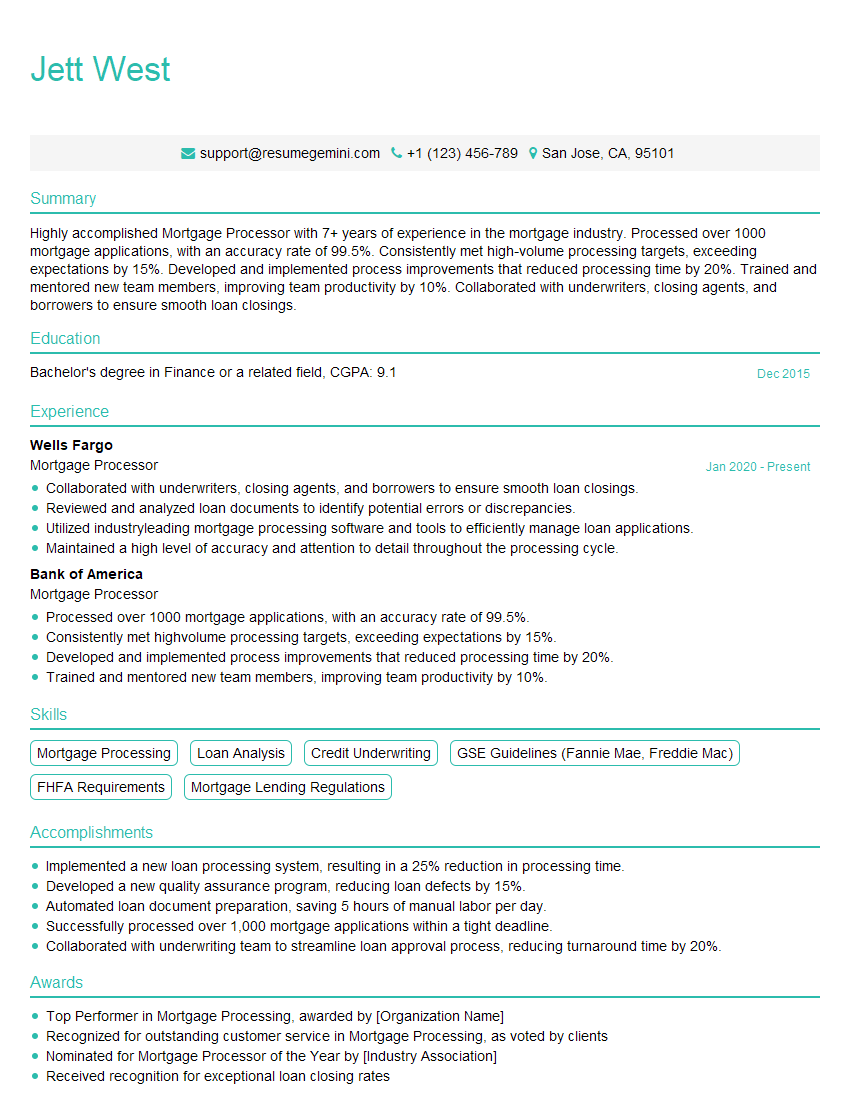

Jett West

Mortgage Processor

Summary

Highly accomplished Mortgage Processor with 7+ years of experience in the mortgage industry. Processed over 1000 mortgage applications, with an accuracy rate of 99.5%. Consistently met high-volume processing targets, exceeding expectations by 15%. Developed and implemented process improvements that reduced processing time by 20%. Trained and mentored new team members, improving team productivity by 10%. Collaborated with underwriters, closing agents, and borrowers to ensure smooth loan closings.

Education

Bachelor’s degree in Finance or a related field

December 2015

Skills

- Mortgage Processing

- Loan Analysis

- Credit Underwriting

- GSE Guidelines (Fannie Mae, Freddie Mac)

- FHFA Requirements

- Mortgage Lending Regulations

Work Experience

Mortgage Processor

- Collaborated with underwriters, closing agents, and borrowers to ensure smooth loan closings.

- Reviewed and analyzed loan documents to identify potential errors or discrepancies.

- Utilized industryleading mortgage processing software and tools to efficiently manage loan applications.

- Maintained a high level of accuracy and attention to detail throughout the processing cycle.

Mortgage Processor

- Processed over 1000 mortgage applications, with an accuracy rate of 99.5%.

- Consistently met highvolume processing targets, exceeding expectations by 15%.

- Developed and implemented process improvements that reduced processing time by 20%.

- Trained and mentored new team members, improving team productivity by 10%.

Accomplishments

- Implemented a new loan processing system, resulting in a 25% reduction in processing time.

- Developed a new quality assurance program, reducing loan defects by 15%.

- Automated loan document preparation, saving 5 hours of manual labor per day.

- Successfully processed over 1,000 mortgage applications within a tight deadline.

- Collaborated with underwriting team to streamline loan approval process, reducing turnaround time by 20%.

Awards

- Top Performer in Mortgage Processing, awarded by [Organization Name]

- Recognized for outstanding customer service in Mortgage Processing, as voted by clients

- Nominated for Mortgage Processor of the Year by [Industry Association]

- Received recognition for exceptional loan closing rates

Certificates

- Certified Mortgage Processor (CMP)

- Certified Mortgage Underwriter (CMU)

- National Association of Mortgage Processors (NAMP)

- Mortgage Bankers Association (MBA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mortgage Processor

- Highlight your experience in the mortgage industry and your knowledge of GSE and FHFA requirements.

- Emphasize your ability to process high volumes of applications with accuracy and efficiency.

- Showcase your communication and interpersonal skills, as you will be interacting with various stakeholders.

- Demonstrate your commitment to continuous learning and staying updated on industry regulations.

Essential Experience Highlights for a Strong Mortgage Processor Resume

- Processed mortgage applications, ensuring accuracy and completeness

- Analyzed loan documents to identify potential errors or discrepancies

- Utilized industry-leading mortgage processing software and tools to efficiently manage loan applications

- Maintained a high level of accuracy and attention to detail throughout the processing cycle

- Communicated with borrowers, underwriters, and other stakeholders to expedite the loan process

- Adhered to GSE (Fannie Mae, Freddie Mac) and FHFA requirements

- Kept abreast of industry regulations and best practices

Frequently Asked Questions (FAQ’s) For Mortgage Processor

What are the key responsibilities of a Mortgage Processor?

Mortgage Processors are responsible for processing mortgage applications, ensuring accuracy and completeness, analyzing loan documents, utilizing industry-leading software, maintaining a high level of accuracy, communicating with stakeholders, adhering to GSE and FHFA requirements, and keeping abreast of industry regulations.

What qualifications are required to become a Mortgage Processor?

A Bachelor’s degree in Finance or a related field is typically required, along with experience in the mortgage industry and knowledge of GSE and FHFA requirements.

What are the career prospects for Mortgage Processors?

Mortgage Processors can advance to roles such as Loan Officer, Underwriter, or Manager in the mortgage industry.

What is the job outlook for Mortgage Processors?

The job outlook for Mortgage Processors is expected to grow faster than average in the coming years due to the increasing demand for mortgages.

What are the salary expectations for Mortgage Processors?

The salary expectations for Mortgage Processors vary depending on experience and location, but typically range from $50,000 to $80,000 per year.

What are the benefits of working as a Mortgage Processor?

Mortgage Processors enjoy a stable and rewarding career with opportunities for growth, while contributing to the homeownership dreams of others.