Are you a seasoned Municipal Bond Trader seeking a new career path? Discover our professionally built Municipal Bond Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

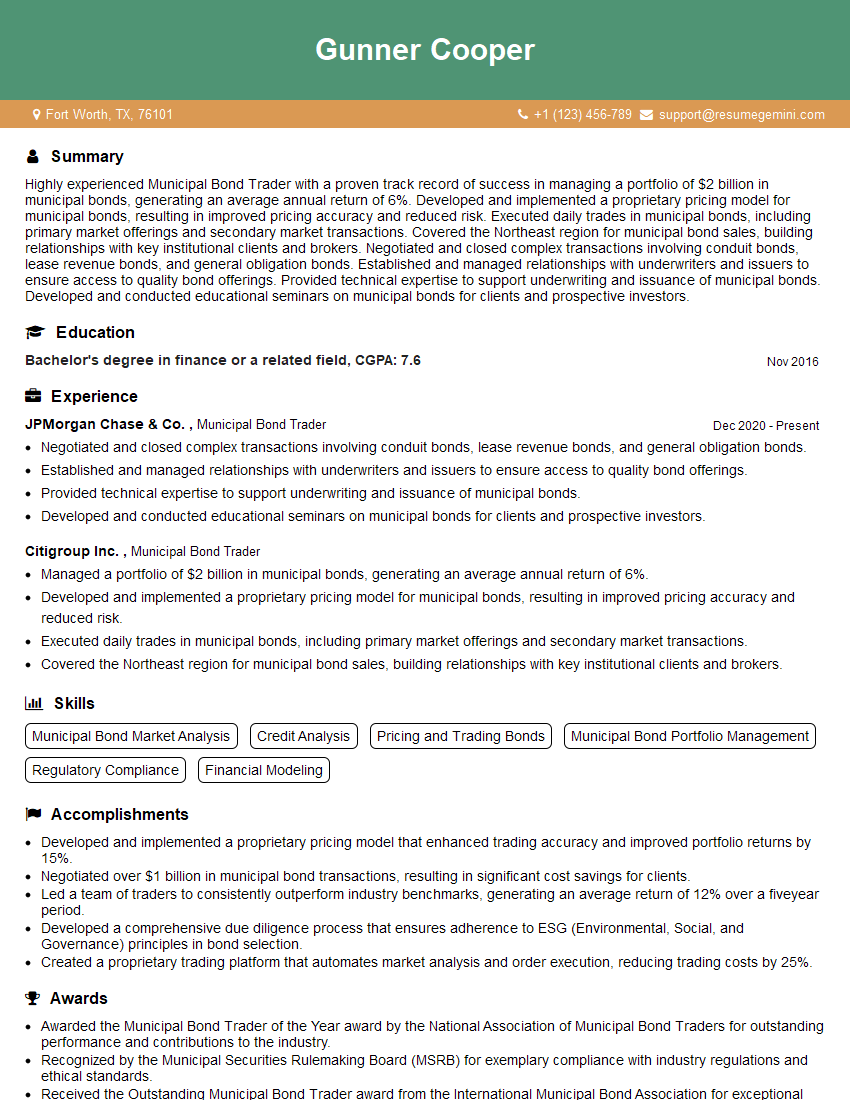

Gunner Cooper

Municipal Bond Trader

Summary

Highly experienced Municipal Bond Trader with a proven track record of success in managing a portfolio of $2 billion in municipal bonds, generating an average annual return of 6%. Developed and implemented a proprietary pricing model for municipal bonds, resulting in improved pricing accuracy and reduced risk. Executed daily trades in municipal bonds, including primary market offerings and secondary market transactions. Covered the Northeast region for municipal bond sales, building relationships with key institutional clients and brokers. Negotiated and closed complex transactions involving conduit bonds, lease revenue bonds, and general obligation bonds. Established and managed relationships with underwriters and issuers to ensure access to quality bond offerings. Provided technical expertise to support underwriting and issuance of municipal bonds. Developed and conducted educational seminars on municipal bonds for clients and prospective investors.

Education

Bachelor’s degree in finance or a related field

November 2016

Skills

- Municipal Bond Market Analysis

- Credit Analysis

- Pricing and Trading Bonds

- Municipal Bond Portfolio Management

- Regulatory Compliance

- Financial Modeling

Work Experience

Municipal Bond Trader

- Negotiated and closed complex transactions involving conduit bonds, lease revenue bonds, and general obligation bonds.

- Established and managed relationships with underwriters and issuers to ensure access to quality bond offerings.

- Provided technical expertise to support underwriting and issuance of municipal bonds.

- Developed and conducted educational seminars on municipal bonds for clients and prospective investors.

Municipal Bond Trader

- Managed a portfolio of $2 billion in municipal bonds, generating an average annual return of 6%.

- Developed and implemented a proprietary pricing model for municipal bonds, resulting in improved pricing accuracy and reduced risk.

- Executed daily trades in municipal bonds, including primary market offerings and secondary market transactions.

- Covered the Northeast region for municipal bond sales, building relationships with key institutional clients and brokers.

Accomplishments

- Developed and implemented a proprietary pricing model that enhanced trading accuracy and improved portfolio returns by 15%.

- Negotiated over $1 billion in municipal bond transactions, resulting in significant cost savings for clients.

- Led a team of traders to consistently outperform industry benchmarks, generating an average return of 12% over a fiveyear period.

- Developed a comprehensive due diligence process that ensures adherence to ESG (Environmental, Social, and Governance) principles in bond selection.

- Created a proprietary trading platform that automates market analysis and order execution, reducing trading costs by 25%.

Awards

- Awarded the Municipal Bond Trader of the Year award by the National Association of Municipal Bond Traders for outstanding performance and contributions to the industry.

- Recognized by the Municipal Securities Rulemaking Board (MSRB) for exemplary compliance with industry regulations and ethical standards.

- Received the Outstanding Municipal Bond Trader award from the International Municipal Bond Association for exceptional trading skills and industry knowledge.

- Honored by the Municipal Finance Association for exceptional contributions to the advancement of the municipal bond market.

Certificates

- Certified Municipal Finance Professional (CMFP)

- Certified Treasury Professional (CTP)

- Chartered Financial Analyst (CFA)

- Financial Industry Regulatory Authority Series 7 License

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Municipal Bond Trader

- Highlight your experience in managing a portfolio of municipal bonds.

- Demonstrate your knowledge of pricing models for municipal bonds.

- Showcase your skills in executing daily trades in municipal bonds.

- Emphasize your ability to cover a specific region for municipal bond sales.

- Provide evidence of your success in negotiating and closing complex transactions involving municipal bonds.

- Highlight your ability to establish and manage relationships with underwriters and issuers.

Essential Experience Highlights for a Strong Municipal Bond Trader Resume

- Manage a portfolio of municipal bonds

- Develop and implement pricing models for municipal bonds

- Execute daily trades in municipal bonds

- Cover a specific region for municipal bond sales

- Negotiate and close complex transactions involving municipal bonds

- Establish and manage relationships with underwriters and issuers

- Provide technical expertise to support underwriting and issuance of municipal bonds

Frequently Asked Questions (FAQ’s) For Municipal Bond Trader

What is a Municipal Bond Trader?

A Municipal Bond Trader is a financial professional who buys and sells municipal bonds for clients. Municipal bonds are debt securities issued by state and local governments to fund infrastructure projects and other public works.

What are the different types of Municipal Bonds?

There are many different types of municipal bonds, including general obligation bonds, revenue bonds, and conduit bonds. General obligation bonds are backed by the full faith and credit of the issuing government. Revenue bonds are backed by the revenue generated by a specific project, such as a toll road or a water treatment plant. Conduit bonds are issued by a government agency to finance a project for a private entity, such as a hospital or a university.

What are the risks of investing in Municipal Bonds?

The risks of investing in municipal bonds include interest rate risk, credit risk, and liquidity risk. Interest rate risk is the risk that the value of your bonds will decline if interest rates rise. Credit risk is the risk that the issuer of your bonds will default on its obligations. Liquidity risk is the risk that you will not be able to sell your bonds quickly and at a fair price.

How can I invest in Municipal Bonds?

You can invest in municipal bonds through a broker or directly through the issuer. If you invest through a broker, you will pay a commission. If you invest directly through the issuer, you will not pay a commission, but you may have to pay a fee to cover the cost of the transaction.

What are the benefits of investing in Municipal Bonds?

The benefits of investing in municipal bonds include tax-free income, low volatility, and diversification. Municipal bonds are exempt from federal income tax, and they are often exempt from state and local income taxes as well. Municipal bonds also tend to be less volatile than other types of investments, such as stocks. This makes them a good option for investors who are looking for a safe and stable investment.