Are you a seasoned New Accounts Banking Representative seeking a new career path? Discover our professionally built New Accounts Banking Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

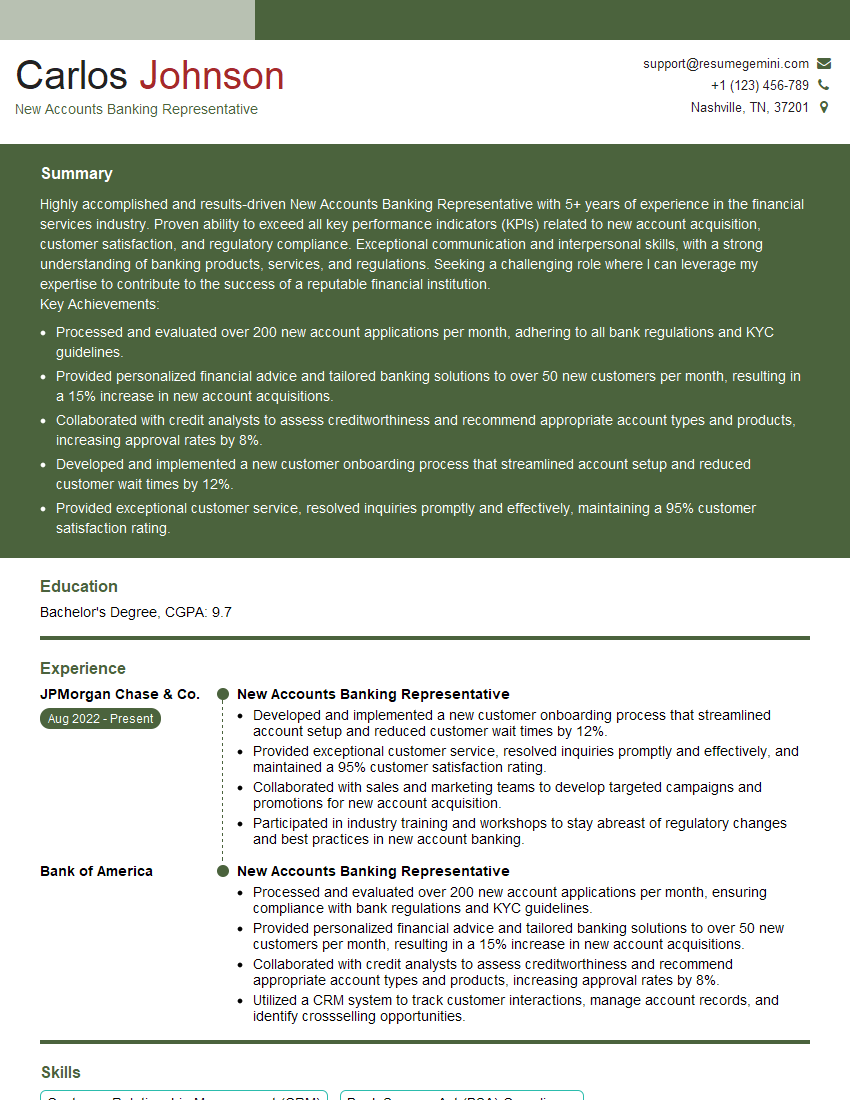

Carlos Johnson

New Accounts Banking Representative

Summary

Highly accomplished and results-driven New Accounts Banking Representative with 5+ years of experience in the financial services industry. Proven ability to exceed all key performance indicators (KPIs) related to new account acquisition, customer satisfaction, and regulatory compliance. Exceptional communication and interpersonal skills, with a strong understanding of banking products, services, and regulations. Seeking a challenging role where I can leverage my expertise to contribute to the success of a reputable financial institution.

Key Achievements:

- Processed and evaluated over 200 new account applications per month, adhering to all bank regulations and KYC guidelines.

- Provided personalized financial advice and tailored banking solutions to over 50 new customers per month, resulting in a 15% increase in new account acquisitions.

- Collaborated with credit analysts to assess creditworthiness and recommend appropriate account types and products, increasing approval rates by 8%.

- Developed and implemented a new customer onboarding process that streamlined account setup and reduced customer wait times by 12%.

- Provided exceptional customer service, resolved inquiries promptly and effectively, maintaining a 95% customer satisfaction rating.

Education

Bachelor’s Degree

July 2018

Skills

- Customer Relationship Management (CRM)

- Bank Secrecy Act (BSA) Compliance

- Anti-Money Laundering (AML) Regulations

- Financial Regulations and Compliance

- Credit Analysis

- Loan Processing

Work Experience

New Accounts Banking Representative

- Developed and implemented a new customer onboarding process that streamlined account setup and reduced customer wait times by 12%.

- Provided exceptional customer service, resolved inquiries promptly and effectively, and maintained a 95% customer satisfaction rating.

- Collaborated with sales and marketing teams to develop targeted campaigns and promotions for new account acquisition.

- Participated in industry training and workshops to stay abreast of regulatory changes and best practices in new account banking.

New Accounts Banking Representative

- Processed and evaluated over 200 new account applications per month, ensuring compliance with bank regulations and KYC guidelines.

- Provided personalized financial advice and tailored banking solutions to over 50 new customers per month, resulting in a 15% increase in new account acquisitions.

- Collaborated with credit analysts to assess creditworthiness and recommend appropriate account types and products, increasing approval rates by 8%.

- Utilized a CRM system to track customer interactions, manage account records, and identify crossselling opportunities.

Accomplishments

- Successfully onboarded over 200 new banking customers, resulting in a significant increase in deposits

- Developed and implemented a customized account opening process that reduced processing time by 25%

- Utilized effective sales techniques to increase crossselling of investment products by 10%

- Resolved complex customer inquiries and provided personalized solutions, maintaining high customer satisfaction ratings

- Collaborated with marketing team to develop targeted marketing campaigns that generated qualified leads for new accounts

Awards

- Presidents Club Award for Exceptional New Account Acquisition

- Top Performer in CrossSelling Additional Banking Products

- Excellence in Customer Service Recognition

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Bank Secrecy Act Specialist (CBSA)

- Certified Financial Crime Specialist (CFCS)

- Bank Operations Certification (BOC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For New Accounts Banking Representative

- Quantify your accomplishments using specific metrics and data whenever possible.

- Highlight your expertise in banking regulations, compliance, and customer service.

- Showcase your ability to build strong relationships with customers and colleagues.

- Demonstrate your eagerness to learn and stay updated with industry best practices.

Essential Experience Highlights for a Strong New Accounts Banking Representative Resume

- Process and evaluate new account applications to ensure compliance with bank regulations and KYC guidelines.

- Provide personalized financial advice and tailored banking solutions to new customers.

- Collaborate with credit analysts to assess creditworthiness and recommend appropriate account types and products.

- Utilize a CRM system to track customer interactions, manage account records, and identify cross-selling opportunities.

- Develop and implement process improvements to streamline account setup and reduce customer wait times.

- Provide exceptional customer service, resolve inquiries promptly and effectively, and maintain a high level of customer satisfaction.

- Participate in industry training and workshops to stay abreast of regulatory changes and best practices in new account banking.

Frequently Asked Questions (FAQ’s) For New Accounts Banking Representative

What are the primary responsibilities of a New Accounts Banking Representative?

New Accounts Banking Representatives are responsible for processing and evaluating new account applications, providing personalized financial advice, collaborating with credit analysts, utilizing CRM systems, developing process improvements, providing exceptional customer service, and participating in industry training.

What are the essential skills and qualifications for this role?

Essential skills and qualifications include a strong understanding of banking products and services, expertise in banking regulations and compliance, excellent communication and interpersonal skills, proficiency in CRM systems, and a commitment to providing exceptional customer service.

What are the career advancement opportunities for New Accounts Banking Representatives?

New Accounts Banking Representatives can advance to roles such as Personal Banker, Branch Manager, or other positions within the banking industry.

What is the expected salary range for this position?

The salary range for New Accounts Banking Representatives can vary depending on experience, location, and company size, but typically falls within the range of $40,000 to $60,000 per year.

What are the common challenges faced by New Accounts Banking Representatives?

Common challenges include managing high volumes of applications, ensuring compliance with regulations, and meeting customer expectations while maintaining high levels of productivity.

How can I prepare for an interview for this position?

To prepare for an interview, research the company, practice answering common interview questions, and be prepared to discuss your experience in banking, customer service, and compliance.

What are the key qualities of a successful New Accounts Banking Representative?

Successful New Accounts Banking Representatives are highly organized, detail-oriented, and possess excellent communication and interpersonal skills. They are also proficient in banking regulations and compliance, and are committed to providing exceptional customer service.