Are you a seasoned Note Teller seeking a new career path? Discover our professionally built Note Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

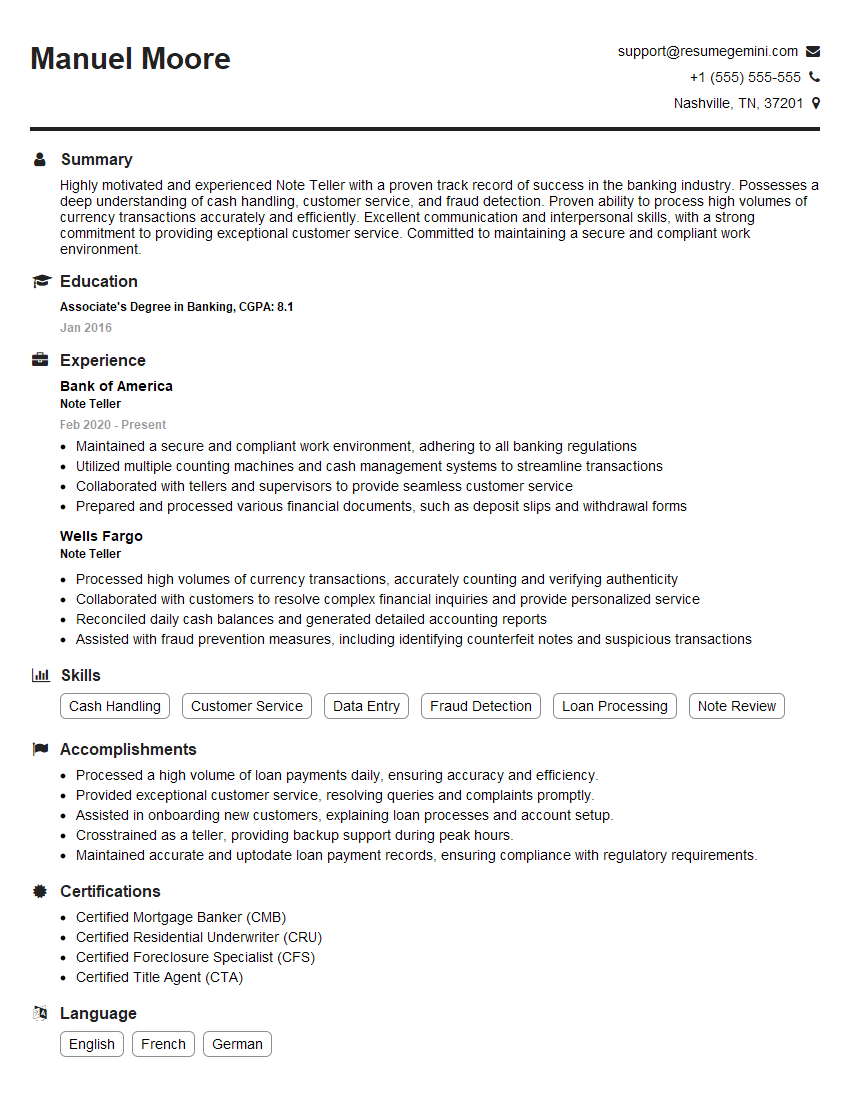

Manuel Moore

Note Teller

Summary

Highly motivated and experienced Note Teller with a proven track record of success in the banking industry. Possesses a deep understanding of cash handling, customer service, and fraud detection. Proven ability to process high volumes of currency transactions accurately and efficiently. Excellent communication and interpersonal skills, with a strong commitment to providing exceptional customer service. Committed to maintaining a secure and compliant work environment.

Education

Associate’s Degree in Banking

January 2016

Skills

- Cash Handling

- Customer Service

- Data Entry

- Fraud Detection

- Loan Processing

- Note Review

Work Experience

Note Teller

- Maintained a secure and compliant work environment, adhering to all banking regulations

- Utilized multiple counting machines and cash management systems to streamline transactions

- Collaborated with tellers and supervisors to provide seamless customer service

- Prepared and processed various financial documents, such as deposit slips and withdrawal forms

Note Teller

- Processed high volumes of currency transactions, accurately counting and verifying authenticity

- Collaborated with customers to resolve complex financial inquiries and provide personalized service

- Reconciled daily cash balances and generated detailed accounting reports

- Assisted with fraud prevention measures, including identifying counterfeit notes and suspicious transactions

Accomplishments

- Processed a high volume of loan payments daily, ensuring accuracy and efficiency.

- Provided exceptional customer service, resolving queries and complaints promptly.

- Assisted in onboarding new customers, explaining loan processes and account setup.

- Crosstrained as a teller, providing backup support during peak hours.

- Maintained accurate and uptodate loan payment records, ensuring compliance with regulatory requirements.

Certificates

- Certified Mortgage Banker (CMB)

- Certified Residential Underwriter (CRU)

- Certified Foreclosure Specialist (CFS)

- Certified Title Agent (CTA)

Languages

- English

- French

- German

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Note Teller

- Highlight your expertise in cash handling and fraud detection.

- Showcase your ability to provide excellent customer service.

- Emphasize your knowledge of banking regulations and compliance.

- Quantify your accomplishments whenever possible, using specific metrics and data.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Note Teller Resume

- Processed high volumes of currency transactions, accurately counting and verifying authenticity.

- Collaborated with customers to resolve complex financial inquiries and provide personalized service.

- Reconciled daily cash balances and generated detailed accounting reports.

- Assisted with fraud prevention measures, including identifying counterfeit notes and suspicious transactions.

- Maintained a secure and compliant work environment, adhering to all banking regulations.

- Prepared and processed various financial documents, such as deposit slips and withdrawal forms.

- Utilized multiple counting machines and cash management systems to streamline transactions.

Frequently Asked Questions (FAQ’s) For Note Teller

What are the primary responsibilities of a Note Teller?

Note Tellers are responsible for processing currency transactions, verifying authenticity, resolving customer inquiries, and maintaining a secure work environment.

What skills are required to be a successful Note Teller?

Note Tellers should possess strong cash handling, customer service, fraud detection, and data entry skills.

What are the potential career paths for Note Tellers?

Note Tellers can advance to roles such as Bank Teller, Customer Service Representative, or Loan Officer.

What is the average salary for a Note Teller?

The average salary for a Note Teller in the United States is approximately $15 per hour.

What are the job prospects for Note Tellers?

Job prospects for Note Tellers are expected to remain stable in the coming years.

What is the work environment like for a Note Teller?

Note Tellers typically work in a fast-paced and customer-oriented environment.