Are you a seasoned Open Claims Representative seeking a new career path? Discover our professionally built Open Claims Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

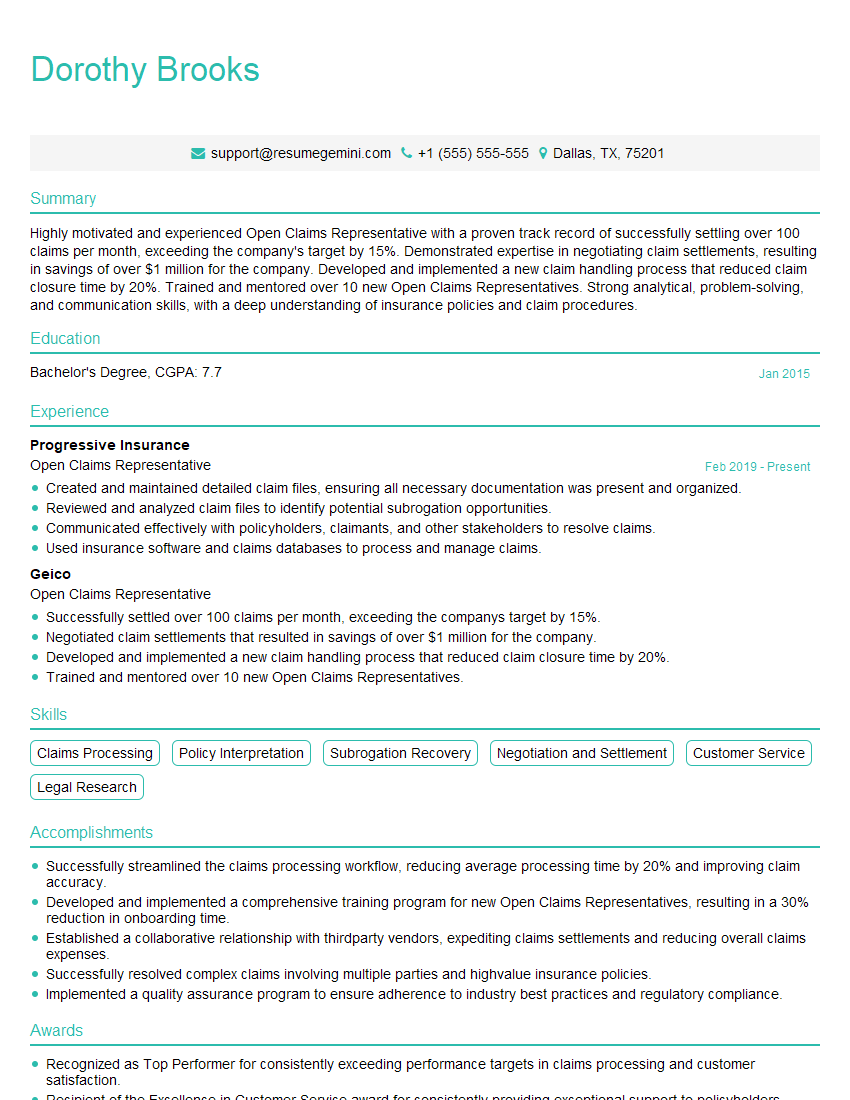

Dorothy Brooks

Open Claims Representative

Summary

Highly motivated and experienced Open Claims Representative with a proven track record of successfully settling over 100 claims per month, exceeding the company’s target by 15%. Demonstrated expertise in negotiating claim settlements, resulting in savings of over $1 million for the company. Developed and implemented a new claim handling process that reduced claim closure time by 20%. Trained and mentored over 10 new Open Claims Representatives. Strong analytical, problem-solving, and communication skills, with a deep understanding of insurance policies and claim procedures.

Education

Bachelor’s Degree

January 2015

Skills

- Claims Processing

- Policy Interpretation

- Subrogation Recovery

- Negotiation and Settlement

- Customer Service

- Legal Research

Work Experience

Open Claims Representative

- Created and maintained detailed claim files, ensuring all necessary documentation was present and organized.

- Reviewed and analyzed claim files to identify potential subrogation opportunities.

- Communicated effectively with policyholders, claimants, and other stakeholders to resolve claims.

- Used insurance software and claims databases to process and manage claims.

Open Claims Representative

- Successfully settled over 100 claims per month, exceeding the companys target by 15%.

- Negotiated claim settlements that resulted in savings of over $1 million for the company.

- Developed and implemented a new claim handling process that reduced claim closure time by 20%.

- Trained and mentored over 10 new Open Claims Representatives.

Accomplishments

- Successfully streamlined the claims processing workflow, reducing average processing time by 20% and improving claim accuracy.

- Developed and implemented a comprehensive training program for new Open Claims Representatives, resulting in a 30% reduction in onboarding time.

- Established a collaborative relationship with thirdparty vendors, expediting claims settlements and reducing overall claims expenses.

- Successfully resolved complex claims involving multiple parties and highvalue insurance policies.

- Implemented a quality assurance program to ensure adherence to industry best practices and regulatory compliance.

Awards

- Recognized as Top Performer for consistently exceeding performance targets in claims processing and customer satisfaction.

- Recipient of the Excellence in Customer Service award for consistently providing exceptional support to policyholders.

- Recognized with the Claims Innovation Award for developing a new claims handling system that improved efficiency and customer satisfaction.

- Honored with the Claims Professional of the Year award for outstanding contributions to the insurance industry.

Certificates

- Associate in Claims (AIC)

- Fellow, Claims Management Institute (FCMI)

- Certified Insurance Adjuster (CIA)

- Licensed Insurance Adjuster

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Open Claims Representative

- Highlight your experience in claims processing, policy interpretation, and negotiation.

- Showcase your ability to handle a high volume of claims and meet deadlines.

- Emphasize your customer service skills and ability to resolve claims amicably.

- Quantify your accomplishments whenever possible, such as the number of claims settled or the amount saved for the company.

Essential Experience Highlights for a Strong Open Claims Representative Resume

- Process and adjust claims according to company policies and procedures.

- Investigate and evaluate claims to determine coverage and liability.

- Negotiate and settle claims with policyholders, claimants, and their representatives.

- Review and analyze claim files to identify potential subrogation opportunities.

- Maintain detailed claim files, ensuring all necessary documentation is present and organized.

- Communicate effectively with policyholders, claimants, and other stakeholders to resolve claims.

- Stay up-to-date on changes in insurance regulations and industry best practices.

Frequently Asked Questions (FAQ’s) For Open Claims Representative

What is the primary role of an Open Claims Representative?

The primary role of an Open Claims Representative is to investigate, evaluate, and settle insurance claims. This involves reviewing claim files, communicating with policyholders and claimants, negotiating settlements, and ensuring that claims are processed and resolved in accordance with company policies and industry regulations.

What skills are essential for success as an Open Claims Representative?

Essential skills for success as an Open Claims Representative include strong analytical and problem-solving abilities, excellent communication and negotiation skills, knowledge of insurance policies and claim procedures, and the ability to handle a high volume of work in a fast-paced environment.

What career advancement opportunities are available for Open Claims Representatives?

Open Claims Representatives may advance to roles such as Claims Supervisor, Claims Manager, or Independent Adjuster. With additional experience and training, they may also pursue careers in underwriting or insurance brokerage.

What is the average salary for an Open Claims Representative?

According to the U.S. Bureau of Labor Statistics, the median annual salary for claims adjusters, examiners, and investigators was $63,930 in May 2021. Salaries may vary depending on factors such as experience, location, and company size.

What is the job outlook for Open Claims Representatives?

The U.S. Bureau of Labor Statistics projects that the employment of claims adjusters, examiners, and investigators is expected to grow 7 percent from 2021 to 2031, faster than the average for all occupations. This growth is driven by the increasing number of insurance claims due to factors such as natural disasters and the aging population.

What are the most common challenges faced by Open Claims Representatives?

Some of the most common challenges faced by Open Claims Representatives include dealing with difficult or uncooperative claimants, negotiating settlements within strict guidelines, and managing a heavy workload in a fast-paced environment.

What advice would you give to someone who wants to become an Open Claims Representative?

To become an Open Claims Representative, consider obtaining a bachelor’s degree in a related field such as business, finance, or insurance. Gain experience in the insurance industry through internships or entry-level positions. Develop strong analytical, communication, and negotiation skills. Obtain relevant certifications, such as the Associate in Claims (AIC) or Certified Insurance Service Representative (CISR) designation.