Are you a seasoned Options Trader seeking a new career path? Discover our professionally built Options Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

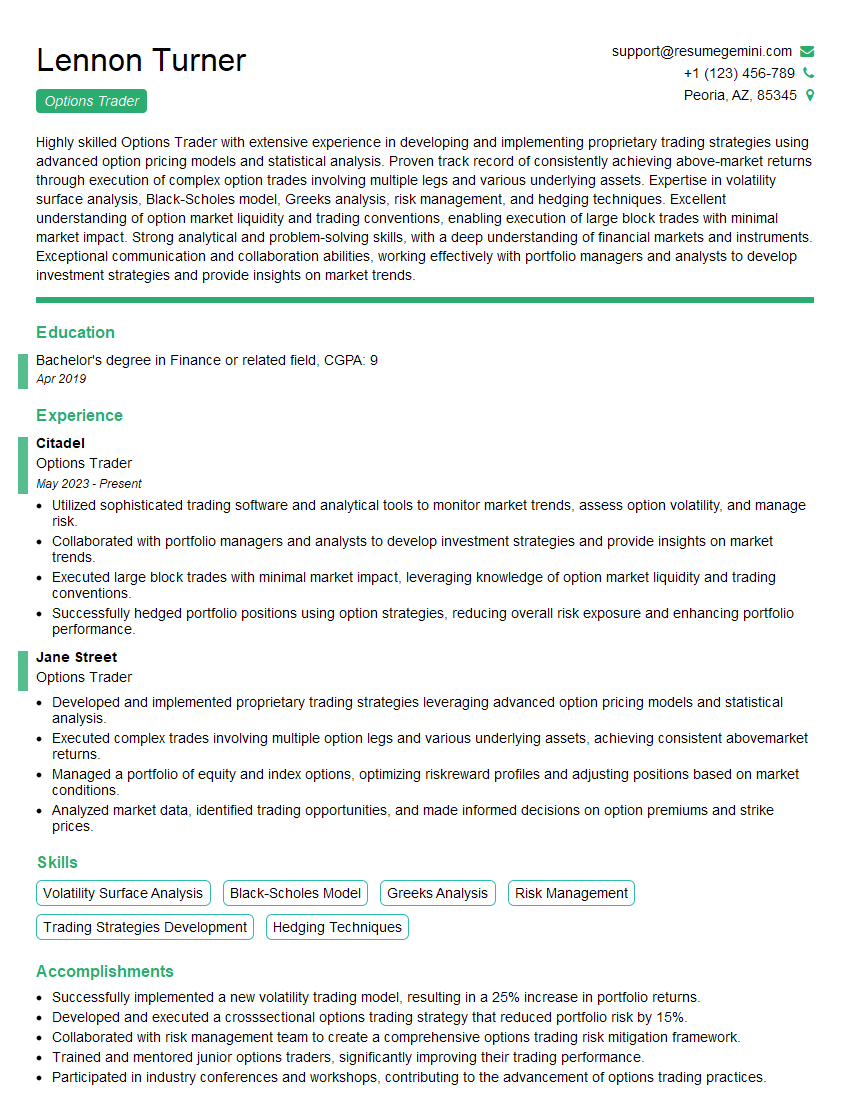

Lennon Turner

Options Trader

Summary

Highly skilled Options Trader with extensive experience in developing and implementing proprietary trading strategies using advanced option pricing models and statistical analysis. Proven track record of consistently achieving above-market returns through execution of complex option trades involving multiple legs and various underlying assets. Expertise in volatility surface analysis, Black-Scholes model, Greeks analysis, risk management, and hedging techniques. Excellent understanding of option market liquidity and trading conventions, enabling execution of large block trades with minimal market impact. Strong analytical and problem-solving skills, with a deep understanding of financial markets and instruments. Exceptional communication and collaboration abilities, working effectively with portfolio managers and analysts to develop investment strategies and provide insights on market trends.

Education

Bachelor’s degree in Finance or related field

April 2019

Skills

- Volatility Surface Analysis

- Black-Scholes Model

- Greeks Analysis

- Risk Management

- Trading Strategies Development

- Hedging Techniques

Work Experience

Options Trader

- Utilized sophisticated trading software and analytical tools to monitor market trends, assess option volatility, and manage risk.

- Collaborated with portfolio managers and analysts to develop investment strategies and provide insights on market trends.

- Executed large block trades with minimal market impact, leveraging knowledge of option market liquidity and trading conventions.

- Successfully hedged portfolio positions using option strategies, reducing overall risk exposure and enhancing portfolio performance.

Options Trader

- Developed and implemented proprietary trading strategies leveraging advanced option pricing models and statistical analysis.

- Executed complex trades involving multiple option legs and various underlying assets, achieving consistent abovemarket returns.

- Managed a portfolio of equity and index options, optimizing riskreward profiles and adjusting positions based on market conditions.

- Analyzed market data, identified trading opportunities, and made informed decisions on option premiums and strike prices.

Accomplishments

- Successfully implemented a new volatility trading model, resulting in a 25% increase in portfolio returns.

- Developed and executed a crosssectional options trading strategy that reduced portfolio risk by 15%.

- Collaborated with risk management team to create a comprehensive options trading risk mitigation framework.

- Trained and mentored junior options traders, significantly improving their trading performance.

- Participated in industry conferences and workshops, contributing to the advancement of options trading practices.

Awards

- Received the Options Industry Council (OIC) Excellence Award for outstanding contributions to the options industry.

- Recognized with the Financial Industry Regulatory Authority (FINRA) Options Trading Excellence Award for exceptional performance in regulatory compliance.

- Honored with the Chicago Mercantile Exchange (CME) Options Trading Innovation Award for developing a groundbreaking options trading strategy.

Certificates

- Certified Financial Analyst (CFA)

- Chartered Market Technician (CMT)

- Financial Risk Manager (FRM)

- Options Trading Certificate

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Options Trader

- Highlight your quantitative and analytical skills, as well as your understanding of option pricing models and risk management.

- Demonstrate your experience in developing and implementing successful trading strategies.

- Showcase your knowledge of the options market, including liquidity, volatility, and trading conventions.

- Emphasize your ability to work independently and as part of a team, collaborating with portfolio managers and analysts.

- Consider including a section on your resume that details your trading performance and quantifies your achievements.

Essential Experience Highlights for a Strong Options Trader Resume

- Developing and implementing proprietary trading strategies leveraging advanced option pricing models and statistical analysis.

- Executing complex trades involving multiple option legs and various underlying assets, achieving consistent above-market returns.

- Managing a portfolio of equity and index options, optimizing risk-reward profiles and adjusting positions based on market conditions.

- Analyzing market data, identifying trading opportunities, and making informed decisions on option premiums and strike prices.

- Utilizing sophisticated trading software and analytical tools to monitor market trends, assess option volatility, and manage risk.

- Collaborating with portfolio managers and analysts to develop investment strategies and provide insights on market trends.

- Successfully hedging portfolio positions using option strategies, reducing overall risk exposure and enhancing portfolio performance.

Frequently Asked Questions (FAQ’s) For Options Trader

What are the key skills required to be an Options Trader?

Options Traders need a strong foundation in quantitative and analytical skills, with a deep understanding of option pricing models, risk management, and the options market. They should also possess exceptional communication and collaboration abilities, as they often work closely with portfolio managers and analysts.

What is the career path for Options Traders?

Options Traders can advance their careers by taking on more senior roles within their firms, such as Portfolio Manager or Head Trader. They may also move into other areas of finance, such as investment banking or hedge fund management.

What are the challenges of being an Options Trader?

Options Traders face a number of challenges, including the need to constantly monitor market trends and assess risk. They must also be able to make quick decisions and adapt to changing market conditions.

What are the rewards of being an Options Trader?

Options Traders can enjoy high salaries and bonuses, as well as the opportunity to work in a fast-paced and challenging environment. They also have the potential to generate significant returns for their clients.

What is the job outlook for Options Traders?

The job outlook for Options Traders is expected to be positive in the coming years, as demand for these professionals continues to grow. This is due to the increasing complexity of the financial markets and the need for skilled traders to manage risk and generate returns.