Are you a seasoned Paying Teller seeking a new career path? Discover our professionally built Paying Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

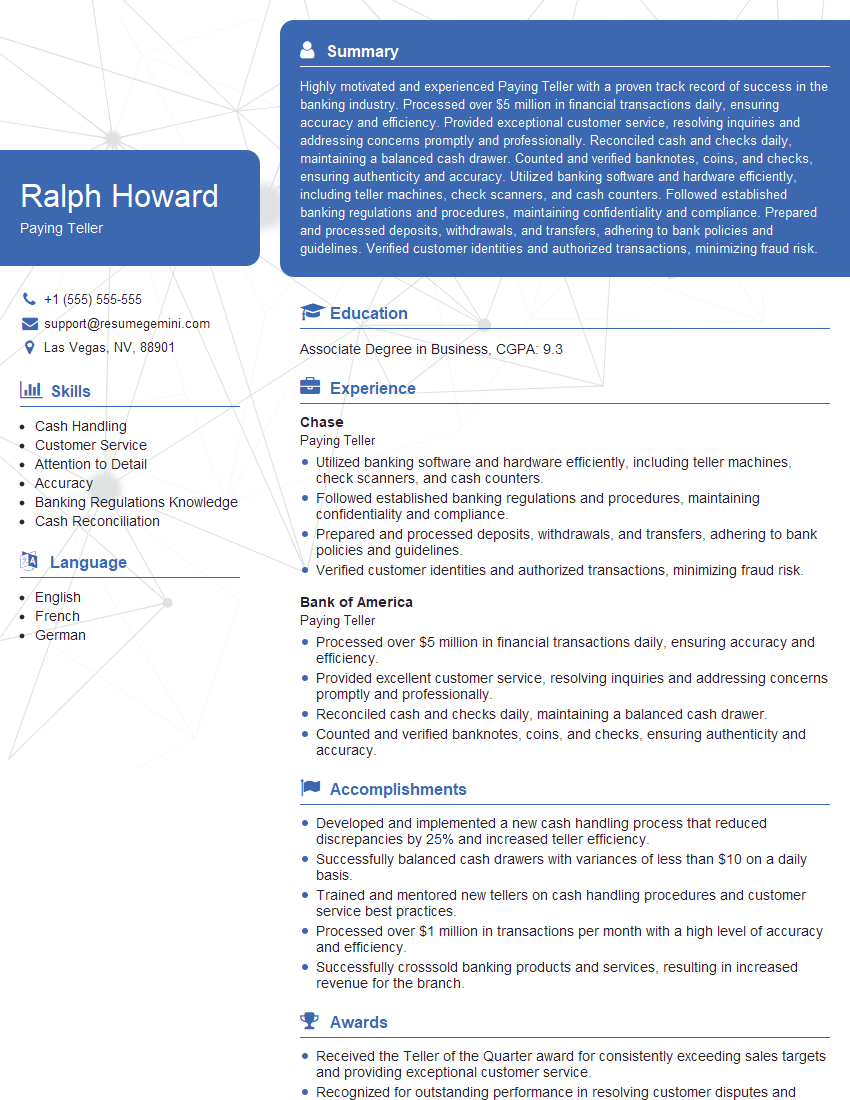

Ralph Howard

Paying Teller

Summary

Highly motivated and experienced Paying Teller with a proven track record of success in the banking industry. Processed over $5 million in financial transactions daily, ensuring accuracy and efficiency. Provided exceptional customer service, resolving inquiries and addressing concerns promptly and professionally. Reconciled cash and checks daily, maintaining a balanced cash drawer. Counted and verified banknotes, coins, and checks, ensuring authenticity and accuracy. Utilized banking software and hardware efficiently, including teller machines, check scanners, and cash counters. Followed established banking regulations and procedures, maintaining confidentiality and compliance. Prepared and processed deposits, withdrawals, and transfers, adhering to bank policies and guidelines. Verified customer identities and authorized transactions, minimizing fraud risk.

Education

Associate Degree in Business

May 2017

Skills

- Cash Handling

- Customer Service

- Attention to Detail

- Accuracy

- Banking Regulations Knowledge

- Cash Reconciliation

Work Experience

Paying Teller

- Utilized banking software and hardware efficiently, including teller machines, check scanners, and cash counters.

- Followed established banking regulations and procedures, maintaining confidentiality and compliance.

- Prepared and processed deposits, withdrawals, and transfers, adhering to bank policies and guidelines.

- Verified customer identities and authorized transactions, minimizing fraud risk.

Paying Teller

- Processed over $5 million in financial transactions daily, ensuring accuracy and efficiency.

- Provided excellent customer service, resolving inquiries and addressing concerns promptly and professionally.

- Reconciled cash and checks daily, maintaining a balanced cash drawer.

- Counted and verified banknotes, coins, and checks, ensuring authenticity and accuracy.

Accomplishments

- Developed and implemented a new cash handling process that reduced discrepancies by 25% and increased teller efficiency.

- Successfully balanced cash drawers with variances of less than $10 on a daily basis.

- Trained and mentored new tellers on cash handling procedures and customer service best practices.

- Processed over $1 million in transactions per month with a high level of accuracy and efficiency.

- Successfully crosssold banking products and services, resulting in increased revenue for the branch.

Awards

- Received the Teller of the Quarter award for consistently exceeding sales targets and providing exceptional customer service.

- Recognized for outstanding performance in resolving customer disputes and maintaining a positive attitude.

- Awarded for maintaining 100% accuracy in check processing and cash transactions.

- Received a commendation for going above and beyond to assist customers with complex financial transactions.

Certificates

- Certified Bank Teller (CBT)

- Certified Financial Services Professional (CFSP)

- Certified Treasury Professional (CTP)

- Anti-Money Laundering Specialist (AMLS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Paying Teller

- Highlight your cash handling skills and experience in your resume.

- Emphasize your customer service skills and ability to resolve issues promptly.

- Quantify your accomplishments and provide specific examples of your success.

- Review common interview questions and practice your answers beforehand.

Essential Experience Highlights for a Strong Paying Teller Resume

- Process financial transactions accurately and efficiently, including deposits, withdrawals, and transfers.

- Provide excellent customer service, resolving inquiries and addressing concerns promptly and professionally.

- Reconcile cash and checks daily, maintaining a balanced cash drawer.

- Count and verify banknotes, coins, and checks, ensuring authenticity and accuracy.

- Utilize banking software and hardware efficiently, including teller machines, check scanners, and cash counters.

- Follow established banking regulations and procedures, maintaining confidentiality and compliance.

- Verify customer identities and authorize transactions, minimizing fraud risk.

Frequently Asked Questions (FAQ’s) For Paying Teller

What are the key skills required to be a Paying Teller?

The key skills required to be a Paying Teller include cash handling, customer service, attention to detail, accuracy, banking regulations knowledge, and cash reconciliation.

What are the primary responsibilities of a Paying Teller?

The primary responsibilities of a Paying Teller include processing financial transactions, providing customer service, reconciling cash and checks, counting and verifying banknotes, coins, and checks, utilizing banking software and hardware, following established banking regulations and procedures, and verifying customer identities and authorizing transactions.

What is the average salary of a Paying Teller?

The average salary of a Paying Teller varies depending on experience, location, and employer. According to Salary.com, the average salary for a Paying Teller in the United States is $32,000 per year.

What are the career advancement opportunities for a Paying Teller?

Career advancement opportunities for a Paying Teller may include promotion to a lead teller, customer service manager, or bank operations manager.

What is the job outlook for Paying Tellers?

The job outlook for Paying Tellers is expected to be stable in the coming years. According to the U.S. Bureau of Labor Statistics, the employment of tellers is projected to grow 4% from 2021 to 2031.

What are the educational requirements to become a Paying Teller?

Most Paying Tellers have at least a high school diploma or equivalent. Some employers may prefer candidates with an associate degree in business or a related field.

What are the personality traits of a successful Paying Teller?

Successful Paying Tellers are typically friendly, outgoing, and have strong customer service skills. They are also detail-oriented, accurate, and able to work under pressure.