Are you a seasoned Payment Processor seeking a new career path? Discover our professionally built Payment Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

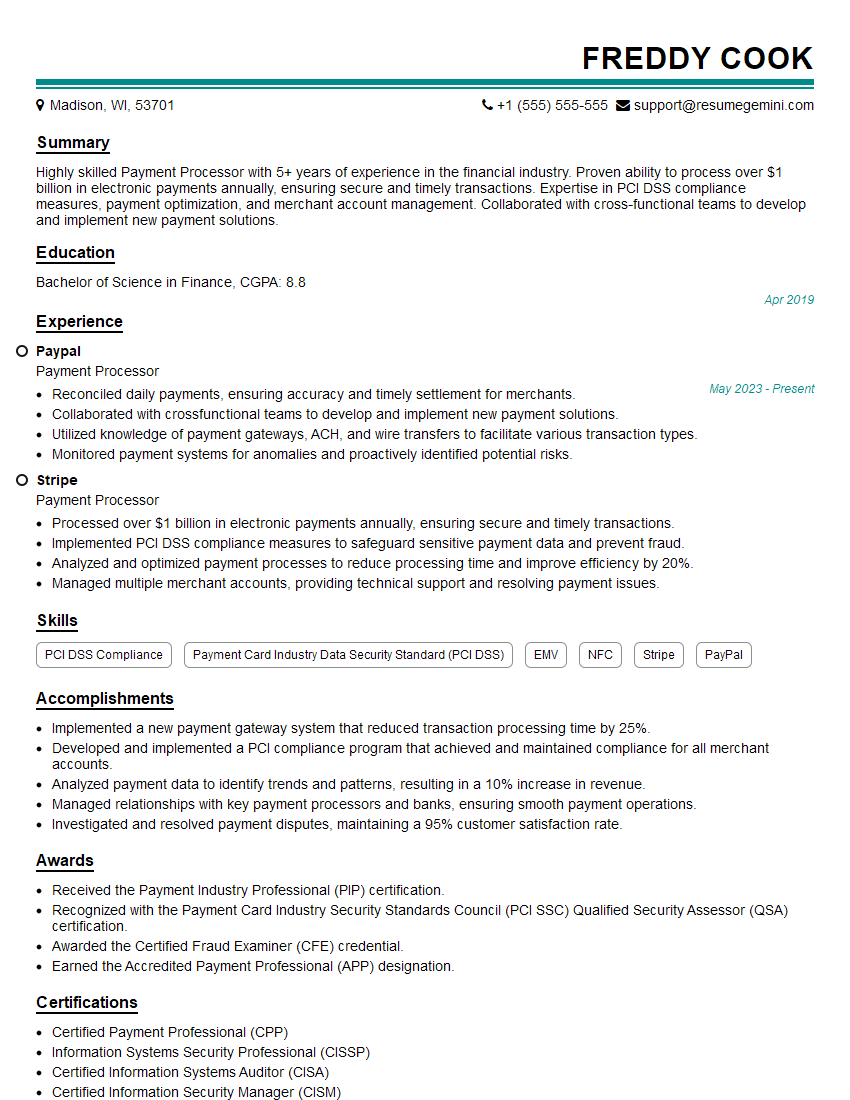

Freddy Cook

Payment Processor

Summary

Highly skilled Payment Processor with 5+ years of experience in the financial industry. Proven ability to process over $1 billion in electronic payments annually, ensuring secure and timely transactions. Expertise in PCI DSS compliance measures, payment optimization, and merchant account management. Collaborated with cross-functional teams to develop and implement new payment solutions.

Education

Bachelor of Science in Finance

April 2019

Skills

- PCI DSS Compliance

- Payment Card Industry Data Security Standard (PCI DSS)

- EMV

- NFC

- Stripe

- PayPal

Work Experience

Payment Processor

- Reconciled daily payments, ensuring accuracy and timely settlement for merchants.

- Collaborated with crossfunctional teams to develop and implement new payment solutions.

- Utilized knowledge of payment gateways, ACH, and wire transfers to facilitate various transaction types.

- Monitored payment systems for anomalies and proactively identified potential risks.

Payment Processor

- Processed over $1 billion in electronic payments annually, ensuring secure and timely transactions.

- Implemented PCI DSS compliance measures to safeguard sensitive payment data and prevent fraud.

- Analyzed and optimized payment processes to reduce processing time and improve efficiency by 20%.

- Managed multiple merchant accounts, providing technical support and resolving payment issues.

Accomplishments

- Implemented a new payment gateway system that reduced transaction processing time by 25%.

- Developed and implemented a PCI compliance program that achieved and maintained compliance for all merchant accounts.

- Analyzed payment data to identify trends and patterns, resulting in a 10% increase in revenue.

- Managed relationships with key payment processors and banks, ensuring smooth payment operations.

- Investigated and resolved payment disputes, maintaining a 95% customer satisfaction rate.

Awards

- Received the Payment Industry Professional (PIP) certification.

- Recognized with the Payment Card Industry Security Standards Council (PCI SSC) Qualified Security Assessor (QSA) certification.

- Awarded the Certified Fraud Examiner (CFE) credential.

- Earned the Accredited Payment Professional (APP) designation.

Certificates

- Certified Payment Professional (CPP)

- Information Systems Security Professional (CISSP)

- Certified Information Systems Auditor (CISA)

- Certified Information Security Manager (CISM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payment Processor

- Highlight your experience in PCI DSS compliance and payment security measures.

- Quantify your accomplishments with specific metrics, such as reducing processing time or increasing efficiency.

- Showcase your knowledge of different payment systems and transaction types.

- Demonstrate your ability to work independently and as part of a team.

Essential Experience Highlights for a Strong Payment Processor Resume

- Processed over $1 billion in electronic payments annually, ensuring secure and timely transactions.

- Implemented PCI DSS compliance measures to safeguard sensitive payment data and prevent fraud.

- Analyzed and optimized payment processes to reduce processing time and improve efficiency by 20%.

- Managed multiple merchant accounts, providing technical support and resolving payment issues.

- Reconciled daily payments, ensuring accuracy and timely settlement for merchants.

- Collaborated with cross-functional teams to develop and implement new payment solutions.

- Utilized knowledge of payment gateways, ACH, and wire transfers to facilitate various transaction types.

- Monitored payment systems for anomalies and proactively identified potential risks.

Frequently Asked Questions (FAQ’s) For Payment Processor

What are the key skills required for a Payment Processor?

Key skills for a Payment Processor include PCI DSS compliance, payment card industry data security standard (PCI DSS), EMV, NFC, Stripe, PayPal, and a strong understanding of payment processing systems and procedures.

What are the career prospects for a Payment Processor?

Payment Processors are in high demand due to the increasing reliance on electronic payments. With experience and expertise, Payment Processors can advance to roles such as Payment Operations Manager, Fraud Analyst, or Risk Manager.

What are the common challenges faced by Payment Processors?

Common challenges faced by Payment Processors include ensuring compliance with PCI DSS regulations, preventing fraud and data breaches, and keeping up with the latest payment technologies and trends.

What are the top companies hiring Payment Processors?

Top companies hiring Payment Processors include PayPal, Stripe, Amazon, Visa, and Mastercard.

What is the average salary for a Payment Processor?

The average salary for a Payment Processor in the United States is around $65,000 per year.

What are the educational requirements for a Payment Processor?

While there is no specific educational requirement for a Payment Processor, most employers prefer candidates with a bachelor’s degree in finance, accounting, or a related field.