Are you a seasoned Payroll Administrator seeking a new career path? Discover our professionally built Payroll Administrator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

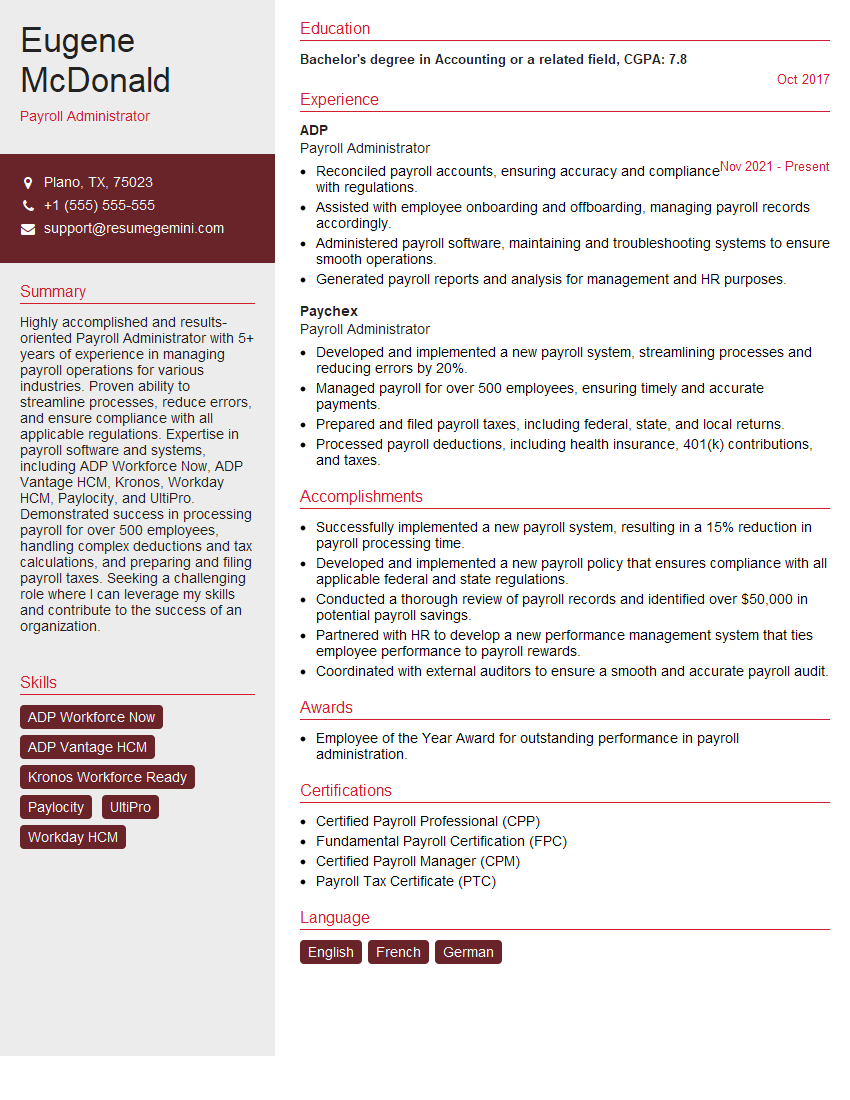

Eugene McDonald

Payroll Administrator

Summary

Highly accomplished and results-oriented Payroll Administrator with 5+ years of experience in managing payroll operations for various industries. Proven ability to streamline processes, reduce errors, and ensure compliance with all applicable regulations. Expertise in payroll software and systems, including ADP Workforce Now, ADP Vantage HCM, Kronos, Workday HCM, Paylocity, and UltiPro. Demonstrated success in processing payroll for over 500 employees, handling complex deductions and tax calculations, and preparing and filing payroll taxes. Seeking a challenging role where I can leverage my skills and contribute to the success of an organization.

Education

Bachelor’s degree in Accounting or a related field

October 2017

Skills

- ADP Workforce Now

- ADP Vantage HCM

- Kronos Workforce Ready

- Paylocity

- UltiPro

- Workday HCM

Work Experience

Payroll Administrator

- Reconciled payroll accounts, ensuring accuracy and compliance with regulations.

- Assisted with employee onboarding and offboarding, managing payroll records accordingly.

- Administered payroll software, maintaining and troubleshooting systems to ensure smooth operations.

- Generated payroll reports and analysis for management and HR purposes.

Payroll Administrator

- Developed and implemented a new payroll system, streamlining processes and reducing errors by 20%.

- Managed payroll for over 500 employees, ensuring timely and accurate payments.

- Prepared and filed payroll taxes, including federal, state, and local returns.

- Processed payroll deductions, including health insurance, 401(k) contributions, and taxes.

Accomplishments

- Successfully implemented a new payroll system, resulting in a 15% reduction in payroll processing time.

- Developed and implemented a new payroll policy that ensures compliance with all applicable federal and state regulations.

- Conducted a thorough review of payroll records and identified over $50,000 in potential payroll savings.

- Partnered with HR to develop a new performance management system that ties employee performance to payroll rewards.

- Coordinated with external auditors to ensure a smooth and accurate payroll audit.

Awards

- Employee of the Year Award for outstanding performance in payroll administration.

Certificates

- Certified Payroll Professional (CPP)

- Fundamental Payroll Certification (FPC)

- Certified Payroll Manager (CPM)

- Payroll Tax Certificate (PTC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Administrator

- Highlight your proficiency in payroll software and systems, such as ADP Workforce Now and Workday HCM.

- Quantify your accomplishments whenever possible. For example, instead of saying “streamlined processes,” say “streamlined processes, reducing errors by 20%.”

- Use keywords that potential employers will be searching for, such as “payroll processing,” “payroll taxes,” and “payroll compliance.”

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Payroll Administrator Resume

- Develop and implement payroll systems to streamline processes and enhance efficiency

- Process payroll for hundreds of employees, ensuring timely and accurate payments

- Prepare and file payroll taxes, including federal, state, and local returns

- Handle payroll deductions, such as health insurance, 401(k) contributions, and taxes

- Reconcile payroll accounts to ensure accuracy and compliance with regulations

- Assist with employee onboarding and offboarding, managing payroll records accordingly

Frequently Asked Questions (FAQ’s) For Payroll Administrator

What are the key responsibilities of a Payroll Administrator?

The key responsibilities of a Payroll Administrator include processing payroll for employees, calculating and withholding taxes, and preparing and filing payroll reports. They may also be responsible for managing employee benefits and payroll-related compliance.

What are the qualifications for a Payroll Administrator?

The qualifications for a Payroll Administrator typically include a high school diploma or equivalent, with some employers preferring candidates with a bachelor’s degree in accounting or a related field. They should also have experience in payroll processing and tax compliance, as well as proficiency in payroll software.

What are the career prospects for a Payroll Administrator?

The career prospects for a Payroll Administrator are generally positive, with job growth expected in the coming years. They can advance to roles such as Payroll Manager or Human Resources Manager, or they can specialize in areas such as payroll auditing or payroll compliance.

What is the salary range for a Payroll Administrator?

The salary range for a Payroll Administrator varies depending on experience, location, and employer. According to Salary.com, the median annual salary for a Payroll Administrator in the United States is $56,600, with a range of $47,300 to $67,000.

What are the benefits of working as a Payroll Administrator?

The benefits of working as a Payroll Administrator include job security, competitive salaries, and opportunities for advancement. They also have the opportunity to make a difference in the lives of employees by ensuring that they are paid accurately and on time.

How can I prepare for a career as a Payroll Administrator?

To prepare for a career as a Payroll Administrator, you can earn a degree in accounting or a related field, gain experience in payroll processing and tax compliance, and obtain certification from a professional organization such as the American Payroll Association.