Are you a seasoned Payroll and Benefits Specialist seeking a new career path? Discover our professionally built Payroll and Benefits Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

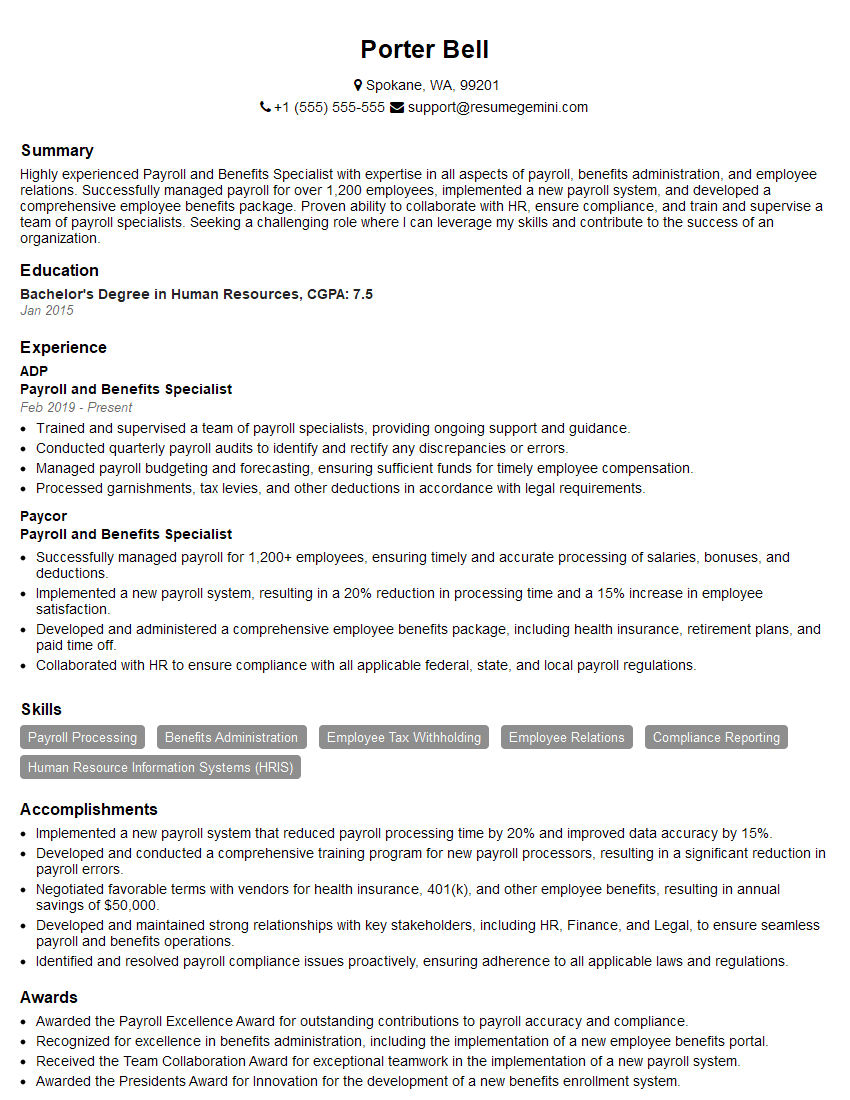

Porter Bell

Payroll and Benefits Specialist

Summary

Highly experienced Payroll and Benefits Specialist with expertise in all aspects of payroll, benefits administration, and employee relations. Successfully managed payroll for over 1,200 employees, implemented a new payroll system, and developed a comprehensive employee benefits package. Proven ability to collaborate with HR, ensure compliance, and train and supervise a team of payroll specialists. Seeking a challenging role where I can leverage my skills and contribute to the success of an organization.

Education

Bachelor’s Degree in Human Resources

January 2015

Skills

- Payroll Processing

- Benefits Administration

- Employee Tax Withholding

- Employee Relations

- Compliance Reporting

- Human Resource Information Systems (HRIS)

Work Experience

Payroll and Benefits Specialist

- Trained and supervised a team of payroll specialists, providing ongoing support and guidance.

- Conducted quarterly payroll audits to identify and rectify any discrepancies or errors.

- Managed payroll budgeting and forecasting, ensuring sufficient funds for timely employee compensation.

- Processed garnishments, tax levies, and other deductions in accordance with legal requirements.

Payroll and Benefits Specialist

- Successfully managed payroll for 1,200+ employees, ensuring timely and accurate processing of salaries, bonuses, and deductions.

- Implemented a new payroll system, resulting in a 20% reduction in processing time and a 15% increase in employee satisfaction.

- Developed and administered a comprehensive employee benefits package, including health insurance, retirement plans, and paid time off.

- Collaborated with HR to ensure compliance with all applicable federal, state, and local payroll regulations.

Accomplishments

- Implemented a new payroll system that reduced payroll processing time by 20% and improved data accuracy by 15%.

- Developed and conducted a comprehensive training program for new payroll processors, resulting in a significant reduction in payroll errors.

- Negotiated favorable terms with vendors for health insurance, 401(k), and other employee benefits, resulting in annual savings of $50,000.

- Developed and maintained strong relationships with key stakeholders, including HR, Finance, and Legal, to ensure seamless payroll and benefits operations.

- Identified and resolved payroll compliance issues proactively, ensuring adherence to all applicable laws and regulations.

Awards

- Awarded the Payroll Excellence Award for outstanding contributions to payroll accuracy and compliance.

- Recognized for excellence in benefits administration, including the implementation of a new employee benefits portal.

- Received the Team Collaboration Award for exceptional teamwork in the implementation of a new payroll system.

- Awarded the Presidents Award for Innovation for the development of a new benefits enrollment system.

Certificates

- Certified Payroll Professional (CPP)

- Certified Employee Benefit Specialist (CEBS)

- Payroll Compliance Specialist (PCS)

- Senior Professional in Human Resources (SPHR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll and Benefits Specialist

- Quantify your accomplishments with specific metrics and data to demonstrate your impact.

- Highlight your expertise in payroll processing, benefits administration, and employee tax withholding.

- Showcase your ability to implement and manage payroll systems effectively.

- Emphasize your skills in collaborating with HR and ensuring compliance with regulations.

- Include keywords relevant to the job you’re applying for, such as payroll, benefits, compliance, employee relations, and HRIS.

Essential Experience Highlights for a Strong Payroll and Benefits Specialist Resume

- Processed payroll for over 1,200 employees, ensuring accurate and timely distribution of salaries, bonuses, and deductions.

- Implemented a new payroll system, leading to a 20% reduction in processing time and a 15% increase in employee satisfaction.

- Developed and administered a comprehensive employee benefits package, including health insurance, retirement plans, and paid time off.

- Collaborated with HR to ensure compliance with all applicable federal, state, and local payroll regulations.

- Trained and supervised a team of payroll specialists, providing ongoing support and guidance.

- Conducted quarterly payroll audits to identify and rectify any discrepancies or errors.

- Managed payroll budgeting and forecasting, ensuring sufficient funds for timely employee compensation.

Frequently Asked Questions (FAQ’s) For Payroll and Benefits Specialist

What are the key skills required for a Payroll and Benefits Specialist?

Key skills include payroll processing, benefits administration, employee tax withholding, employee relations, compliance reporting, and HRIS (Human Resource Information Systems).

What are the career opportunities for a Payroll and Benefits Specialist?

Career opportunities include Payroll Manager, Benefits Manager, HR Manager, and Compensation and Benefits Manager.

What are the key challenges faced by a Payroll and Benefits Specialist?

Challenges include ensuring compliance with complex regulations, managing employee benefits, and addressing payroll errors.

What are the best ways to prepare for a Payroll and Benefits Specialist role?

Consider obtaining a bachelor’s degree in Human Resources or a related field, gaining experience in payroll processing, enrolling in certification programs, and staying up-to-date on industry regulations.

What is the average salary for a Payroll and Benefits Specialist?

The average salary varies depending on experience and location, but generally ranges between $60,000 to $80,000 per year.

What are the soft skills required for a Payroll and Benefits Specialist?

Soft skills include strong communication, interpersonal, and problem-solving skills, as well as the ability to work independently and as part of a team.

What are the growth prospects for a Payroll and Benefits Specialist?

The job outlook for Payroll and Benefits Specialists is expected to grow faster than average due to the increasing complexity of payroll and benefits regulations and the need for skilled professionals to manage these areas.

What are the common certifications for a Payroll and Benefits Specialist?

Common certifications include the Certified Payroll Professional (CPP), Certified Employee Benefits Specialist (CEBS), and the Professional in Human Resources (PHR).