Are you a seasoned Payroll Assistant seeking a new career path? Discover our professionally built Payroll Assistant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

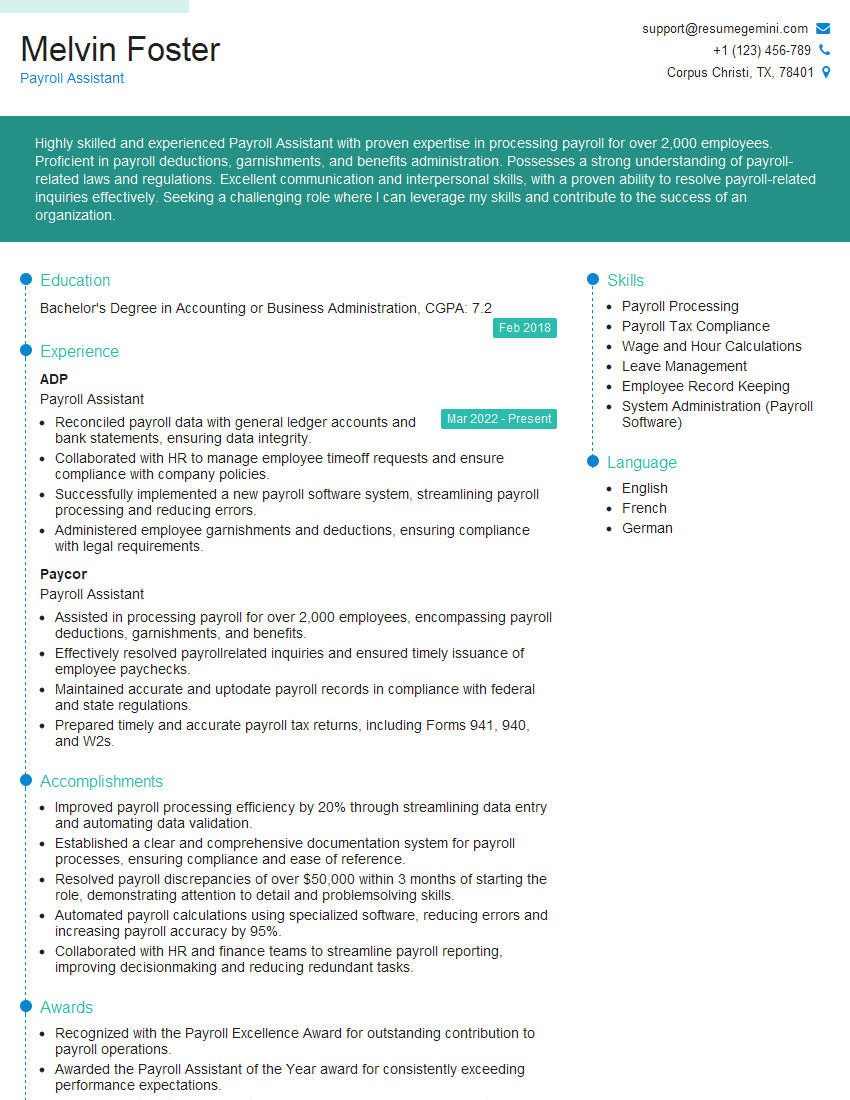

Melvin Foster

Payroll Assistant

Summary

Highly skilled and experienced Payroll Assistant with proven expertise in processing payroll for over 2,000 employees. Proficient in payroll deductions, garnishments, and benefits administration. Possesses a strong understanding of payroll-related laws and regulations. Excellent communication and interpersonal skills, with a proven ability to resolve payroll-related inquiries effectively. Seeking a challenging role where I can leverage my skills and contribute to the success of an organization.

Education

Bachelor’s Degree in Accounting or Business Administration

February 2018

Skills

- Payroll Processing

- Payroll Tax Compliance

- Wage and Hour Calculations

- Leave Management

- Employee Record Keeping

- System Administration (Payroll Software)

Work Experience

Payroll Assistant

- Reconciled payroll data with general ledger accounts and bank statements, ensuring data integrity.

- Collaborated with HR to manage employee timeoff requests and ensure compliance with company policies.

- Successfully implemented a new payroll software system, streamlining payroll processing and reducing errors.

- Administered employee garnishments and deductions, ensuring compliance with legal requirements.

Payroll Assistant

- Assisted in processing payroll for over 2,000 employees, encompassing payroll deductions, garnishments, and benefits.

- Effectively resolved payrollrelated inquiries and ensured timely issuance of employee paychecks.

- Maintained accurate and uptodate payroll records in compliance with federal and state regulations.

- Prepared timely and accurate payroll tax returns, including Forms 941, 940, and W2s.

Accomplishments

- Improved payroll processing efficiency by 20% through streamlining data entry and automating data validation.

- Established a clear and comprehensive documentation system for payroll processes, ensuring compliance and ease of reference.

- Resolved payroll discrepancies of over $50,000 within 3 months of starting the role, demonstrating attention to detail and problemsolving skills.

- Automated payroll calculations using specialized software, reducing errors and increasing payroll accuracy by 95%.

- Collaborated with HR and finance teams to streamline payroll reporting, improving decisionmaking and reducing redundant tasks.

Awards

- Recognized with the Payroll Excellence Award for outstanding contribution to payroll operations.

- Awarded the Payroll Assistant of the Year award for consistently exceeding performance expectations.

- Received certification as a Certified Payroll Professional (CPP) from the American Payroll Association.

Certificates

- Certified Payroll Professional (CPP)

- Certified Payroll Manager (CPM)

- Fundamental Payroll Certification (FPC)

- American Payroll Association (APA) Membership

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Assistant

- Highlight your experience and skills in payroll processing, tax compliance, and employee record keeping.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Use keywords throughout your resume to match the job descriptions you are applying for.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Payroll Assistant Resume

- Process payroll for over 2,000 employees, including deductions, garnishments, and benefits.

- Resolve payroll-related inquiries and ensure timely issuance of employee paychecks.

- Maintain accurate and up-to-date payroll records in compliance with federal and state regulations.

- Prepare timely and accurate payroll tax returns, including Forms 941, 940, and W2s.

- Reconcile payroll data with general ledger accounts and bank statements, ensuring data integrity.

- Collaborate with HR to manage employee time-off requests and ensure compliance with company policies.

- Administer employee garnishments and deductions, ensuring compliance with legal requirements.

Frequently Asked Questions (FAQ’s) For Payroll Assistant

What are the key skills required to be a successful Payroll Assistant?

Key skills for a successful Payroll Assistant include proficiency in payroll processing, payroll tax compliance, wage and hour calculations, leave management, employee record keeping, and system administration (payroll software).

What are the typical duties and responsibilities of a Payroll Assistant?

Typical duties and responsibilities of a Payroll Assistant include processing payroll, resolving payroll-related inquiries, maintaining payroll records, preparing payroll tax returns, reconciling payroll data, and administering employee garnishments and deductions.

What is the average salary for a Payroll Assistant?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Payroll Assistants was $56,310 in May 2021.

What are the career advancement opportunities for a Payroll Assistant?

Career advancement opportunities for a Payroll Assistant include promotions to Payroll Administrator, Payroll Manager, or Human Resources Manager.

What are the educational requirements for a Payroll Assistant?

Educational requirements for a Payroll Assistant typically include a high school diploma or equivalent, although some employers may prefer candidates with a bachelor’s degree in accounting or business administration.

What are the certifications available for Payroll Assistants?

Certifications available for Payroll Assistants include the Certified Payroll Professional (CPP) certification offered by the American Payroll Association and the Fundamental Payroll Certification (FPC) offered by the National Payroll Reporting Consortium.