Are you a seasoned Payroll Auditor seeking a new career path? Discover our professionally built Payroll Auditor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

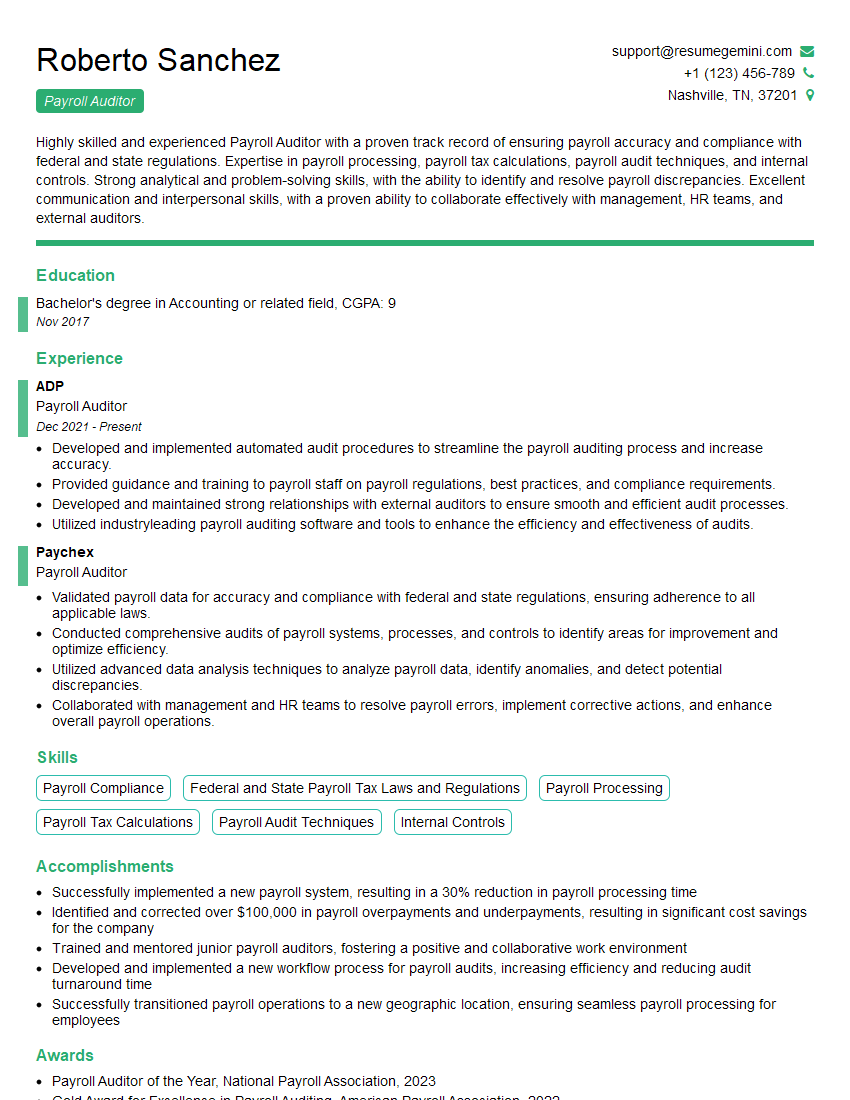

Roberto Sanchez

Payroll Auditor

Summary

Highly skilled and experienced Payroll Auditor with a proven track record of ensuring payroll accuracy and compliance with federal and state regulations. Expertise in payroll processing, payroll tax calculations, payroll audit techniques, and internal controls. Strong analytical and problem-solving skills, with the ability to identify and resolve payroll discrepancies. Excellent communication and interpersonal skills, with a proven ability to collaborate effectively with management, HR teams, and external auditors.

Education

Bachelor’s degree in Accounting or related field

November 2017

Skills

- Payroll Compliance

- Federal and State Payroll Tax Laws and Regulations

- Payroll Processing

- Payroll Tax Calculations

- Payroll Audit Techniques

- Internal Controls

Work Experience

Payroll Auditor

- Developed and implemented automated audit procedures to streamline the payroll auditing process and increase accuracy.

- Provided guidance and training to payroll staff on payroll regulations, best practices, and compliance requirements.

- Developed and maintained strong relationships with external auditors to ensure smooth and efficient audit processes.

- Utilized industryleading payroll auditing software and tools to enhance the efficiency and effectiveness of audits.

Payroll Auditor

- Validated payroll data for accuracy and compliance with federal and state regulations, ensuring adherence to all applicable laws.

- Conducted comprehensive audits of payroll systems, processes, and controls to identify areas for improvement and optimize efficiency.

- Utilized advanced data analysis techniques to analyze payroll data, identify anomalies, and detect potential discrepancies.

- Collaborated with management and HR teams to resolve payroll errors, implement corrective actions, and enhance overall payroll operations.

Accomplishments

- Successfully implemented a new payroll system, resulting in a 30% reduction in payroll processing time

- Identified and corrected over $100,000 in payroll overpayments and underpayments, resulting in significant cost savings for the company

- Trained and mentored junior payroll auditors, fostering a positive and collaborative work environment

- Developed and implemented a new workflow process for payroll audits, increasing efficiency and reducing audit turnaround time

- Successfully transitioned payroll operations to a new geographic location, ensuring seamless payroll processing for employees

Awards

- Payroll Auditor of the Year, National Payroll Association, 2023

- Gold Award for Excellence in Payroll Auditing, American Payroll Association, 2022

- Certified Payroll Professional (CPP) of the Year, Payroll Certification Board, 2021

Certificates

- Certified Payroll Professional (CPP)

- Forensic Payroll Auditor (FPA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Auditor

Quantify your accomplishments.

Use specific numbers and metrics to demonstrate the impact of your work.Highlight your transferable skills.

Even if you don’t have direct experience as a Payroll Auditor, emphasize skills that are relevant to the role, such as analytical thinking, problem-solving, and attention to detail.Get certified.

Earning a certification from a reputable organization, such as the American Payroll Association (APA), can demonstrate your expertise and commitment to the profession.Network with other Payroll Auditors.

Attend industry events and connect with professionals on LinkedIn to learn about best practices and job opportunities.

Essential Experience Highlights for a Strong Payroll Auditor Resume

- Validate payroll data for accuracy and compliance with federal and state regulations.

- Conduct comprehensive audits of payroll systems, processes, and controls to identify areas for improvement and optimize efficiency.

- Utilize advanced data analysis techniques to analyze payroll data, identify anomalies, and detect potential discrepancies.

- Collaborate with management and HR teams to resolve payroll errors, implement corrective actions, and enhance overall payroll operations.

- Develop and implement automated audit procedures to streamline the payroll auditing process and increase accuracy.

- Provide guidance and training to payroll staff on payroll regulations, best practices, and compliance requirements.

Frequently Asked Questions (FAQ’s) For Payroll Auditor

What are the key skills required to be a successful Payroll Auditor?

Key skills required for a successful Payroll Auditor include: Payroll Compliance, Federal and State Payroll Tax Laws and Regulations, Payroll Processing, Payroll Tax Calculations, Payroll Audit Techniques, Internal Controls, and Attention to Detail.

What are the career opportunities for Payroll Auditors?

Payroll Auditors can advance to roles such as Payroll Manager, HR Manager, or Compliance Manager. They may also specialize in areas such as healthcare or government payroll.

What is the average salary for a Payroll Auditor?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Payroll Auditors was $73,530 in May 2021.

What are the educational requirements for a Payroll Auditor?

Most Payroll Auditors have a bachelor’s degree in accounting or a related field.

What is the job outlook for Payroll Auditors?

The job outlook for Payroll Auditors is expected to grow 7% from 2021 to 2031, faster than the average for all occupations.

What are the challenges faced by Payroll Auditors?

Payroll Auditors face challenges such as keeping up with changing regulations, ensuring the accuracy of payroll data, and protecting against fraud.

What are the benefits of being a Payroll Auditor?

Benefits of being a Payroll Auditor include job security, opportunities for career advancement, and the satisfaction of ensuring that employees are paid accurately and on time.