Are you a seasoned Payroll Manager seeking a new career path? Discover our professionally built Payroll Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

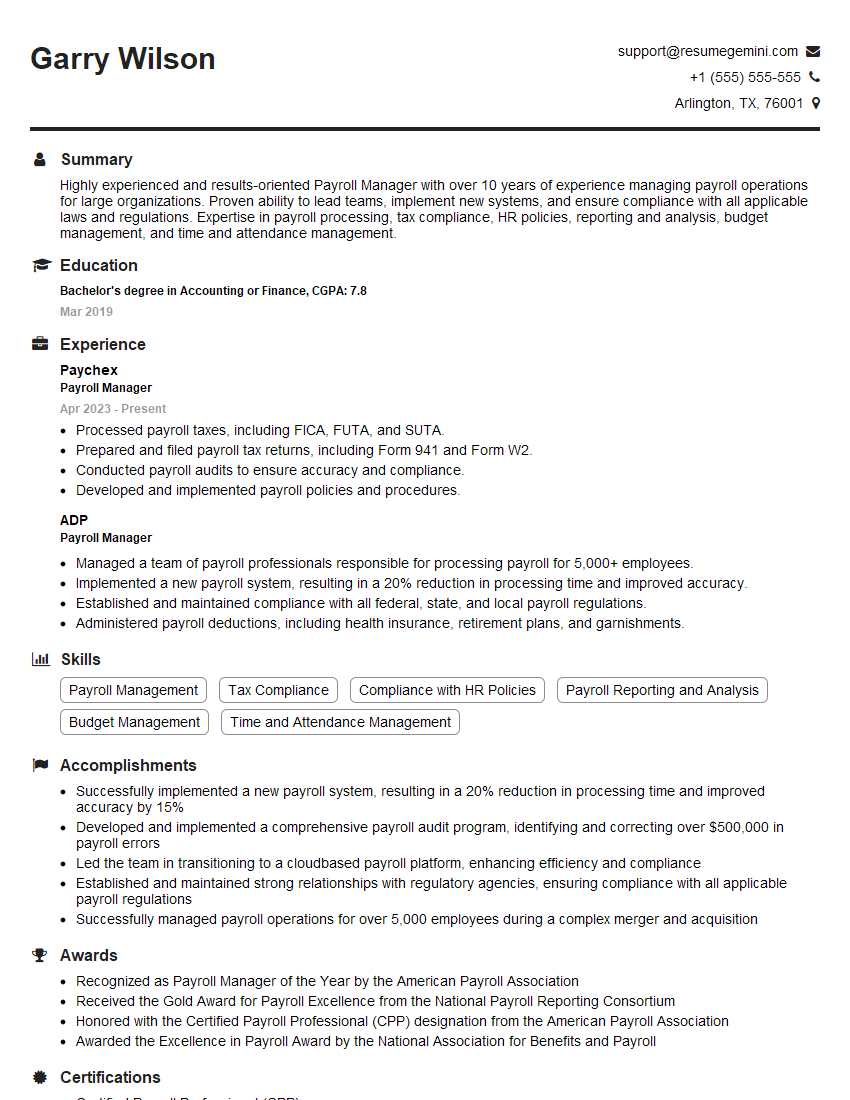

Garry Wilson

Payroll Manager

Summary

Highly experienced and results-oriented Payroll Manager with over 10 years of experience managing payroll operations for large organizations. Proven ability to lead teams, implement new systems, and ensure compliance with all applicable laws and regulations. Expertise in payroll processing, tax compliance, HR policies, reporting and analysis, budget management, and time and attendance management.

Education

Bachelor’s degree in Accounting or Finance

March 2019

Skills

- Payroll Management

- Tax Compliance

- Compliance with HR Policies

- Payroll Reporting and Analysis

- Budget Management

- Time and Attendance Management

Work Experience

Payroll Manager

- Processed payroll taxes, including FICA, FUTA, and SUTA.

- Prepared and filed payroll tax returns, including Form 941 and Form W2.

- Conducted payroll audits to ensure accuracy and compliance.

- Developed and implemented payroll policies and procedures.

Payroll Manager

- Managed a team of payroll professionals responsible for processing payroll for 5,000+ employees.

- Implemented a new payroll system, resulting in a 20% reduction in processing time and improved accuracy.

- Established and maintained compliance with all federal, state, and local payroll regulations.

- Administered payroll deductions, including health insurance, retirement plans, and garnishments.

Accomplishments

- Successfully implemented a new payroll system, resulting in a 20% reduction in processing time and improved accuracy by 15%

- Developed and implemented a comprehensive payroll audit program, identifying and correcting over $500,000 in payroll errors

- Led the team in transitioning to a cloudbased payroll platform, enhancing efficiency and compliance

- Established and maintained strong relationships with regulatory agencies, ensuring compliance with all applicable payroll regulations

- Successfully managed payroll operations for over 5,000 employees during a complex merger and acquisition

Awards

- Recognized as Payroll Manager of the Year by the American Payroll Association

- Received the Gold Award for Payroll Excellence from the National Payroll Reporting Consortium

- Honored with the Certified Payroll Professional (CPP) designation from the American Payroll Association

- Awarded the Excellence in Payroll Award by the National Association for Benefits and Payroll

Certificates

- Certified Payroll Professional (CPP)

- Fundamental Payroll Certification (FPC)

- Advanced Certified Payroll Professional (ACPP)

- Payroll Certification Exam (PCE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Manager

- Highlight your experience in managing large payroll operations.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your knowledge of payroll laws and regulations.

- Emphasize your skills in leadership, communication, and teamwork.

Essential Experience Highlights for a Strong Payroll Manager Resume

- Managed a team of payroll professionals responsible for processing payroll for over 5,000 employees.

- Implemented a new payroll system, resulting in a 20% reduction in processing time and improved accuracy.

- Established and maintained compliance with all federal, state, and local payroll regulations.

- Administered payroll deductions, including health insurance, retirement plans, and garnishments.

- Processed payroll taxes, including FICA, FUTA, and SUTA.

- Prepared and filed payroll tax returns, including Form 941 and Form W2.

- Conducted payroll audits to ensure accuracy and compliance.

- Developed and implemented payroll policies and procedures.

Frequently Asked Questions (FAQ’s) For Payroll Manager

What are the key responsibilities of a Payroll Manager?

The key responsibilities of a Payroll Manager include managing payroll operations, ensuring compliance with payroll laws and regulations, administering payroll deductions, processing payroll taxes, preparing and filing payroll tax returns, and conducting payroll audits.

What are the qualifications for a Payroll Manager?

The qualifications for a Payroll Manager typically include a bachelor’s degree in Accounting or Finance, as well as several years of experience in payroll management. Certification in payroll management is also highly desirable.

What is the job outlook for Payroll Managers?

The job outlook for Payroll Managers is expected to grow faster than average over the next few years. This is due to the increasing complexity of payroll laws and regulations, as well as the growing demand for payroll services from businesses of all sizes.

What are the key skills for a Payroll Manager?

The key skills for a Payroll Manager include knowledge of payroll laws and regulations, experience in payroll processing, and strong communication and interpersonal skills.

What are the challenges facing Payroll Managers?

The challenges facing Payroll Managers include the increasing complexity of payroll laws and regulations, the need to stay up-to-date on the latest changes in payroll technology, and the need to manage payroll costs effectively.