Are you a seasoned Payroll Specialist seeking a new career path? Discover our professionally built Payroll Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

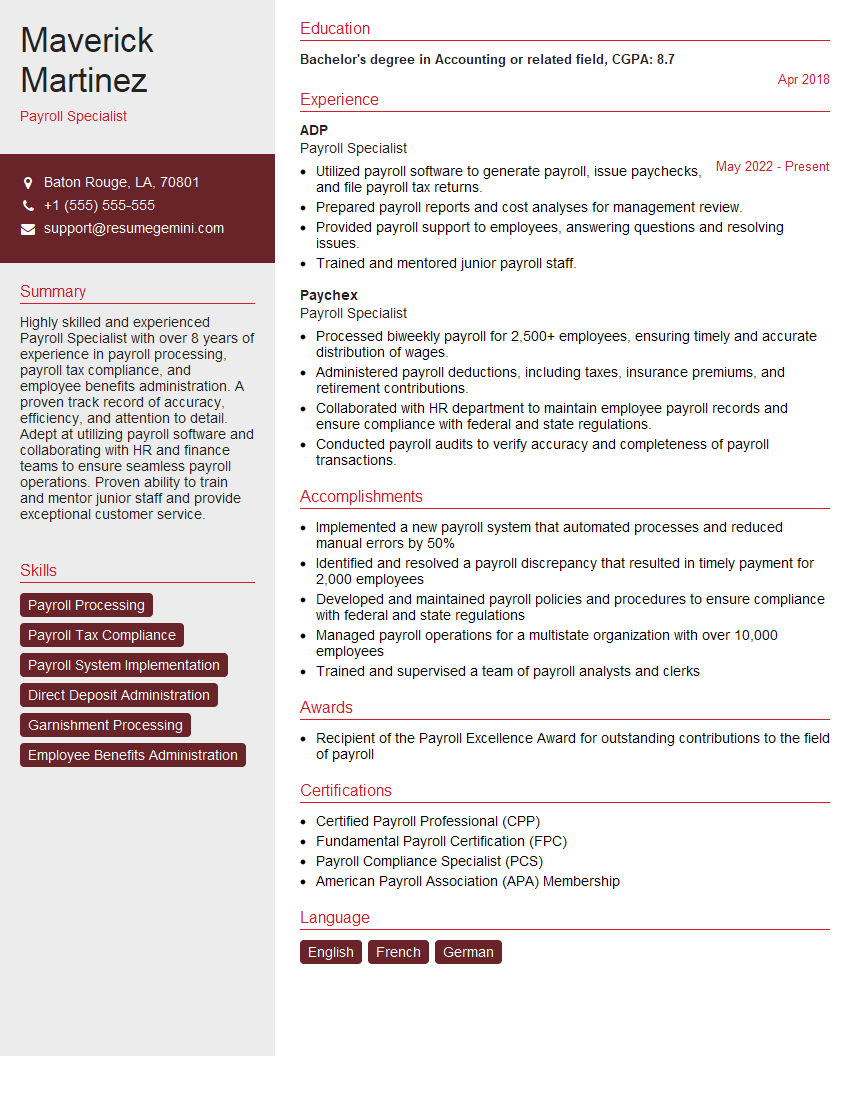

Maverick Martinez

Payroll Specialist

Summary

Highly skilled and experienced Payroll Specialist with over 8 years of experience in payroll processing, payroll tax compliance, and employee benefits administration. A proven track record of accuracy, efficiency, and attention to detail. Adept at utilizing payroll software and collaborating with HR and finance teams to ensure seamless payroll operations. Proven ability to train and mentor junior staff and provide exceptional customer service.

Education

Bachelor’s degree in Accounting or related field

April 2018

Skills

- Payroll Processing

- Payroll Tax Compliance

- Payroll System Implementation

- Direct Deposit Administration

- Garnishment Processing

- Employee Benefits Administration

Work Experience

Payroll Specialist

- Utilized payroll software to generate payroll, issue paychecks, and file payroll tax returns.

- Prepared payroll reports and cost analyses for management review.

- Provided payroll support to employees, answering questions and resolving issues.

- Trained and mentored junior payroll staff.

Payroll Specialist

- Processed biweekly payroll for 2,500+ employees, ensuring timely and accurate distribution of wages.

- Administered payroll deductions, including taxes, insurance premiums, and retirement contributions.

- Collaborated with HR department to maintain employee payroll records and ensure compliance with federal and state regulations.

- Conducted payroll audits to verify accuracy and completeness of payroll transactions.

Accomplishments

- Implemented a new payroll system that automated processes and reduced manual errors by 50%

- Identified and resolved a payroll discrepancy that resulted in timely payment for 2,000 employees

- Developed and maintained payroll policies and procedures to ensure compliance with federal and state regulations

- Managed payroll operations for a multistate organization with over 10,000 employees

- Trained and supervised a team of payroll analysts and clerks

Awards

- Recipient of the Payroll Excellence Award for outstanding contributions to the field of payroll

Certificates

- Certified Payroll Professional (CPP)

- Fundamental Payroll Certification (FPC)

- Payroll Compliance Specialist (PCS)

- American Payroll Association (APA) Membership

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Specialist

- Highlight your experience and skills in payroll processing, tax compliance, and employee benefits administration.

- Showcase your knowledge of payroll software and your ability to collaborate with HR and finance teams.

- Demonstrate your accuracy, efficiency, and attention to detail.

- Emphasize your customer service skills and your ability to train and mentor junior staff.

Essential Experience Highlights for a Strong Payroll Specialist Resume

- Process biweekly payroll for over 2,500 employees, ensuring timely and accurate distribution of wages.

- Administer payroll deductions, including taxes, insurance premiums, and retirement contributions.

- Collaborate with HR department to maintain employee payroll records and ensure compliance with federal and state regulations.

- Conduct payroll audits to verify accuracy and completeness of payroll transactions.

- Utilize payroll software to generate payroll, issue paychecks, and file payroll tax returns.

- Prepare payroll reports and cost analyses for management review.

- Provide payroll support to employees, answering questions and resolving issues.

Frequently Asked Questions (FAQ’s) For Payroll Specialist

What are the key responsibilities of a Payroll Specialist?

Payroll Specialists are responsible for processing payroll, administering payroll deductions, collaborating with HR, conducting payroll audits, utilizing payroll software, preparing payroll reports, and providing payroll support to employees.

What skills are required to be a successful Payroll Specialist?

Successful Payroll Specialists possess strong analytical and problem-solving skills, as well as proficiency in payroll processing, payroll tax compliance, and employee benefits administration. They are also proficient in the use of payroll software and have excellent communication and interpersonal skills.

What is the career path for a Payroll Specialist?

Payroll Specialists can advance their careers by becoming Payroll Managers or Payroll Supervisors. They may also specialize in areas such as payroll tax compliance or payroll accounting.

What is the job outlook for Payroll Specialists?

The job outlook for Payroll Specialists is expected to grow faster than average in the coming years. This is due to the increasing complexity of payroll regulations and the need for businesses to ensure compliance.

What are the top companies that hire Payroll Specialists?

Top companies that hire Payroll Specialists include ADP, Paychex, and Ceridian.