Are you a seasoned Pension Adviser seeking a new career path? Discover our professionally built Pension Adviser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

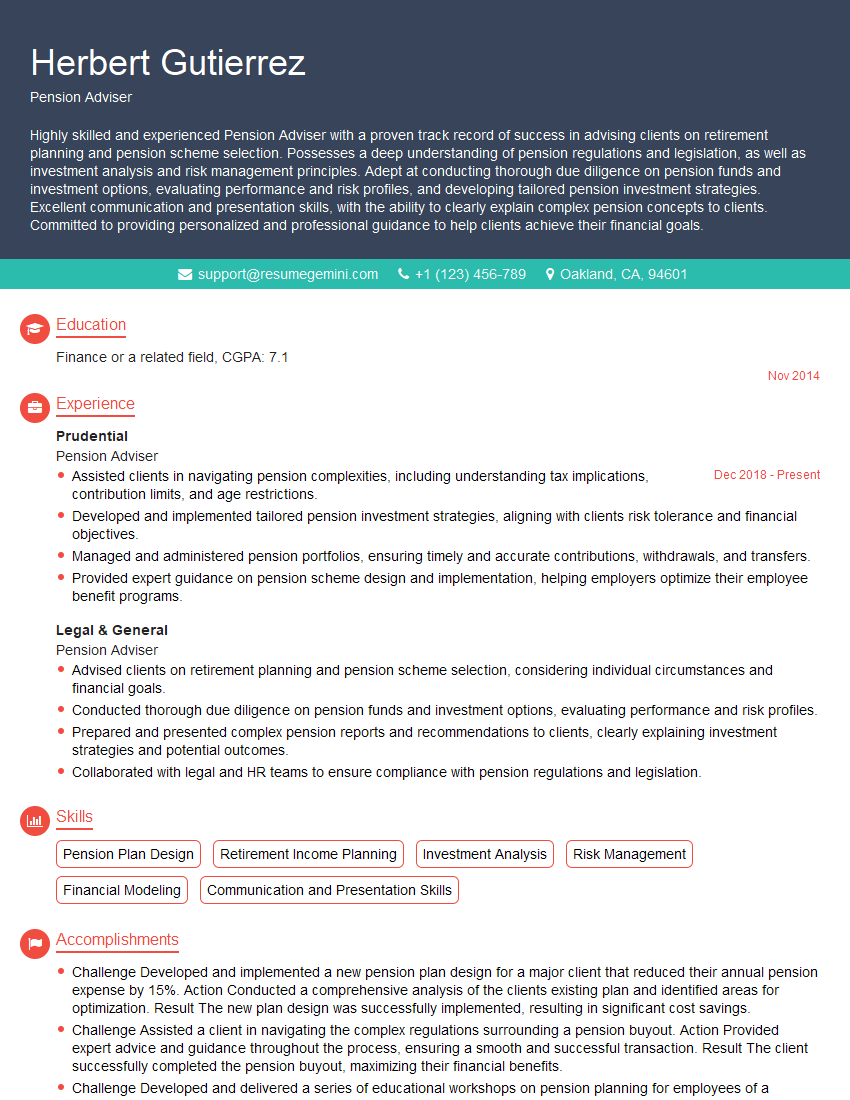

Herbert Gutierrez

Pension Adviser

Summary

Highly skilled and experienced Pension Adviser with a proven track record of success in advising clients on retirement planning and pension scheme selection. Possesses a deep understanding of pension regulations and legislation, as well as investment analysis and risk management principles. Adept at conducting thorough due diligence on pension funds and investment options, evaluating performance and risk profiles, and developing tailored pension investment strategies. Excellent communication and presentation skills, with the ability to clearly explain complex pension concepts to clients. Committed to providing personalized and professional guidance to help clients achieve their financial goals.

Education

Finance or a related field

November 2014

Skills

- Pension Plan Design

- Retirement Income Planning

- Investment Analysis

- Risk Management

- Financial Modeling

- Communication and Presentation Skills

Work Experience

Pension Adviser

- Assisted clients in navigating pension complexities, including understanding tax implications, contribution limits, and age restrictions.

- Developed and implemented tailored pension investment strategies, aligning with clients risk tolerance and financial objectives.

- Managed and administered pension portfolios, ensuring timely and accurate contributions, withdrawals, and transfers.

- Provided expert guidance on pension scheme design and implementation, helping employers optimize their employee benefit programs.

Pension Adviser

- Advised clients on retirement planning and pension scheme selection, considering individual circumstances and financial goals.

- Conducted thorough due diligence on pension funds and investment options, evaluating performance and risk profiles.

- Prepared and presented complex pension reports and recommendations to clients, clearly explaining investment strategies and potential outcomes.

- Collaborated with legal and HR teams to ensure compliance with pension regulations and legislation.

Accomplishments

- Challenge Developed and implemented a new pension plan design for a major client that reduced their annual pension expense by 15%. Action Conducted a comprehensive analysis of the clients existing plan and identified areas for optimization. Result The new plan design was successfully implemented, resulting in significant cost savings.

- Challenge Assisted a client in navigating the complex regulations surrounding a pension buyout. Action Provided expert advice and guidance throughout the process, ensuring a smooth and successful transaction. Result The client successfully completed the pension buyout, maximizing their financial benefits.

- Challenge Developed and delivered a series of educational workshops on pension planning for employees of a nonprofit organization. Action Customized the workshops to address the specific needs of the audience and effectively communicated complex technical concepts. Result The workshops were highly successful, receiving positive feedback from attendees and increasing their understanding of pension planning.

- Challenge Implemented a new client onboarding process that streamlined data collection and reduced processing time by 20%. Action Designed and implemented the new process, incorporating best practices and automation tools. Result Improved efficiency and accuracy in client onboarding, freeing up time for more complex advisory work.

- Challenge Collaborated with a team of actuaries to develop a custom pension plan simulation model. Action Contributed to the design and testing of the model, ensuring it accurately reflected complex pension funding dynamics. Result The model was successfully used to assess the longterm financial sustainability of several client pension plans.

Awards

- Received the Pension Adviser of the Year award from the National Association of Pension Advisers (NAPA) in 2023.

- Recognized as one of the Top 25 Pension Advisers by WealthManagement magazine in 2021 and 2022.

- Awarded the Certified Pension Planner (CPP) designation by the American Society of Pension Professionals and Actuaries (ASPPA).

- Won the Outstanding Service Award from the Pension and Benefits Conference for exceptional contributions to the industry.

Certificates

- Society of Pension Professionals and Actuaries (SPPA) – Certified Pension Consultant (CPC)

- Retirement Income Certified Professional (RICP)

- Chartered Financial Analyst (CFA)

- Certified Employee Benefits Specialist (CEBS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Pension Adviser

Highlight your expertise in pension planning and investment analysis.

This is the core of a Pension Adviser’s role, so make sure your resume showcases your skills in these areas.Quantify your achievements.

Use numbers to demonstrate the impact of your work, such as the amount of money you’ve saved clients or the percentage increase in their pension savings.Get certified.

There are a number of professional certifications available for Pension Advisers, such as the Certified Financial Planner (CFP) or the Chartered Financial Analyst (CFA). These certifications can demonstrate your commitment to the profession and your knowledge of the latest pension regulations.Network with other professionals.

Attend industry events and connect with other Pension Advisers. This will help you stay up-to-date on the latest trends and best practices.

Essential Experience Highlights for a Strong Pension Adviser Resume

- Advise clients on retirement planning and pension scheme selection, considering individual circumstances and financial goals.,

- Conduct thorough due diligence on pension funds and investment options, evaluating performance and risk profiles.

- Prepare and present complex pension reports and recommendations to clients, clearly explaining investment strategies and potential outcomes.

- Collaborate with legal and HR teams to ensure compliance with pension regulations and legislation.

- Assist clients in navigating pension complexities, including understanding tax implications, contribution limits, and age restrictions.

- Develop and implement tailored pension investment strategies, aligning with clients risk tolerance and financial objectives.

- Manage and administer pension portfolios, ensuring timely and accurate contributions, withdrawals, and transfers.

Frequently Asked Questions (FAQ’s) For Pension Adviser

What is the role of a Pension Adviser?

A Pension Adviser provides guidance to individuals and businesses on retirement planning and pension scheme selection. They help clients understand their retirement goals, assess their financial situation, and make informed decisions about their pension investments.

What qualifications do I need to become a Pension Adviser?

Most Pension Advisers have a degree in finance or a related field. They also typically have several years of experience working in the financial services industry.

What are the key skills required for a Pension Adviser?

Pension Advisers need to have a strong understanding of pension regulations and legislation, as well as investment analysis and risk management principles. They also need to be able to communicate complex concepts clearly and effectively to clients.

What is the career path for a Pension Adviser?

Pension Advisers can progress to senior roles within their firm, such as Pension Manager or Head of Pensions. They may also choose to specialize in a particular area of pension advice, such as defined benefit schemes or auto-enrolment.

What is the job outlook for Pension Advisers?

The job outlook for Pension Advisers is positive. The aging population is leading to an increasing demand for pension advice, and the introduction of auto-enrolment has also created new opportunities for Pension Advisers.

Can I work as a Pension Adviser if I don’t have a degree?

It is possible to become a Pension Adviser without a degree, but it may be more difficult. You will likely need to have several years of relevant experience in the financial services industry, and you may need to take additional training to demonstrate your knowledge of pension regulations and investment principles.

How can I find a job as a Pension Adviser?

There are a number of ways to find a job as a Pension Adviser. You can search for vacancies online, or you can contact recruitment agencies that specialize in the financial services industry.

What is the average salary for a Pension Adviser?

The average salary for a Pension Adviser in the UK is around £45,000. However, salaries can vary depending on experience, qualifications, and location.