Are you a seasoned Pension Consultant seeking a new career path? Discover our professionally built Pension Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

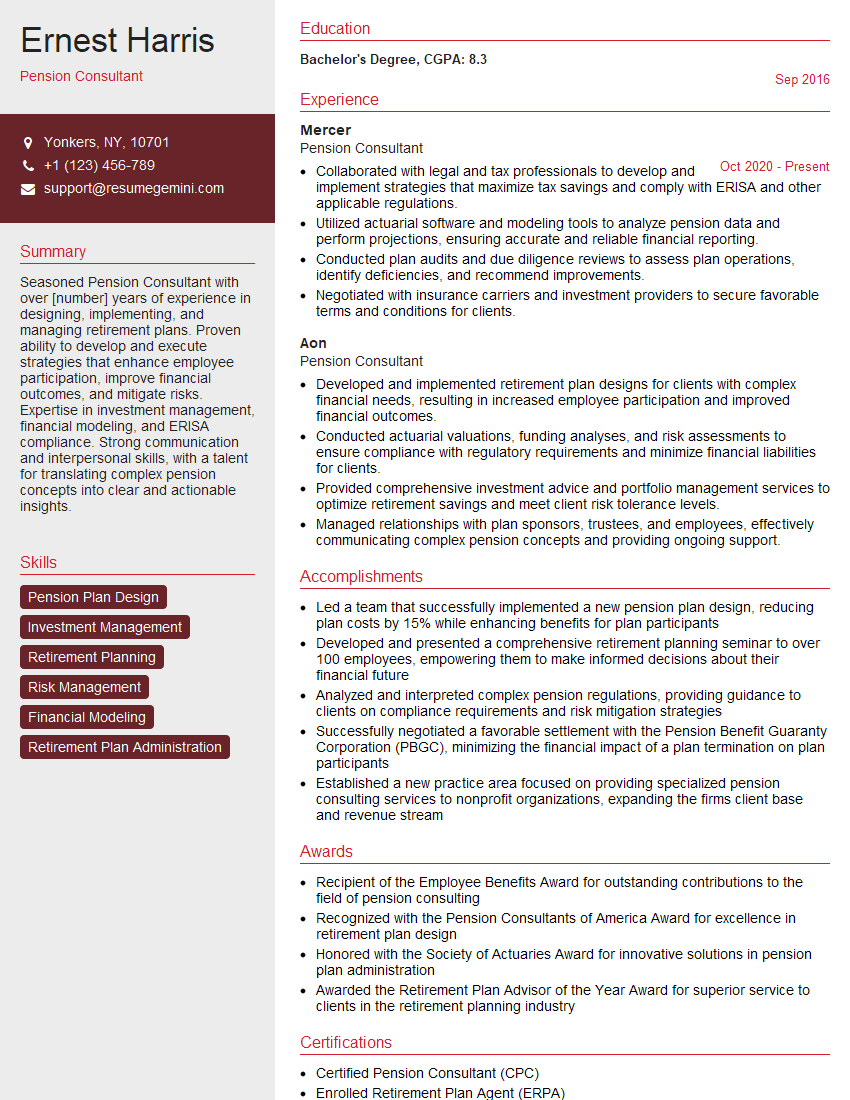

Ernest Harris

Pension Consultant

Summary

Seasoned Pension Consultant with over [number] years of experience in designing, implementing, and managing retirement plans. Proven ability to develop and execute strategies that enhance employee participation, improve financial outcomes, and mitigate risks. Expertise in investment management, financial modeling, and ERISA compliance. Strong communication and interpersonal skills, with a talent for translating complex pension concepts into clear and actionable insights.

Education

Bachelor’s Degree

September 2016

Skills

- Pension Plan Design

- Investment Management

- Retirement Planning

- Risk Management

- Financial Modeling

- Retirement Plan Administration

Work Experience

Pension Consultant

- Collaborated with legal and tax professionals to develop and implement strategies that maximize tax savings and comply with ERISA and other applicable regulations.

- Utilized actuarial software and modeling tools to analyze pension data and perform projections, ensuring accurate and reliable financial reporting.

- Conducted plan audits and due diligence reviews to assess plan operations, identify deficiencies, and recommend improvements.

- Negotiated with insurance carriers and investment providers to secure favorable terms and conditions for clients.

Pension Consultant

- Developed and implemented retirement plan designs for clients with complex financial needs, resulting in increased employee participation and improved financial outcomes.

- Conducted actuarial valuations, funding analyses, and risk assessments to ensure compliance with regulatory requirements and minimize financial liabilities for clients.

- Provided comprehensive investment advice and portfolio management services to optimize retirement savings and meet client risk tolerance levels.

- Managed relationships with plan sponsors, trustees, and employees, effectively communicating complex pension concepts and providing ongoing support.

Accomplishments

- Led a team that successfully implemented a new pension plan design, reducing plan costs by 15% while enhancing benefits for plan participants

- Developed and presented a comprehensive retirement planning seminar to over 100 employees, empowering them to make informed decisions about their financial future

- Analyzed and interpreted complex pension regulations, providing guidance to clients on compliance requirements and risk mitigation strategies

- Successfully negotiated a favorable settlement with the Pension Benefit Guaranty Corporation (PBGC), minimizing the financial impact of a plan termination on plan participants

- Established a new practice area focused on providing specialized pension consulting services to nonprofit organizations, expanding the firms client base and revenue stream

Awards

- Recipient of the Employee Benefits Award for outstanding contributions to the field of pension consulting

- Recognized with the Pension Consultants of America Award for excellence in retirement plan design

- Honored with the Society of Actuaries Award for innovative solutions in pension plan administration

- Awarded the Retirement Plan Advisor of the Year Award for superior service to clients in the retirement planning industry

Certificates

- Certified Pension Consultant (CPC)

- Enrolled Retirement Plan Agent (ERPA)

- Accredited Investment Fiduciary (AIF)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Pension Consultant

- Highlight your expertise in pension plan design and actuarial analysis.

- Showcase your understanding of investment management and risk mitigation strategies.

- Quantify your accomplishments with specific metrics and results.

- Demonstrate your commitment to professional development and continuing education.

Essential Experience Highlights for a Strong Pension Consultant Resume

- Design and implement pension plans tailored to clients’ unique financial needs and objectives.

- Conduct actuarial valuations, funding analyses, and risk assessments to ensure regulatory compliance and financial stability.

- Provide comprehensive investment advice and portfolio management services to optimize retirement savings.

- Manage relationships with plan sponsors, trustees, and employees, providing ongoing support and education.

- Collaborate with legal and tax professionals to develop tax-efficient and ERISA-compliant strategies.

- Utilize actuarial software and modeling tools to analyze pension data and perform accurate projections.

Frequently Asked Questions (FAQ’s) For Pension Consultant

What are the key skills required for a successful Pension Consultant?

A successful Pension Consultant typically possesses a strong foundation in pension plan design, investment management, financial modeling, and ERISA compliance. They should also have excellent communication and interpersonal skills, as well as the ability to analyze complex data and provide clear and actionable insights.

What are the career prospects for a Pension Consultant?

Pension Consultants are in high demand due to the increasing complexity of retirement planning and the need for specialized expertise. With experience, Pension Consultants can advance to senior-level positions, such as Principal or Managing Director, or specialize in a particular area, such as investment consulting or risk management.

What are the challenges faced by Pension Consultants?

Pension Consultants face a number of challenges, including the need to stay up-to-date on regulatory changes, the complexity of retirement planning, and the need to meet the diverse needs of clients. They must also be able to effectively communicate complex concepts to clients and stakeholders.

What are the key trends in the pension consulting industry?

Key trends in the pension consulting industry include the increasing use of technology, the focus on defined contribution plans, and the need for personalized retirement planning. Pension Consultants must be adaptable and innovative to meet the evolving needs of the industry.

What are the professional organizations for Pension Consultants?

There are several professional organizations for Pension Consultants, including the American Academy of Actuaries, the Society of Actuaries, and the International Foundation of Employee Benefit Plans. These organizations provide opportunities for continuing education, networking, and professional development.