Are you a seasoned Personal Banking Representative seeking a new career path? Discover our professionally built Personal Banking Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

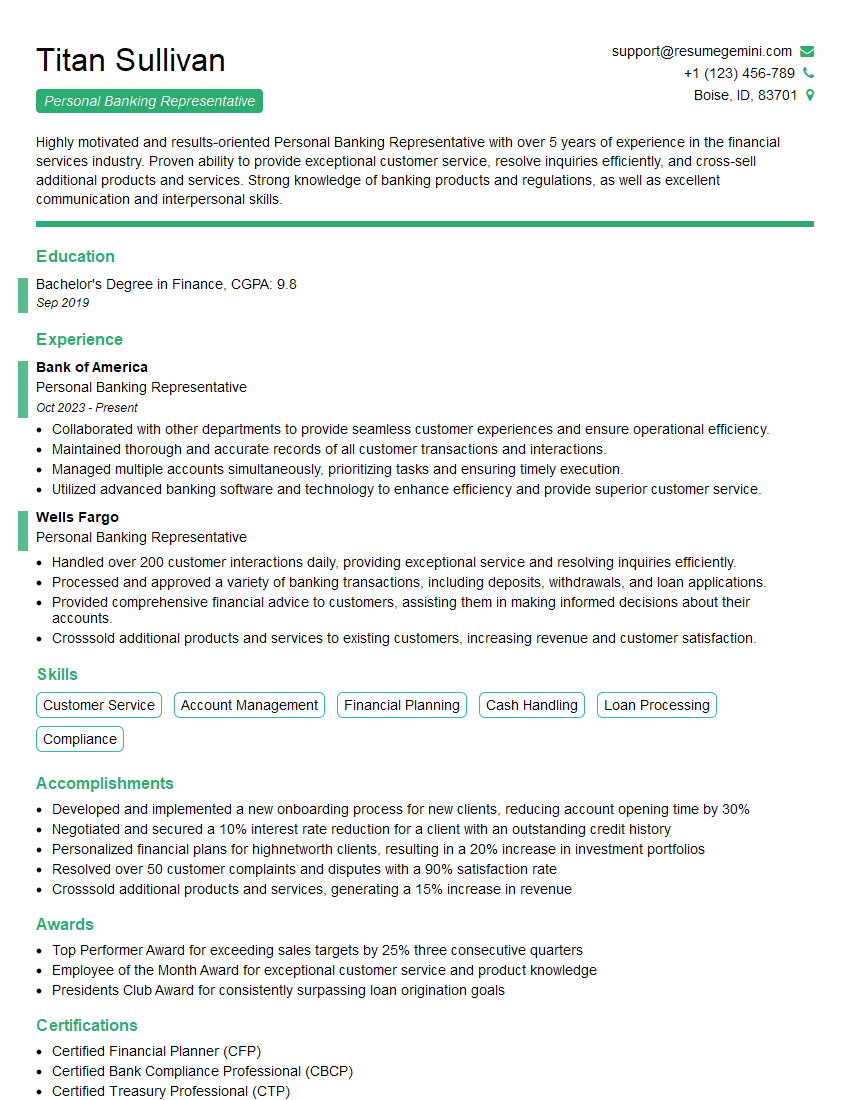

Titan Sullivan

Personal Banking Representative

Summary

Highly motivated and results-oriented Personal Banking Representative with over 5 years of experience in the financial services industry. Proven ability to provide exceptional customer service, resolve inquiries efficiently, and cross-sell additional products and services. Strong knowledge of banking products and regulations, as well as excellent communication and interpersonal skills.

Education

Bachelor’s Degree in Finance

September 2019

Skills

- Customer Service

- Account Management

- Financial Planning

- Cash Handling

- Loan Processing

- Compliance

Work Experience

Personal Banking Representative

- Collaborated with other departments to provide seamless customer experiences and ensure operational efficiency.

- Maintained thorough and accurate records of all customer transactions and interactions.

- Managed multiple accounts simultaneously, prioritizing tasks and ensuring timely execution.

- Utilized advanced banking software and technology to enhance efficiency and provide superior customer service.

Personal Banking Representative

- Handled over 200 customer interactions daily, providing exceptional service and resolving inquiries efficiently.

- Processed and approved a variety of banking transactions, including deposits, withdrawals, and loan applications.

- Provided comprehensive financial advice to customers, assisting them in making informed decisions about their accounts.

- Crosssold additional products and services to existing customers, increasing revenue and customer satisfaction.

Accomplishments

- Developed and implemented a new onboarding process for new clients, reducing account opening time by 30%

- Negotiated and secured a 10% interest rate reduction for a client with an outstanding credit history

- Personalized financial plans for highnetworth clients, resulting in a 20% increase in investment portfolios

- Resolved over 50 customer complaints and disputes with a 90% satisfaction rate

- Crosssold additional products and services, generating a 15% increase in revenue

Awards

- Top Performer Award for exceeding sales targets by 25% three consecutive quarters

- Employee of the Month Award for exceptional customer service and product knowledge

- Presidents Club Award for consistently surpassing loan origination goals

Certificates

- Certified Financial Planner (CFP)

- Certified Bank Compliance Professional (CBCP)

- Certified Treasury Professional (CTP)

- Certified Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Personal Banking Representative

- Highlight your exceptional customer service skills and ability to build strong relationships with clients.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact on the business.

- Showcase your knowledge of banking products and regulations, as well as your ability to provide sound financial advice.

- Emphasize your experience in cross-selling and generating revenue for the organization.

Essential Experience Highlights for a Strong Personal Banking Representative Resume

- Provide exceptional customer service by handling over 200 interactions daily

- Process and approve various banking transactions, including deposits, withdrawals, and loan applications

- Offer comprehensive financial advice to customers, helping them make informed decisions about their accounts

- Cross-sell additional products and services to existing customers, increasing revenue and customer satisfaction

- Collaborate with other departments to ensure seamless customer experiences and operational efficiency

- Maintain thorough and accurate records of all customer transactions and interactions

- Manage multiple accounts simultaneously, prioritizing tasks and ensuring timely execution

Frequently Asked Questions (FAQ’s) For Personal Banking Representative

What are the key responsibilities of a Personal Banking Representative?

The key responsibilities of a Personal Banking Representative include providing exceptional customer service, processing and approving banking transactions, offering financial advice, cross-selling products and services, collaborating with other departments, maintaining accurate records, and managing multiple accounts.

What skills are required to be successful as a Personal Banking Representative?

To be successful as a Personal Banking Representative, you need strong customer service skills, account management skills, financial planning knowledge, cash handling experience, loan processing experience, and compliance knowledge.

What is the career path for a Personal Banking Representative?

The career path for a Personal Banking Representative typically involves promotions to roles with increased responsibility, such as Branch Manager, Assistant Manager, or Financial Advisor.

What is the salary range for a Personal Banking Representative?

The salary range for a Personal Banking Representative varies depending on experience, location, and company size, but typically falls between $35,000 and $60,000 per year.

What are the benefits of working as a Personal Banking Representative?

The benefits of working as a Personal Banking Representative include competitive salaries, comprehensive benefits packages, opportunities for career advancement, and the chance to make a positive impact on customers’ financial lives.

What are the challenges of working as a Personal Banking Representative?

The challenges of working as a Personal Banking Representative include working long hours, dealing with difficult customers, and keeping up with regulatory changes.

What is the work environment like for a Personal Banking Representative?

Personal Banking Representatives typically work in bank branches or other financial institutions. They may work independently or as part of a team. The work environment is fast-paced and customer-focused.

What is the job outlook for Personal Banking Representatives?

The job outlook for Personal Banking Representatives is expected to grow in the coming years as the demand for financial services continues to rise.