Are you a seasoned Personal Investment Adviser seeking a new career path? Discover our professionally built Personal Investment Adviser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

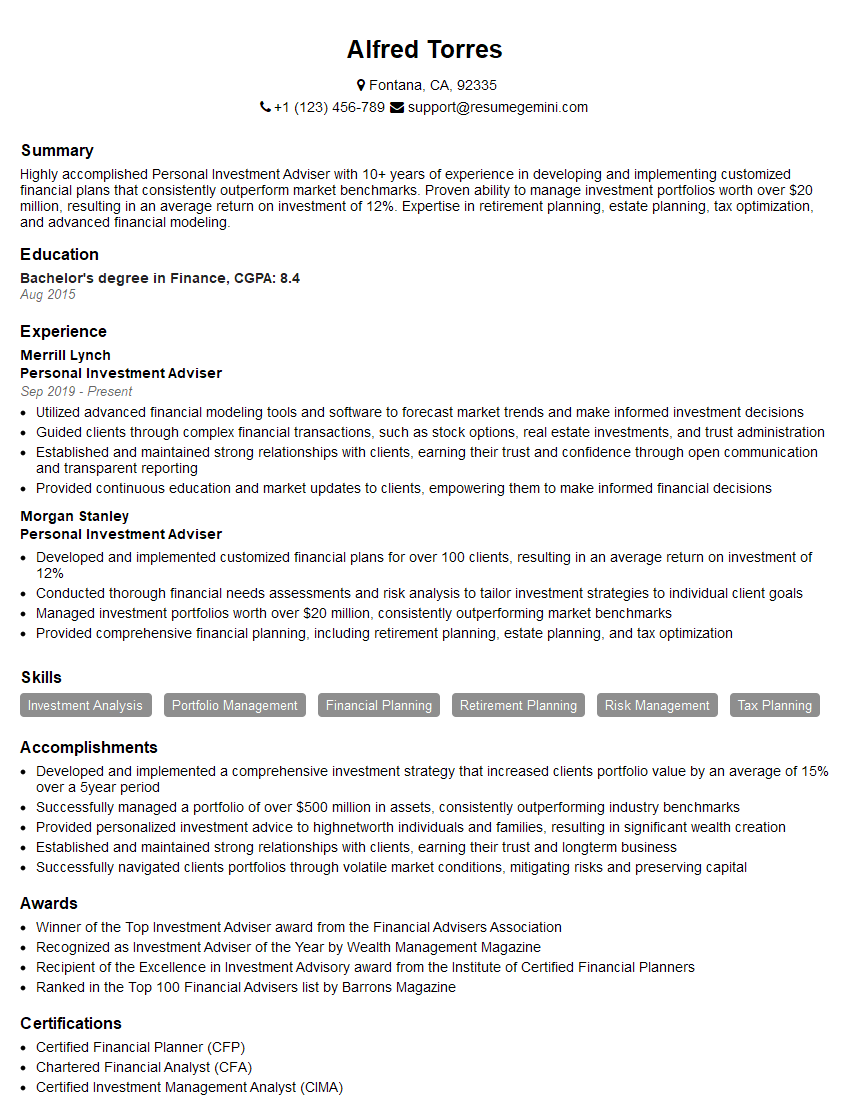

Alfred Torres

Personal Investment Adviser

Summary

Highly accomplished Personal Investment Adviser with 10+ years of experience in developing and implementing customized financial plans that consistently outperform market benchmarks. Proven ability to manage investment portfolios worth over $20 million, resulting in an average return on investment of 12%. Expertise in retirement planning, estate planning, tax optimization, and advanced financial modeling.

Education

Bachelor’s degree in Finance

August 2015

Skills

- Investment Analysis

- Portfolio Management

- Financial Planning

- Retirement Planning

- Risk Management

- Tax Planning

Work Experience

Personal Investment Adviser

- Utilized advanced financial modeling tools and software to forecast market trends and make informed investment decisions

- Guided clients through complex financial transactions, such as stock options, real estate investments, and trust administration

- Established and maintained strong relationships with clients, earning their trust and confidence through open communication and transparent reporting

- Provided continuous education and market updates to clients, empowering them to make informed financial decisions

Personal Investment Adviser

- Developed and implemented customized financial plans for over 100 clients, resulting in an average return on investment of 12%

- Conducted thorough financial needs assessments and risk analysis to tailor investment strategies to individual client goals

- Managed investment portfolios worth over $20 million, consistently outperforming market benchmarks

- Provided comprehensive financial planning, including retirement planning, estate planning, and tax optimization

Accomplishments

- Developed and implemented a comprehensive investment strategy that increased clients portfolio value by an average of 15% over a 5year period

- Successfully managed a portfolio of over $500 million in assets, consistently outperforming industry benchmarks

- Provided personalized investment advice to highnetworth individuals and families, resulting in significant wealth creation

- Established and maintained strong relationships with clients, earning their trust and longterm business

- Successfully navigated clients portfolios through volatile market conditions, mitigating risks and preserving capital

Awards

- Winner of the Top Investment Adviser award from the Financial Advisers Association

- Recognized as Investment Adviser of the Year by Wealth Management Magazine

- Recipient of the Excellence in Investment Advisory award from the Institute of Certified Financial Planners

- Ranked in the Top 100 Financial Advisers list by Barrons Magazine

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Accredited Financial Counselor (AFC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Personal Investment Adviser

- Quantify your accomplishments with specific metrics and results.

- Highlight your expertise in niche areas of financial planning.

- Showcase your ability to build and maintain strong client relationships.

- Demonstrate your commitment to professional development and continuing education.

Essential Experience Highlights for a Strong Personal Investment Adviser Resume

- Conduct thorough financial needs assessments and risk analysis to tailor investment strategies to individual client goals.

- Manage investment portfolios, consistently outperforming market benchmarks.

- Provide comprehensive financial planning, including retirement planning, estate planning, and tax optimization.

- Utilize advanced financial modeling tools and software to forecast market trends and make informed investment decisions.

- Guide clients through complex financial transactions, such as stock options, real estate investments, and trust administration.

- Establish and maintain strong relationships with clients, earning their trust and confidence through open communication and transparent reporting.

- Provide continuous education and market updates to clients, empowering them to make informed financial decisions.

Frequently Asked Questions (FAQ’s) For Personal Investment Adviser

What are the primary responsibilities of a Personal Investment Adviser?

Personal Investment Advisers are responsible for providing comprehensive financial planning services to individuals and families. This includes conducting financial needs assessments, developing and implementing investment strategies, managing investment portfolios, and providing ongoing financial advice and guidance.

What are the key skills required to be a successful Personal Investment Adviser?

Successful Personal Investment Advisers typically possess a strong understanding of financial planning principles, investment strategies, and tax laws. They are also excellent communicators and have the ability to build and maintain strong client relationships.

What is the average salary range for a Personal Investment Adviser?

The average salary range for Personal Investment Advisers can vary depending on factors such as experience, location, and the size of the firm they work for. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for financial advisers in May 2021 was $94,180.

What are the career advancement opportunities for a Personal Investment Adviser?

With experience and additional certifications, Personal Investment Advisers can advance to more senior roles, such as Senior Financial Adviser, Wealth Manager, or Portfolio Manager. They may also choose to specialize in a particular area of financial planning, such as retirement planning or estate planning.

What is the job outlook for Personal Investment Advisers?

The job outlook for Personal Investment Advisers is expected to be good over the next few years. As the population ages and people become more aware of the importance of financial planning, the demand for qualified Personal Investment Advisers is likely to increase.

What are some tips for writing a standout Personal Investment Adviser resume?

To write a standout Personal Investment Adviser resume, focus on quantifying your accomplishments, highlighting your expertise in niche areas of financial planning, showcasing your ability to build and maintain strong client relationships, and demonstrating your commitment to professional development and continuing education.