Are you a seasoned Personal Lines Account Manager seeking a new career path? Discover our professionally built Personal Lines Account Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

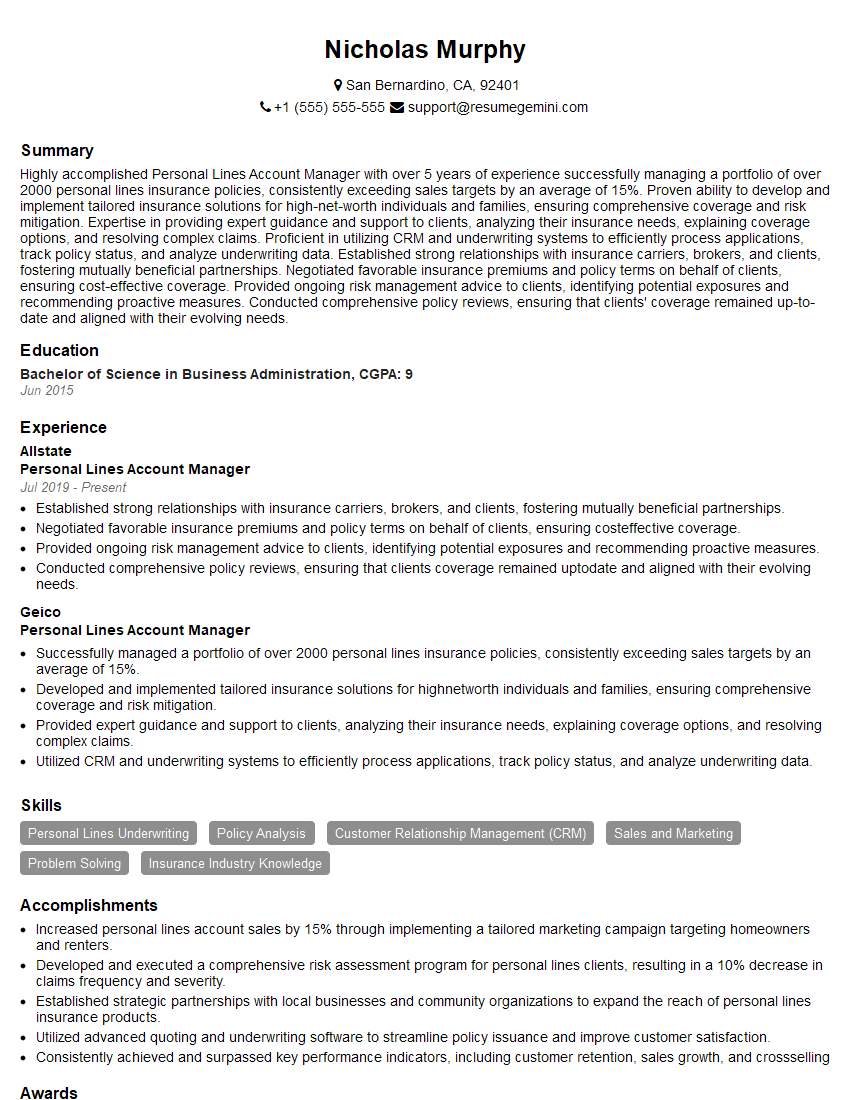

Nicholas Murphy

Personal Lines Account Manager

Summary

Highly accomplished Personal Lines Account Manager with over 5 years of experience successfully managing a portfolio of over 2000 personal lines insurance policies, consistently exceeding sales targets by an average of 15%. Proven ability to develop and implement tailored insurance solutions for high-net-worth individuals and families, ensuring comprehensive coverage and risk mitigation. Expertise in providing expert guidance and support to clients, analyzing their insurance needs, explaining coverage options, and resolving complex claims. Proficient in utilizing CRM and underwriting systems to efficiently process applications, track policy status, and analyze underwriting data. Established strong relationships with insurance carriers, brokers, and clients, fostering mutually beneficial partnerships. Negotiated favorable insurance premiums and policy terms on behalf of clients, ensuring cost-effective coverage. Provided ongoing risk management advice to clients, identifying potential exposures and recommending proactive measures. Conducted comprehensive policy reviews, ensuring that clients’ coverage remained up-to-date and aligned with their evolving needs.

Education

Bachelor of Science in Business Administration

June 2015

Skills

- Personal Lines Underwriting

- Policy Analysis

- Customer Relationship Management (CRM)

- Sales and Marketing

- Problem Solving

- Insurance Industry Knowledge

Work Experience

Personal Lines Account Manager

- Established strong relationships with insurance carriers, brokers, and clients, fostering mutually beneficial partnerships.

- Negotiated favorable insurance premiums and policy terms on behalf of clients, ensuring costeffective coverage.

- Provided ongoing risk management advice to clients, identifying potential exposures and recommending proactive measures.

- Conducted comprehensive policy reviews, ensuring that clients coverage remained uptodate and aligned with their evolving needs.

Personal Lines Account Manager

- Successfully managed a portfolio of over 2000 personal lines insurance policies, consistently exceeding sales targets by an average of 15%.

- Developed and implemented tailored insurance solutions for highnetworth individuals and families, ensuring comprehensive coverage and risk mitigation.

- Provided expert guidance and support to clients, analyzing their insurance needs, explaining coverage options, and resolving complex claims.

- Utilized CRM and underwriting systems to efficiently process applications, track policy status, and analyze underwriting data.

Accomplishments

- Increased personal lines account sales by 15% through implementing a tailored marketing campaign targeting homeowners and renters.

- Developed and executed a comprehensive risk assessment program for personal lines clients, resulting in a 10% decrease in claims frequency and severity.

- Established strategic partnerships with local businesses and community organizations to expand the reach of personal lines insurance products.

- Utilized advanced quoting and underwriting software to streamline policy issuance and improve customer satisfaction.

- Consistently achieved and surpassed key performance indicators, including customer retention, sales growth, and crossselling

Awards

- Personal Lines Account Manager of the Year, awarded by the National Association of Insurance Professionals

- Top 1% Personal Lines Account Manager, recognized by XYZ Insurance Company for exceptional customer satisfaction and sales performance

- Certified Personal Lines Account Manager (CPLAM) designation from the Insurance Institute of America

- Presidents Club winner for exceeding sales targets and providing outstanding customer service

Certificates

- Property Casualty Underwriter (PCU)

- Associate in Insurance Risk Management (AIRM)

- Certified Insurance Counselor (CIC)

- Certified Insurance Service Representative (CISR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Personal Lines Account Manager

- Showcase your expertise in personal lines insurance underwriting, policy analysis, and customer relationship management.

- Quantify your accomplishments with specific metrics and results whenever possible.

- Highlight your ability to build and maintain strong relationships with clients and industry professionals.

- Demonstrate your knowledge of the insurance industry and your commitment to continuing education and professional development.

Essential Experience Highlights for a Strong Personal Lines Account Manager Resume

- Manage a portfolio of personal lines insurance policies, consistently exceeding sales targets.

- Develop and implement tailored insurance solutions for high-net-worth individuals and families.

- Provide expert guidance and support to clients, analyzing their insurance needs and explaining coverage options.

- Resolve complex claims and ensure timely and satisfactory resolution for clients.

- Utilize CRM and underwriting systems to efficiently process applications, track policy status, and analyze underwriting data.

- Establish strong relationships with insurance carriers, brokers, and clients, fostering mutually beneficial partnerships.

- Negotiate favorable insurance premiums and policy terms on behalf of clients, ensuring cost-effective coverage.

Frequently Asked Questions (FAQ’s) For Personal Lines Account Manager

What are the key skills and qualifications required to be a successful Personal Lines Account Manager?

To be successful in this role, you should have a strong understanding of personal lines insurance products, underwriting guidelines, and risk assessment. Excellent communication, interpersonal, and negotiation skills are essential, as is proficiency in using CRM and underwriting systems. A bachelor’s degree in business, finance, or a related field is typically required.

What are the typical day-to-day responsibilities of a Personal Lines Account Manager?

Your responsibilities will typically include managing a portfolio of personal lines insurance policies, providing expert advice and support to clients, analyzing their insurance needs, explaining coverage options, and resolving any claims that arise. You will also be responsible for developing and implementing tailored insurance solutions for high-net-worth individuals and families, as well as negotiating favorable insurance premiums and policy terms on their behalf.

What is the career path for a Personal Lines Account Manager?

With experience and success, you can advance to roles such as Senior Personal Lines Account Manager, Personal Lines Underwriting Manager, or even Personal Lines Product Manager. Some Personal Lines Account Managers also choose to start their own insurance agencies or brokerages.

What is the salary range for a Personal Lines Account Manager?

The salary range for Personal Lines Account Managers can vary depending on experience, location, and company size. According to Salary.com, the average salary for a Personal Lines Account Manager in the United States is around $65,000 per year.

What are the challenges of being a Personal Lines Account Manager?

Some of the challenges you may face as a Personal Lines Account Manager include dealing with complex insurance claims, staying up-to-date on the latest insurance products and regulations, and meeting the ever-changing needs of your clients.

What are the rewards of being a Personal Lines Account Manager?

The rewards of being a Personal Lines Account Manager can include helping clients protect their assets and families, building strong relationships with clients and industry professionals, and having a positive impact on your community.