Are you a seasoned Personal Lines Underwriter seeking a new career path? Discover our professionally built Personal Lines Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

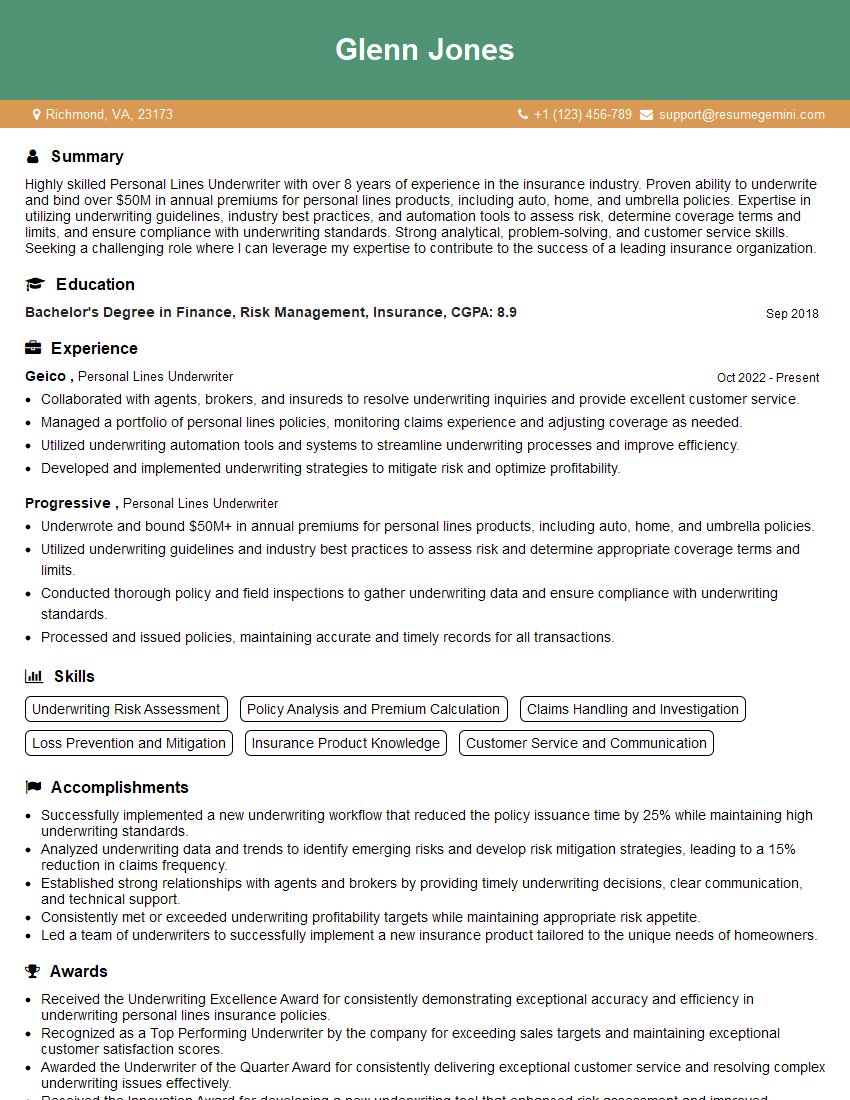

Glenn Jones

Personal Lines Underwriter

Summary

Highly skilled Personal Lines Underwriter with over 8 years of experience in the insurance industry. Proven ability to underwrite and bind over $50M in annual premiums for personal lines products, including auto, home, and umbrella policies. Expertise in utilizing underwriting guidelines, industry best practices, and automation tools to assess risk, determine coverage terms and limits, and ensure compliance with underwriting standards. Strong analytical, problem-solving, and customer service skills. Seeking a challenging role where I can leverage my expertise to contribute to the success of a leading insurance organization.

Education

Bachelor’s Degree in Finance, Risk Management, Insurance

September 2018

Skills

- Underwriting Risk Assessment

- Policy Analysis and Premium Calculation

- Claims Handling and Investigation

- Loss Prevention and Mitigation

- Insurance Product Knowledge

- Customer Service and Communication

Work Experience

Personal Lines Underwriter

- Collaborated with agents, brokers, and insureds to resolve underwriting inquiries and provide excellent customer service.

- Managed a portfolio of personal lines policies, monitoring claims experience and adjusting coverage as needed.

- Utilized underwriting automation tools and systems to streamline underwriting processes and improve efficiency.

- Developed and implemented underwriting strategies to mitigate risk and optimize profitability.

Personal Lines Underwriter

- Underwrote and bound $50M+ in annual premiums for personal lines products, including auto, home, and umbrella policies.

- Utilized underwriting guidelines and industry best practices to assess risk and determine appropriate coverage terms and limits.

- Conducted thorough policy and field inspections to gather underwriting data and ensure compliance with underwriting standards.

- Processed and issued policies, maintaining accurate and timely records for all transactions.

Accomplishments

- Successfully implemented a new underwriting workflow that reduced the policy issuance time by 25% while maintaining high underwriting standards.

- Analyzed underwriting data and trends to identify emerging risks and develop risk mitigation strategies, leading to a 15% reduction in claims frequency.

- Established strong relationships with agents and brokers by providing timely underwriting decisions, clear communication, and technical support.

- Consistently met or exceeded underwriting profitability targets while maintaining appropriate risk appetite.

- Led a team of underwriters to successfully implement a new insurance product tailored to the unique needs of homeowners.

Awards

- Received the Underwriting Excellence Award for consistently demonstrating exceptional accuracy and efficiency in underwriting personal lines insurance policies.

- Recognized as a Top Performing Underwriter by the company for exceeding sales targets and maintaining exceptional customer satisfaction scores.

- Awarded the Underwriter of the Quarter Award for consistently delivering exceptional customer service and resolving complex underwriting issues effectively.

- Received the Innovation Award for developing a new underwriting tool that enhanced risk assessment and improved underwriting accuracy.

Certificates

- Associate in Insurance Underwriting (AIU)

- Certified Insurance Underwriter (CIU)

- Certified Professional Insurance Agent (CPIA)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Personal Lines Underwriter

- Highlight your underwriting expertise and experience in personal lines products.

- Showcase your ability to assess risk accurately and make sound underwriting decisions.

- Emphasize your strong analytical and problem-solving skills.

- Demonstrate your proficiency in using underwriting automation tools and systems.

Essential Experience Highlights for a Strong Personal Lines Underwriter Resume

- Underwrote and bound $50M+ in annual premiums for personal lines products, including auto, home, and umbrella policies.

- Utilized underwriting guidelines and industry best practices to assess risk and determine appropriate coverage terms and limits.

- Conducted thorough policy and field inspections to gather underwriting data and ensure compliance with underwriting standards.

- Processed and issued policies, maintaining accurate and timely records for all transactions.

- Collaborated with agents, brokers, and insureds to resolve underwriting inquiries and provide excellent customer service.

- Managed a portfolio of personal lines policies, monitoring claims experience and adjusting coverage as needed.

Frequently Asked Questions (FAQ’s) For Personal Lines Underwriter

What are the key responsibilities of a Personal Lines Underwriter?

The key responsibilities of a Personal Lines Underwriter include assessing risk, determining coverage terms and limits, conducting policy and field inspections, processing and issuing policies, collaborating with agents and brokers, and managing a portfolio of personal lines policies.

What are the qualifications for a Personal Lines Underwriter?

The qualifications for a Personal Lines Underwriter typically include a Bachelor’s Degree in Finance, Risk Management, Insurance, or a related field, as well as several years of experience in the insurance industry.

What are the skills required for a Personal Lines Underwriter?

The skills required for a Personal Lines Underwriter include underwriting risk assessment, policy analysis and premium calculation, claims handling and investigation, loss prevention and mitigation, insurance product knowledge, customer service and communication, and proficiency in using underwriting automation tools and systems.

What is the career path for a Personal Lines Underwriter?

The career path for a Personal Lines Underwriter can include promotions to Senior Underwriter, Underwriting Manager, and eventually Chief Underwriting Officer.

What is the average salary for a Personal Lines Underwriter?

The average salary for a Personal Lines Underwriter varies depending on experience and location, but typically ranges from $60,000 to $100,000 per year.

What are the job opportunities for a Personal Lines Underwriter?

Job opportunities for a Personal Lines Underwriter are available in insurance companies, agencies, and brokerages.