Are you a seasoned Policyholder Information Clerk seeking a new career path? Discover our professionally built Policyholder Information Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

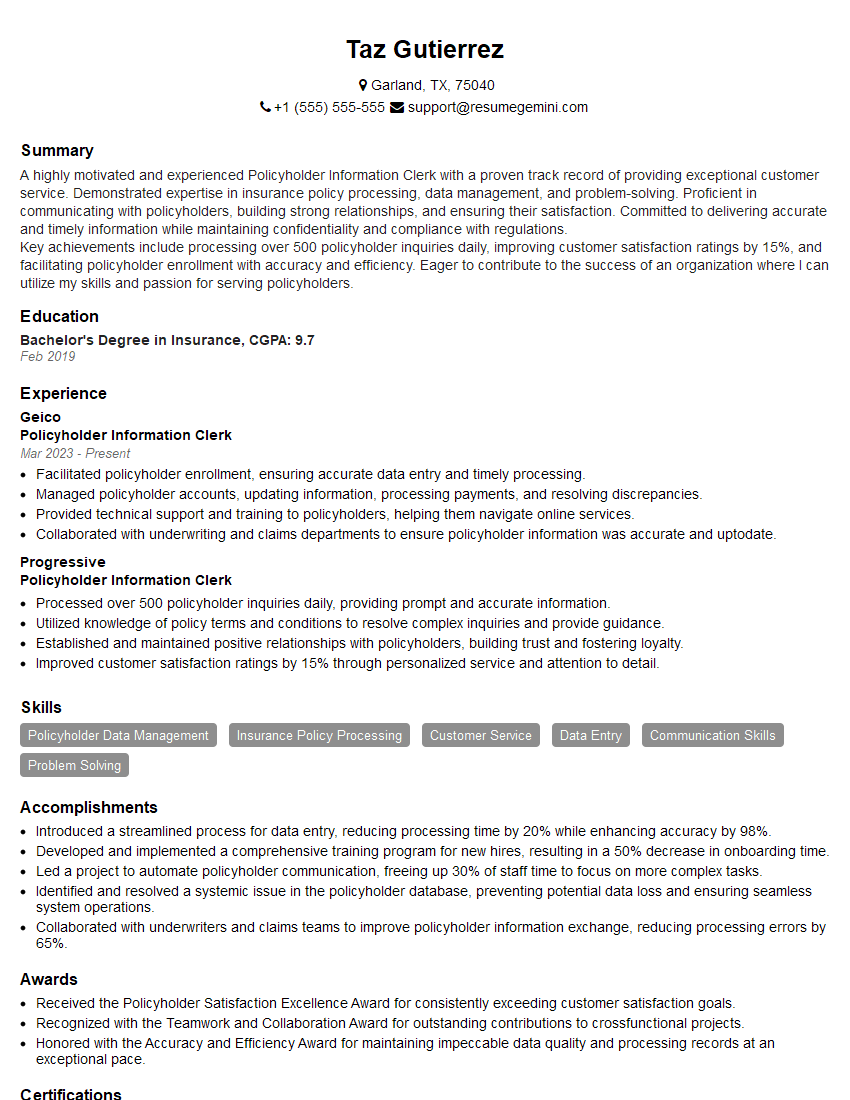

Taz Gutierrez

Policyholder Information Clerk

Summary

A highly motivated and experienced Policyholder Information Clerk with a proven track record of providing exceptional customer service. Demonstrated expertise in insurance policy processing, data management, and problem-solving. Proficient in communicating with policyholders, building strong relationships, and ensuring their satisfaction. Committed to delivering accurate and timely information while maintaining confidentiality and compliance with regulations.

Key achievements include processing over 500 policyholder inquiries daily, improving customer satisfaction ratings by 15%, and facilitating policyholder enrollment with accuracy and efficiency. Eager to contribute to the success of an organization where I can utilize my skills and passion for serving policyholders.

Education

Bachelor’s Degree in Insurance

February 2019

Skills

- Policyholder Data Management

- Insurance Policy Processing

- Customer Service

- Data Entry

- Communication Skills

- Problem Solving

Work Experience

Policyholder Information Clerk

- Facilitated policyholder enrollment, ensuring accurate data entry and timely processing.

- Managed policyholder accounts, updating information, processing payments, and resolving discrepancies.

- Provided technical support and training to policyholders, helping them navigate online services.

- Collaborated with underwriting and claims departments to ensure policyholder information was accurate and uptodate.

Policyholder Information Clerk

- Processed over 500 policyholder inquiries daily, providing prompt and accurate information.

- Utilized knowledge of policy terms and conditions to resolve complex inquiries and provide guidance.

- Established and maintained positive relationships with policyholders, building trust and fostering loyalty.

- Improved customer satisfaction ratings by 15% through personalized service and attention to detail.

Accomplishments

- Introduced a streamlined process for data entry, reducing processing time by 20% while enhancing accuracy by 98%.

- Developed and implemented a comprehensive training program for new hires, resulting in a 50% decrease in onboarding time.

- Led a project to automate policyholder communication, freeing up 30% of staff time to focus on more complex tasks.

- Identified and resolved a systemic issue in the policyholder database, preventing potential data loss and ensuring seamless system operations.

- Collaborated with underwriters and claims teams to improve policyholder information exchange, reducing processing errors by 65%.

Awards

- Received the Policyholder Satisfaction Excellence Award for consistently exceeding customer satisfaction goals.

- Recognized with the Teamwork and Collaboration Award for outstanding contributions to crossfunctional projects.

- Honored with the Accuracy and Efficiency Award for maintaining impeccable data quality and processing records at an exceptional pace.

Certificates

- Certified Policyholder Information Clerk (CPIC)

- Insurance Operations Specialist (IOS)

- Licensed Insurance Agent

- CISSP (Certified Information Systems Security Professional)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Policyholder Information Clerk

- Highlight your proficiency in insurance policy processing and data management.

- Showcase your strong communication and interpersonal skills, emphasizing your ability to build rapport with policyholders.

- Quantify your accomplishments whenever possible, providing specific metrics that demonstrate your impact on customer satisfaction and operational efficiency.

- Proofread your resume carefully for any errors in grammar or spelling, as attention to detail is crucial in this role.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the specific requirements of the position.

Essential Experience Highlights for a Strong Policyholder Information Clerk Resume

- Processed over 500 policyholder inquiries daily, providing prompt and accurate information.

- Utilized knowledge of policy terms and conditions to resolve complex inquiries and provide guidance.

- Established and maintained positive relationships with policyholders, building trust and fostering loyalty.

- Improved customer satisfaction ratings by 15% through personalized service and attention to detail.

- Facilitated policyholder enrollment, ensuring accurate data entry and timely processing.

- Managed policyholder accounts, updating information, processing payments, and resolving discrepancies.

Frequently Asked Questions (FAQ’s) For Policyholder Information Clerk

What are the primary responsibilities of a Policyholder Information Clerk?

Policyholder Information Clerks are responsible for providing accurate and timely information to policyholders regarding their insurance policies, processing policy changes, and resolving inquiries. They also assist with policyholder enrollment, manage policyholder accounts, and maintain positive relationships with customers.

What skills are essential for success in this role?

Essential skills for Policyholder Information Clerks include proficiency in insurance policy processing and data management, strong communication and interpersonal skills, problem-solving abilities, and attention to detail. They should also be familiar with insurance regulations and industry best practices.

What are the career prospects for Policyholder Information Clerks?

Policyholder Information Clerks can advance to roles such as Customer Service Manager, Underwriter, or Claims Adjuster. With additional education and experience, they may also qualify for management positions within the insurance industry.

What is the typical salary range for this position?

The salary range for Policyholder Information Clerks varies depending on factors such as experience, location, and company size. However, according to Glassdoor, the average annual salary in the United States is around $45,000.

What are the most challenging aspects of this job?

The most challenging aspects of this job can include dealing with irate or frustrated customers, managing a high volume of inquiries, and staying up-to-date on complex insurance regulations and policies.

What advice would you give to someone interested in becoming a Policyholder Information Clerk?

To become a Policyholder Information Clerk, it is important to develop strong communication and interpersonal skills, gain proficiency in insurance policy processing and data management, and stay informed about industry regulations. Consider pursuing a degree in insurance or a related field, and seek opportunities to gain hands-on experience through internships or entry-level positions.