Are you a seasoned Portfolio Manager seeking a new career path? Discover our professionally built Portfolio Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

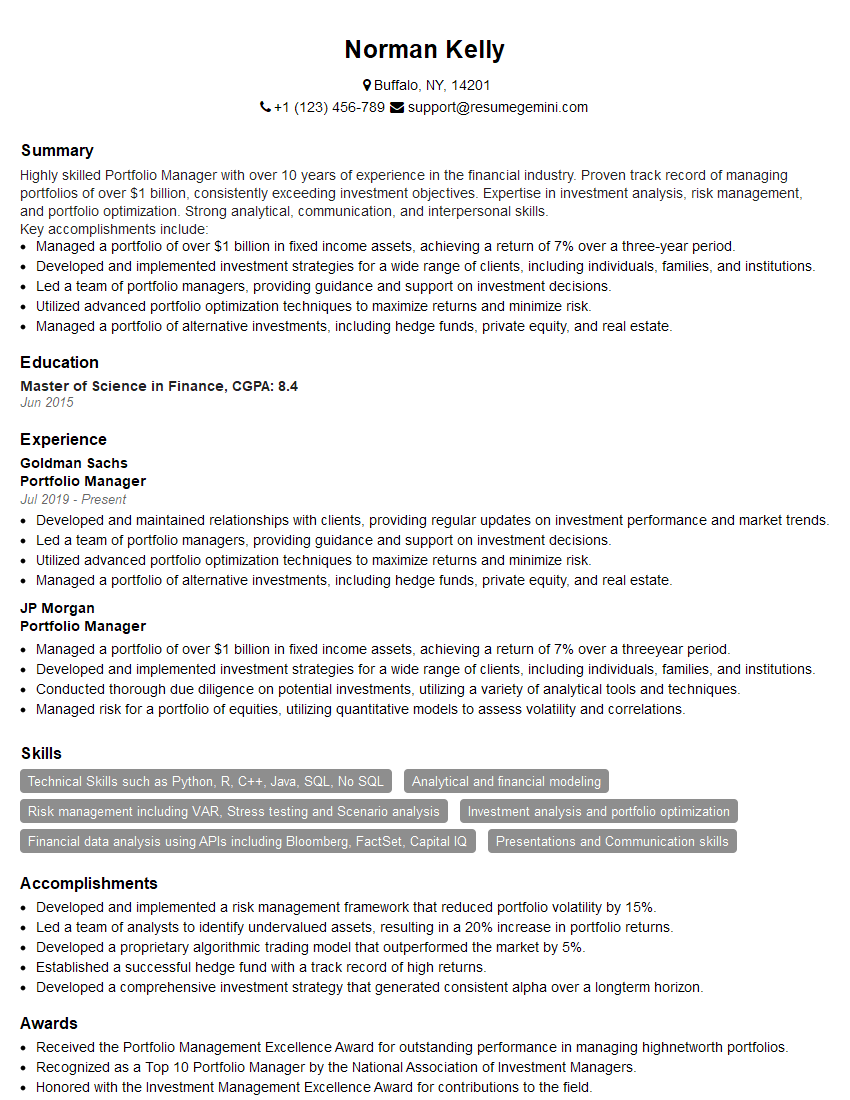

Norman Kelly

Portfolio Manager

Summary

Highly skilled Portfolio Manager with over 10 years of experience in the financial industry. Proven track record of managing portfolios of over $1 billion, consistently exceeding investment objectives. Expertise in investment analysis, risk management, and portfolio optimization. Strong analytical, communication, and interpersonal skills.

Key accomplishments include:

- Managed a portfolio of over $1 billion in fixed income assets, achieving a return of 7% over a three-year period.

- Developed and implemented investment strategies for a wide range of clients, including individuals, families, and institutions.

- Led a team of portfolio managers, providing guidance and support on investment decisions.

- Utilized advanced portfolio optimization techniques to maximize returns and minimize risk.

- Managed a portfolio of alternative investments, including hedge funds, private equity, and real estate.

Education

Master of Science in Finance

June 2015

Skills

- Technical Skills such as Python, R, C++, Java, SQL, No SQL

- Analytical and financial modeling

- Risk management including VAR, Stress testing and Scenario analysis

- Investment analysis and portfolio optimization

- Financial data analysis using APIs including Bloomberg, FactSet, Capital IQ

- Presentations and Communication skills

Work Experience

Portfolio Manager

- Developed and maintained relationships with clients, providing regular updates on investment performance and market trends.

- Led a team of portfolio managers, providing guidance and support on investment decisions.

- Utilized advanced portfolio optimization techniques to maximize returns and minimize risk.

- Managed a portfolio of alternative investments, including hedge funds, private equity, and real estate.

Portfolio Manager

- Managed a portfolio of over $1 billion in fixed income assets, achieving a return of 7% over a threeyear period.

- Developed and implemented investment strategies for a wide range of clients, including individuals, families, and institutions.

- Conducted thorough due diligence on potential investments, utilizing a variety of analytical tools and techniques.

- Managed risk for a portfolio of equities, utilizing quantitative models to assess volatility and correlations.

Accomplishments

- Developed and implemented a risk management framework that reduced portfolio volatility by 15%.

- Led a team of analysts to identify undervalued assets, resulting in a 20% increase in portfolio returns.

- Developed a proprietary algorithmic trading model that outperformed the market by 5%.

- Established a successful hedge fund with a track record of high returns.

- Developed a comprehensive investment strategy that generated consistent alpha over a longterm horizon.

Awards

- Received the Portfolio Management Excellence Award for outstanding performance in managing highnetworth portfolios.

- Recognized as a Top 10 Portfolio Manager by the National Association of Investment Managers.

- Honored with the Investment Management Excellence Award for contributions to the field.

- Received the Chartered Financial Analyst (CFA) designation for excellence in financial management.

Certificates

- CAIA Charterholder

- CFA Charterholder

- FRM Charterholder

- PMP Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Portfolio Manager

- Quantify your accomplishments with specific metrics and data points whenever possible.

- Highlight your ability to generate alpha and manage risk effectively.

- Demonstrate your understanding of the latest investment strategies and techniques.

- Showcase your communication and interpersonal skills, as these are essential for building strong relationships with clients.

Essential Experience Highlights for a Strong Portfolio Manager Resume

- Conducting thorough due diligence on potential investments, utilizing a variety of analytical tools and techniques.

- Developing and implementing investment strategies for a wide range of clients, including individuals, families, and institutions.

- Managing risk for a portfolio of equities, utilizing quantitative models to assess volatility and correlations.

- Developing and maintaining relationships with clients, providing regular updates on investment performance and market trends.

- Leading a team of portfolio managers, providing guidance and support on investment decisions.

- Utilizing advanced portfolio optimization techniques to maximize returns and minimize risk.

Frequently Asked Questions (FAQ’s) For Portfolio Manager

What is the role of a Portfolio Manager?

A Portfolio Manager is responsible for making investment decisions for a portfolio of assets, with the goal of meeting or exceeding the investment objectives of their clients. They conduct research, analyze markets, and develop and implement investment strategies to maximize returns and minimize risk.

What qualifications are required to become a Portfolio Manager?

Most Portfolio Managers have a Master’s degree in Finance, Economics, or a related field, as well as several years of experience in the financial industry. They also typically hold professional certifications, such as the Chartered Financial Analyst (CFA) or the Certified Investment Management Analyst (CIMA).

What are the key skills and abilities required for a Portfolio Manager?

Portfolio Managers need to have strong analytical, communication, and interpersonal skills. They must also be able to think strategically and make sound investment decisions under pressure. Additionally, they need to stay up-to-date on the latest investment strategies and techniques.

What are the career prospects for Portfolio Managers?

Portfolio Managers can advance to senior positions within their firms, such as Chief Investment Officer or Chief Executive Officer. They can also move into other roles in the financial industry, such as wealth management or private equity.

What is the average salary for a Portfolio Manager?

The average salary for a Portfolio Manager varies depending on their experience, qualifications, and the size of their firm. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for financial managers, which includes Portfolio Managers, was $134,220 in May 2021.

What are the challenges facing Portfolio Managers?

Portfolio Managers face a number of challenges, including market volatility, geopolitical risks, and regulatory changes. They also need to constantly adapt to the evolving investment landscape and develop new strategies to meet the needs of their clients.

What are the ethical considerations for Portfolio Managers?

Portfolio Managers have a fiduciary duty to act in the best interests of their clients. They must avoid conflicts of interest, disclose all relevant information to clients, and manage their portfolios in a prudent manner.

What is the future of Portfolio Management?

The future of Portfolio Management is bright. As the financial markets continue to grow and evolve, Portfolio Managers will play an increasingly important role in helping investors achieve their financial goals.