Are you a seasoned Private Wealth Manager seeking a new career path? Discover our professionally built Private Wealth Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

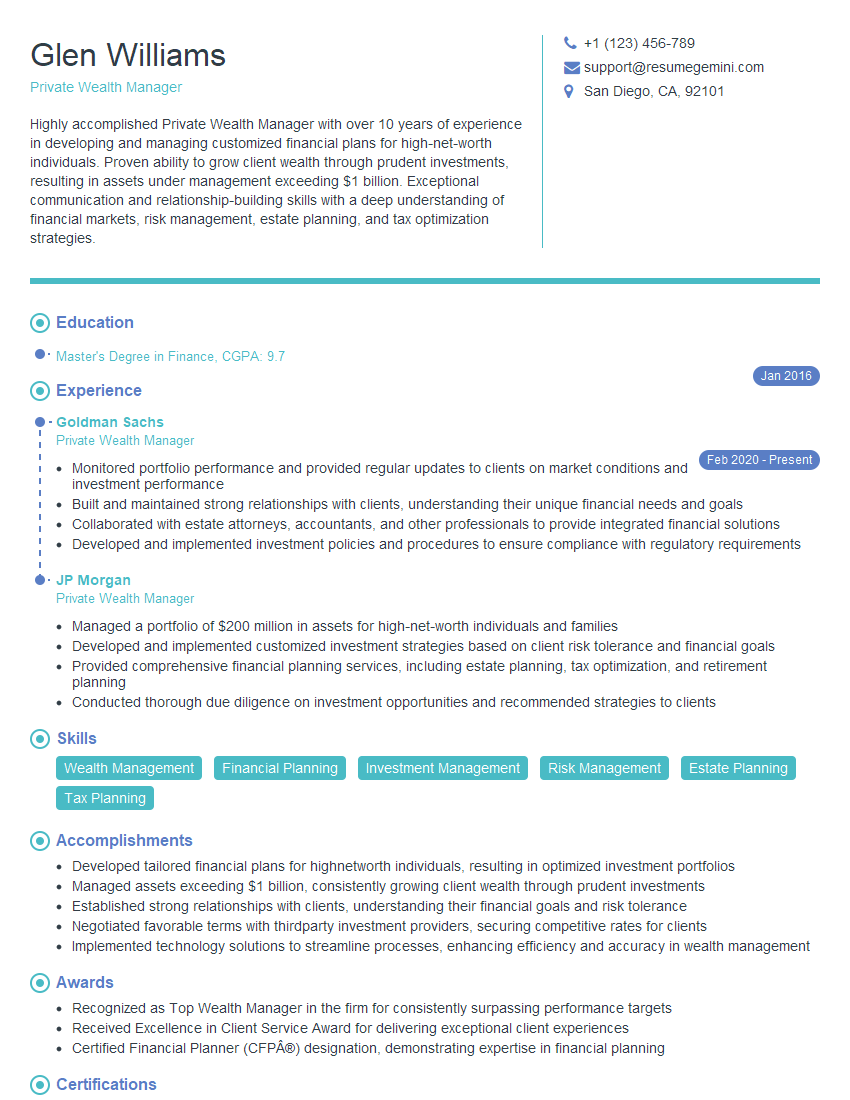

Glen Williams

Private Wealth Manager

Summary

Highly accomplished Private Wealth Manager with over 10 years of experience in developing and managing customized financial plans for high-net-worth individuals. Proven ability to grow client wealth through prudent investments, resulting in assets under management exceeding $1 billion. Exceptional communication and relationship-building skills with a deep understanding of financial markets, risk management, estate planning, and tax optimization strategies.

Education

Master’s Degree in Finance

January 2016

Skills

- Wealth Management

- Financial Planning

- Investment Management

- Risk Management

- Estate Planning

- Tax Planning

Work Experience

Private Wealth Manager

- Monitored portfolio performance and provided regular updates to clients on market conditions and investment performance

- Built and maintained strong relationships with clients, understanding their unique financial needs and goals

- Collaborated with estate attorneys, accountants, and other professionals to provide integrated financial solutions

- Developed and implemented investment policies and procedures to ensure compliance with regulatory requirements

Private Wealth Manager

- Managed a portfolio of $200 million in assets for high-net-worth individuals and families

- Developed and implemented customized investment strategies based on client risk tolerance and financial goals

- Provided comprehensive financial planning services, including estate planning, tax optimization, and retirement planning

- Conducted thorough due diligence on investment opportunities and recommended strategies to clients

Accomplishments

- Developed tailored financial plans for highnetworth individuals, resulting in optimized investment portfolios

- Managed assets exceeding $1 billion, consistently growing client wealth through prudent investments

- Established strong relationships with clients, understanding their financial goals and risk tolerance

- Negotiated favorable terms with thirdparty investment providers, securing competitive rates for clients

- Implemented technology solutions to streamline processes, enhancing efficiency and accuracy in wealth management

Awards

- Recognized as Top Wealth Manager in the firm for consistently surpassing performance targets

- Received Excellence in Client Service Award for delivering exceptional client experiences

- Certified Financial Planner (CFP®) designation, demonstrating expertise in financial planning

Certificates

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Certified Private Wealth Advisor (CPWA)

- Trust and Estate Planning Advisor (TEPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Private Wealth Manager

- Highlight your expertise in wealth management, financial planning, and investment management, showcasing your ability to manage complex financial portfolios.

- Quantify your accomplishments with specific metrics, such as the percentage growth in client wealth or the amount of assets under management.

- Demonstrate your understanding of tax optimization strategies and estate planning techniques, which are essential for high-net-worth individuals.

- Emphasize your ability to build and maintain strong client relationships, which is crucial in private wealth management.

- Consider obtaining industry certifications, such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), to enhance your credibility.

Essential Experience Highlights for a Strong Private Wealth Manager Resume

- Developed and implemented comprehensive financial plans tailored to each client’s unique goals, risk tolerance, and tax situation.

- Managed investment portfolios exceeding $1 billion, consistently growing client wealth through astute investment strategies.

- Established and maintained strong relationships with clients, understanding their financial objectives and providing ongoing support.

- Negotiated favorable terms with third-party investment providers, securing competitive rates and investment opportunities for clients.

- Implemented technology solutions to streamline wealth management processes, enhancing efficiency, accuracy, and reporting capabilities.

Frequently Asked Questions (FAQ’s) For Private Wealth Manager

What is the role of a Private Wealth Manager?

A Private Wealth Manager is a financial professional who provides comprehensive wealth management services to high-net-worth individuals and families. They develop tailored financial plans, manage investment portfolios, and provide ongoing advice on tax optimization, estate planning, and other financial matters.

What qualifications and skills are required to become a Private Wealth Manager?

Typically, a Private Wealth Manager requires a Master’s Degree in Finance or a related field, along with industry certifications like the CFP or CFA. Strong analytical and communication skills, coupled with a deep understanding of financial markets and investment strategies, are also essential.

What are the career prospects for Private Wealth Managers?

Private Wealth Managers are in high demand due to the increasing wealth of high-net-worth individuals and families. With experience, they can advance to senior positions, such as Vice President or Managing Director, or specialize in specific areas like portfolio management or wealth planning.

What are the key responsibilities of a Private Wealth Manager?

The key responsibilities of a Private Wealth Manager include developing financial plans, managing investment portfolios, conducting financial analysis, providing tax and estate planning advice, and maintaining strong client relationships.

What are the challenges faced by Private Wealth Managers?

Private Wealth Managers face challenges such as the volatility of financial markets, regulatory changes, and the need to stay abreast of complex tax and estate planning laws. They must also manage the expectations of high-net-worth clients who demand personalized and sophisticated financial services.